Tala CEO Shivani Siroya not only points to the idea of building trust to grow a customer base but also belief in her instincts.

Economic growth in Nigeria is projected to rise consistently. Fintech's engagement in the SME sector could push it further.

As the African economy grows, the digital property marketplace Seso is perfectly positioned to grow with them, chief commercial officer Kweku Essien said.

The Central Bank of Nigeria (CBN) plans to lower transaction fees for the eNaira platform by 50%, which they say will increase the volume of transactions on the central bank digital currency (CBDC).

Nova Credit will leverage its Credit Passport to help approve newcomers from Nigeria for the Vesti Card.

The Central Bank of Kenya (CBK) announced the complete interoperability of mobile money payment services in Kenya.

If you work for a fintech planning to offer services in an emerging market, you'd be wise to take a few steps from DriveWealth's playbook.

Sponsored

Sponsored content is a type of promotional media paid for by an advertiser but created and shared by a publisher. Fintech Nexus contracts sponsored content articles to experienced journalists comfortable in the fintech space.

Studies have highlighted Africa's growing adoption rates of cryptocurrencies but little has been devoted to how the crypto winter impacts,

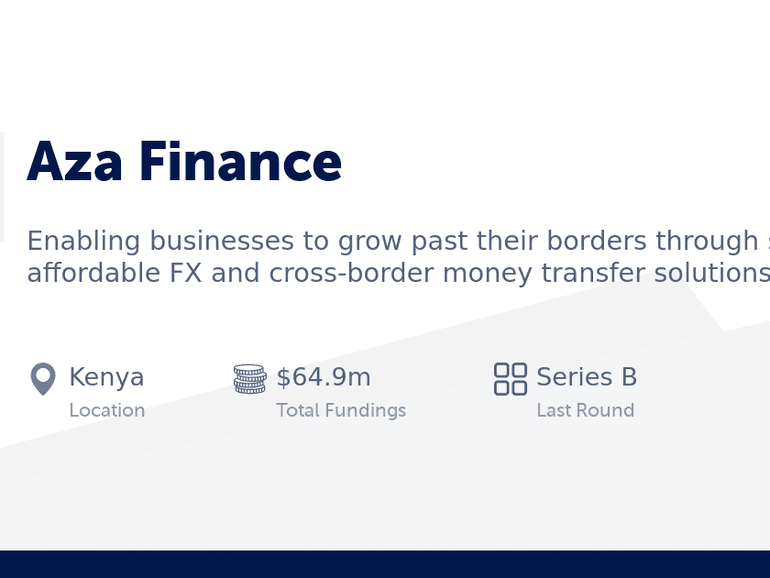

In this conversation, we chat with Elizabeth Rossiello – the CEO and founder of AZA, an established provider of currency trading solutions which accelerate global access to frontier markets through an innovative infrastructure. Elizabeth founded the company in 2013 in Nairobi, Kenya and has expanded it to 10+ markets across Africa and Europe.

Before founding AZA, Elizabeth was a rating analyst for microfinance institutions across sub-Saharan Africa, consulting for Grameen Foundation, Gates Foundation and the Acumen Fund, as well as working with regulators and policy-makers on legislation for financial innovations. Elizabeth co-chairs the World Economic Forum's Council on Blockchain and holds an M.A. in International Business and Finance from Columbia University.

More specifically, we touch on ratings agencies and the activity of rating intitutions, M-Pesa and how it influenced the thinking towards a crypto-centric future, Africa’s banking landscape and some of the outstanding issues it faces, Bitpesa and how it became Aza, banking infrastructure in Africa, and so so much more!