As we hurtle towards a global recession, the effects are starting to show in the fintech sector.

Finch Capital has published the results of its latest State of European Fintech study, showing a significant decline in Fintech activity.

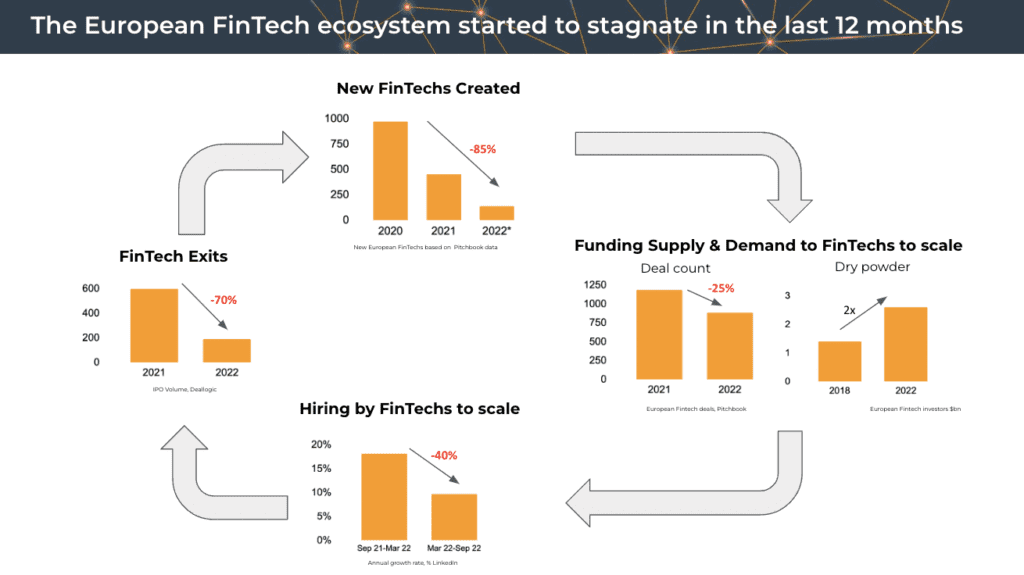

As macroeconomic conditions have become more challenging, investment in the fintech sector, which has seen significant growth over the past two years, has slowed. The creation of new fintechs peaked in 2018 and has declined by over 85%.

Finch Capital forecasts a period of “cooling and consolidation” across the sector.

Macro economic conditions rubbing off on sector

Buffeted by crisis after crisis, it seems the fintech industry has finally decided to scale down activity, waiting for the economic storm to pass.

The report found that the deal count has dropped 25% in the past year. Pre-seed was significantly affected, and Finch expects the decline to continue well into 2024. The level of fintechs founded in the first half of 2022 dropped significantly after remaining above 400 since 2015.

In 2021, Europe’s top 20 funding rounds accounted for 50% of the market. Across the investment ecosystem, there has been a 25% decline in funds raised by FinTechs, with, like any previous cycle, corporate investors retreating in the face of macroeconomic uncertainty.

These findings coincide with a general sentiment of uncertainty about the future. Each quarter, optimism within the community has slowly decreased, giving way to concerns about rising energy prices and inflation, pinching profit margins, and affecting revenue.

“After many years of impressive growth, perhaps overheated, there is no doubt that a worsening macroeconomic situation and tightening money supply are weighing on the fintech sector,” said Radboud Vlaar, Managing Partner at Finch Capital. “This doesn’t mean funding has dried up, simply that investors are becoming more discerning and price sensitive.”

He remains optimistic about the outcome.

The silver lining

Dry powder within fintech has reached new heights, doubling in the past five years. While employment has slowed, with layoffs reaching significant highs, it has not ground to a halt, and 10% of European fintechs continue publicizing vacancies.

“Our research indicates that dry powder is at an all-time high, with $28bn of undeployed capital among fintech investors,” he continued.

While unsustainable with the 40% decline in new funds raised in 2022 compared to the year prior, Finch believes funding will continue to flow to strong fintechs with growth potential.

“With investors becoming more cautious about where they put their money, and potentially overinvested start-ups struggling to exit, we are likely to see a period of consolidation in the fintech space…creating a smaller but more sustainable ecosystem,” said Vlaar.

“There was always an element of uncertainty around the long-term sustainability of valuations for certain companies, particularly at growth stages. This shake-up, while painful, is also necessary.”

“Consolidation and more competitive investment flows, combined with still significant levels of undeployed capital, will bring maturity to the fintech sector. And, despite difficult near-term prospects in the economy, a new normal level of activity will resume in fintech over the next 12 to 18 months, focusing on long-term sustainability.”