Within a decade, the form factor for computing will radically change from staring at screens with flat imagery, to participating in embedded virtual worlds with fully navigable, hyper-realistic environments. Those environments will be filled with software agents, some hybrid human and others entirely AI, that are entirely unrecognizable as anything but real to 90% of the population.

The question of consciousness goes to the root of why we build, what we create, and how we decide what is valuable and what is not. And if we can control our self-conception and the modeling we do of the world, the texture of life becomes better. A recurrent theme in our writing is that systems don’t care about their agents per se. There are many game theoretical equilibria where agents suffer, but systems perpetuate. So figuring out how an agent within a system reflects on happiness is paramount.

This week, we look at:

What it means to ask questions and find answers

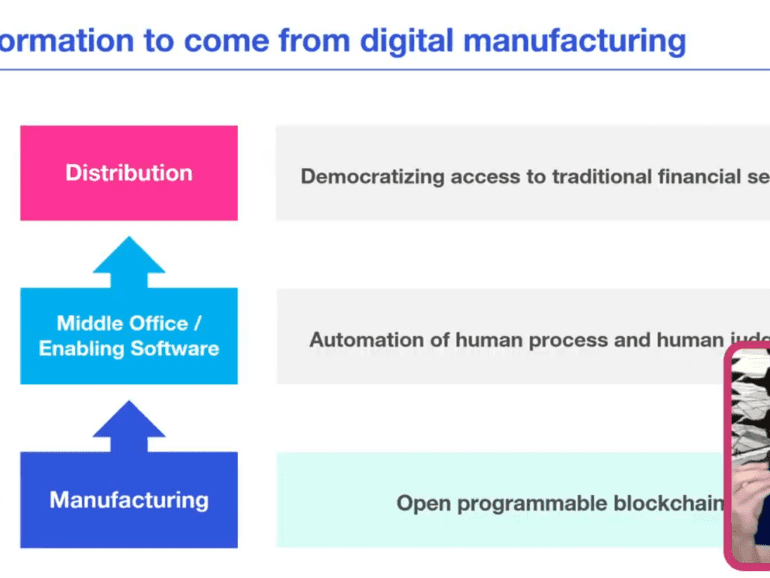

From asking simple questions that result in neobanks and roboadvisors. Who will win — Schwab or Robinhood?

To asking macro questions about the finance / high-tech competition. Who will win — Goldman Sachs or Google?

To asking profound questions about the nature of the work, and the art of finding your own questions.

We can't formulate the questions for you. But we can give you a framework of needs for both the individual, and the organization.

The questions that you ask are the answers that you will get.

I presented earlier this week at the Ally Invest virtual conference, and the prompt asked for a description of what happens to finance from Fintech to Crypto / Blockchain to Augmented Reality / Virtual Worlds and finally to Artificial Intelligence.

artificial intelligencebig techdigital transformationenterprise blockchainidentity and privacyIndiaregulation & compliancetelecom & infrastructure

·This week, we look at:

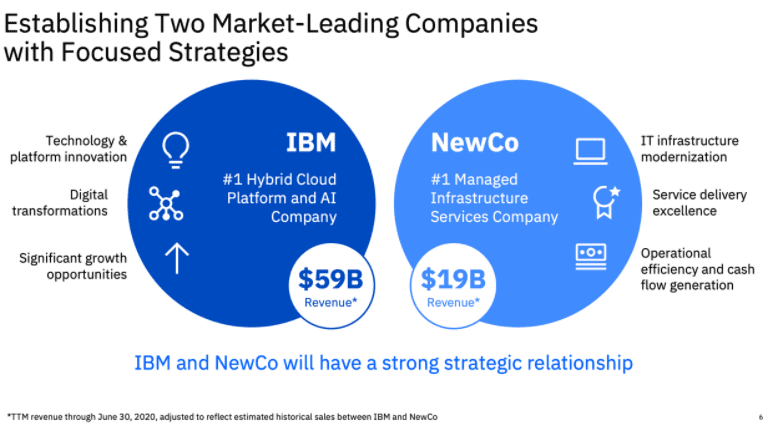

IBM spinning out its managed services division with $18 billion of revenue in order to focus on hybrid cloud and digital transformation

Reliance Jio, the Indian mobile telecom provider with 400 million users, contemplating financial services with backing from Google and Facebook

The role that technology infrastructure plays in the delivery of financial services

This week, we look at:

