“Every business will become a bank” has become a common refrain among tech circles. If Apple is anything to go by, it is becoming less of a prediction and more of a fact.

A mix of embedded finance and open banking are the cocktail for reaching this prophecy. As more developments toward open data sharing diminish banks’ proprietary advantage and digital solutions are explored, it has become easier and cheaper for any brand to offer its own financial products.

“This pretty unique blend of things is changing in the market right now,” said Brian Hanrahan, CEO of Nuapay. “You had embedded finance making steady steps for the last several years. What’s happening now in conjunction with it is instant payments rails, and then you have open banking on top of that.”

“It’s a mix of things that didn’t exist before and certainly didn’t coexist. So I think the providers of these solutions have the potential to scale. Still, I think for many other businesses with that consumer touch point, it will allow them to maximize their revenue and their gains from the shift as well.”

Trust in financial institutions dropping

Banks themselves have undergone a crisis of confidence over the past month. The fragile fabric of trust that was still being built up since 2008 has been disrupted, once again, by a round of bank closures.

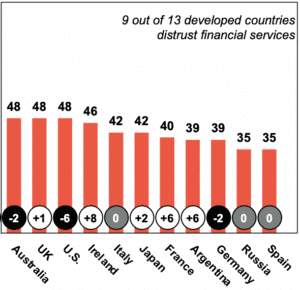

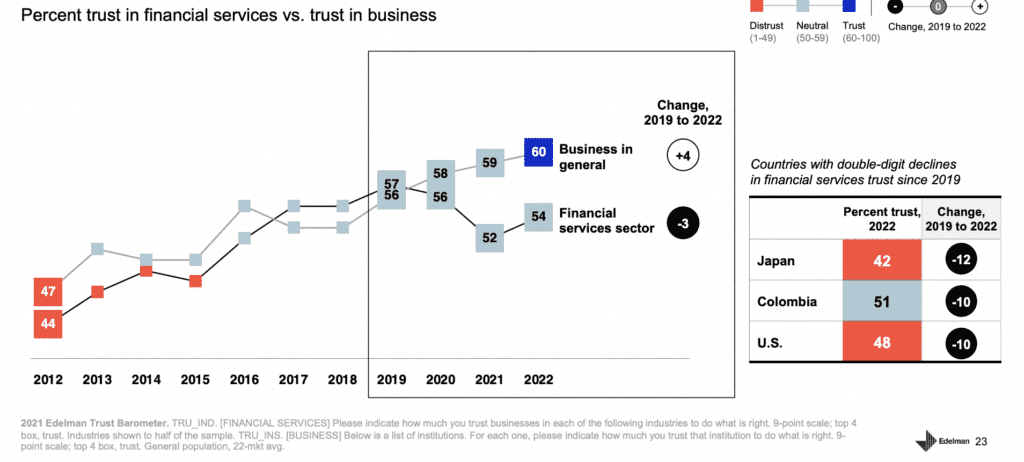

In Edleman’s most recent survey, it was found that trust was at an all-time low. Financial services fared as one of the worst, dropping ten percentage points in the US, joining much of Europe in rallying distrust. Digital payments were the only subsector that resisted this trend.

Younger generations place even more doubt on financial institutions. The World Economic Forum found that only 28% of GenZ and Millenials trusted their banks to be fair and honest about their products.

On the other hand, trust in businesses has increased, which could lay fertile soil for brands looking to incorporate financial services in their product stack. Consumers searching for trustworthy financial products may be more inclined to follow their preferred brands’ lead loyally.

The perpetual ‘year for embedded finance’

Embedded finance drives the charge toward the brave new world, making it increasingly easier for non-finance companies to integrate financial products into their offering.

While it isn’t a new concept, digitization has supercharged the sector, opening out a scope of opportunity that can be personalized to meet consumer needs.

“If you think about embedded finance, like in a pre-digital era, you have use cases, like people going into a car dealership and being offered a loan by the car dealership,” said Hanrahan. “You’re moving the service or the product to the point of need.”

“It’s a subtle difference, but it’s really important. It’s a huge difference in terms of the value out of the dealer, the probability of the sale, the association, and increasing the order value. So the dynamic changes entirely when you move something to the physical point of need.”

“Now all that’s happening is digitalization,” he continued. “APIs and mobile banking allow us to do that in more compelling ways.”

Open Banking boosts development

Open banking is the latest piece, adding to the scope for increased embedded finance.

Banks’ long-standing advantage of retaining access to customer information has now been disrupted. With the UK leading the way, jurisdictions worldwide are adopting their own approaches to open banking. The shift could directly influence embedded finance.

“You can tailor products and offers to people much more effectively if you have better data on them,” said Hanrahan. “With open banking, the paradigm changes even more from being locked into a proprietary stack.”

“You could offer a great account but must offer it on a specific bank’s license. Whereas with open banking, you can decouple the layers of the value chain. Consumers can now get a great app, which then plugs into any of the banks that they happen to want to leave their money with.”

He explained it had allowed alternative payment methods to be integrated into the product, such as direct fund transfers, allowing customers to bypass card payments if required.

In addition, the convergence of the two technologies allows businesses to focus on creating financial products specific to their business and customer base.

“It’s quite a compelling thing for a lot of companies to get involved with because the financial services sector is one of the biggest industries in the world. People participating in it can often at least differentiate themselves or maybe even massively increase their revenues.”

Companies’ engagement with their customers can also extend to their financial health. Hanrahan explained that a side effect of the shift has allowed companies to view their customers’ affordability, allowing them to be more responsible in accepting petitions for loans.

In the UK, with new Customer Duty laws coming into effect this year, this will allow businesses to retain compliance and support trust that the company is working in consumers’ best interest.

“It’s a pretty exciting time in terms of what’s possible,” said Hanrahan.

RELATED: Why licensing matters: how banking licenses impact embedded finance