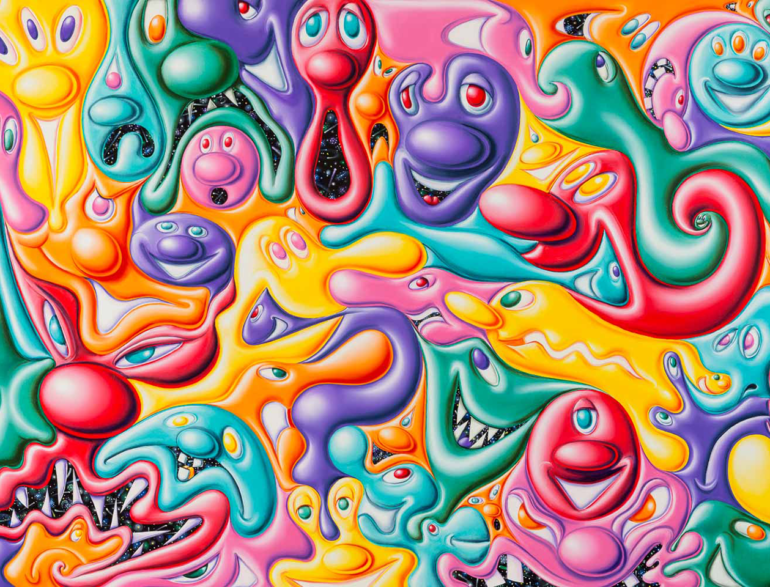

The painting above by Kenny Scharf is a look into one of many new artists’ work investors may gain exposure to through a new fund.

Yieldstreet, a fintech that aims to give retail investors access to alternative investments, announced Friday that users would have access to a new fractional art investing platform called the Art Equity Platform.

The Art Equity Fund will be the first of many funds on the platform to give investors exposure toward ownership of physical art through subsidiary art investment firm Athena Art Finance.

The firm already enabled customers to access alternative asset classes like legal finance, real estate, marine, and shipping investing: investments that Yieldstreet said are usually only open to institutional investors.

For retail investors, the minimum investment on Yieldstreet’s platform is $500 to receive quarterly payouts from Yieldstreet’s Prism fund. And, of course, accredited investors can get access to more. The minimum investment in the art fund is $10,000.

Fractional ownership

After this fund, Yieldstreet plans to launch others for investors to own fractional interest in actual artwork. The firm said in a release that the fund would focus on “blue-chip” and mid-career Post War & Contemporary artworks from famous artists like George Condo, Keith Haring, and Scharf.

Yieldstreet acquired Athena Art Finance in April 2019 for around $180 million and has included exposure in its regular funds toward art investments since. The firm has raised $278.5 million across six funding rounds, including $100 million this June in a Series C.

The idea to bring a direct equity investment fund draws from the recent NFT explosion, Yieldstreet said in a release. While NFT seller OpenSea made a reported $10 billion in sales in October alone, physical art investing firms are still gaining ground. The trend is growing: Yieldstreet peer Masterworks specializes in fractional art investing and is now a unicorn.

“Investing invaluable artwork has been a mere dream for most retail investors, who love and recognize both its intrinsic and extrinsic value,” Yieldstreet Co-founder and President Michael Weisz said. “This is a big moment for them and for Yieldstreet. This platform throws the doors wide open to the world of high-end art ownership while also marking Yieldstreet’s foray into art equity investments.”

Events hinted

The firm said it plans to offer ways for its members to experience the art the fund owns— hinting at events like private viewing galleries with “insight into the artworks significance” from art experts. The goal was to offer a new equity fund to give investors access to an alternative asset class, compared to Yieldstreet’s other options that provide asset-backed loan funds.

Athena Art Finance is run by its founder, Managing Director Rebecca Fine, an art lawyer with nearly three decades of experience in the art market. She joined the Yieldstreet fund team under President Michael Weisz.

Weisz co-founded Yieldstreet in 2015 after serving as VP at a New York hedge fund with $1.2 billion under management. His premise was to help everyday investors access asset classes that are typically only 1% and accredited investors.

Since its founding, the firm has funded $2.5 billion and is on track to create $3 billion of income outside of traditional investments by 2025.