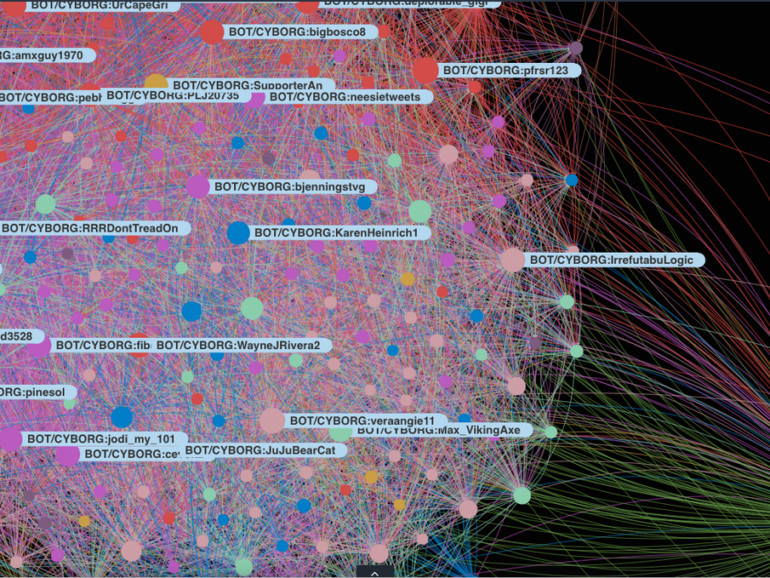

Deep Fakes behind South Park creators' new parody, Sassy Justice

The AI-created author of the fake Hunter Biden intelligence report

GPT-3 winning the love and attention of people on Hacker News

How should we react to these robots and their desire to mess with our minds

Unlike equities, the crypto markets were born from machines, and are constructed from code. Hold dear the tokens in which you believe, and stay away from the stories of easy money. Nothing is easy. To win Russian roulette is not good fortune. It is, instead, a grave mistake to play a lethal game. Have you nothing to lose?

And then Brexit. And then Taiwan and China. And then Covid, again. And then, who knows.

From now on and forever, your counterparty is the data center running an AI cluster on top of the Internet. The data center that has already profiled you and knows everything about you. Bring the tinfoil hat.

artificial intelligenceaugmented realityCryptodecentralized financeenterprise blockchainMetaverse / xRnarrative zeitgeistNFTs and digital objectsregulation & complianceventure capital

·In this conversation, we talk with Jamie Burke of Outlier Ventures. This is a fascinating and educational conversation that covers frontier technology companies and protocols in blockchain, IoT, and artificial intelligence, and the convergence of these themes in the future. Jamie walks us through the core investment thesis, as well as the commercial model behind shifting from incubation to acceleration of 30+ companies. We pick up on wisdom about marketing timing and fund structure along the way.

You work. You get money. You take money and invest it. If you are lucky, it becomes larger. Otherwise, it becomes smaller. If you have a lot of money, you can either start a company or not. If you start a company, you invest in your own ability to influence outcomes and in your own transformation function. There are other, personal utility functions also being satisfied in executing the transformation function. Alternately, you focus on the work of getting capital into other companies. For this allocation and selection work, you are rewarded. To this, you can add the capital of others, until you are doing selection on their behalf.

In this conversation, we have a really cool conversation on fintech, crypto assets, payments and all the things around it with Ivan Soto-Wright, the CEO and Co-founder of MoonPay.

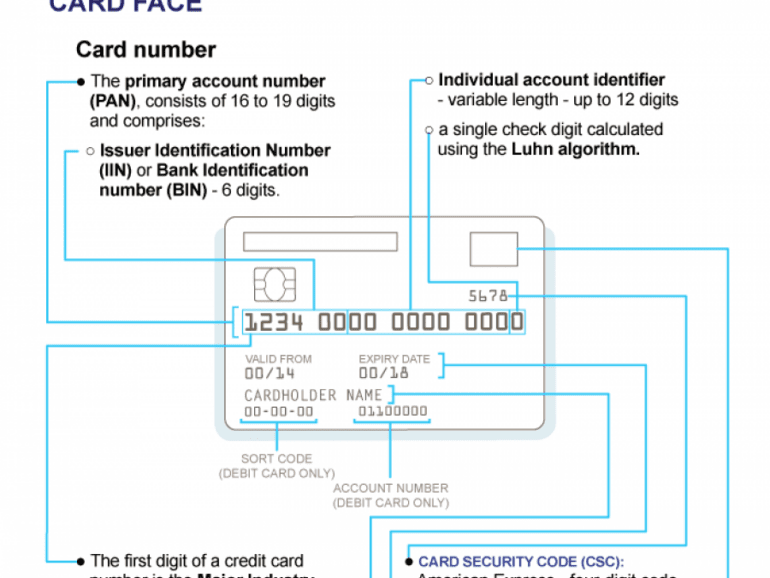

More specifically, we discuss Liability-driven Investment (LDI), the proliferation of AI in personal finance to drive sound decision-making, innovation in finance is following the same trajectory that resulted in VOIP for the telecommunication industry, the geographical maze of crypto KYC, payment networks, and crypto payment processing.

Instead, we are going to tap again into a new development in Art and Neural Networks as a metaphor of where AI progress sits today, and what is feasible in the years to come. For our 2019 “initiation” on this topic with foundational concepts, see here. Today, let’s talk about OpenAI’s CLIP model, connecting natural language inputs with image search navigation, and the generative neural art models like VQ-GAN.

Compared to GPT-3, which is really good at generating language, CLIP is really good at associating language with images through adjacent categories, rather than by training on an entire image data set.