AI GPT, is known for its "generative" attributes, but the transformer model underlying its evolution could make the biggest impact.

Lenders gravitate towards using artificial intelligence (AI), so they must be dedicated to removing biases from their models. Luckily there are tools to help them maximize returns and minimize risks.

A recent book by McKinsey executives details the way to do digital and AI transformation. They enable and augment an existing strategy

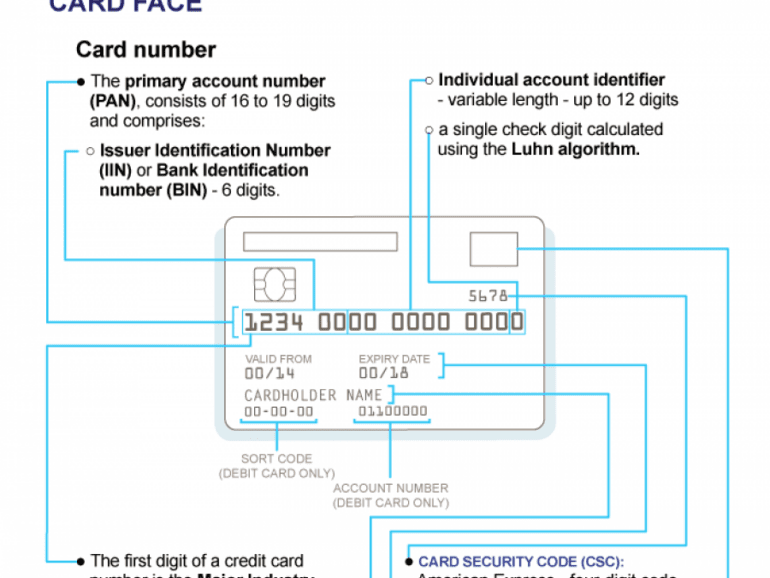

While statistics vary year by year, there was a 79 percent increase in document fraud in 2022. Such a number doesn't come as a surprise to Inscribe fraud analyst Daragh McMeel. A rise in fraud rates often occurs when the economy travels an uncertain and difficult path.

Sponsored

Sponsored content is a type of promotional media paid for by an advertiser but created and shared by a publisher. Fintech Nexus contracts sponsored content articles to experienced journalists comfortable in the fintech space.

The increased use of AI in financial services is inevitable, but for it to fully flourish, many issues must be addressed, including legal, educational and technological ones. As they get resolved, several factors will still increase use in the interim.

Glia's voice banking solution extends its Al-powered virtual assistants to banking customer phone calls, replacing menu-based IVR technology.

Sponsored

Sponsored content is a type of promotional media paid for by an advertiser but created and shared by a publisher. Fintech Nexus contracts sponsored content articles to experienced journalists comfortable in the fintech space.

In this conversation, we chat with Kevin Levitt who currently leads global business development for the financial services industry at NVIDIA. He focuses on global trends in accelerated compute and AI for consumer finance – including fintech, retail banking, credit card and insurance. Prior to joining NVIDIA, Kevin served as Vice President of Business Development at Credit Karma, and Vice President of Sales for Roostify.

More specifically, we touch on the role data plays in the financial industry, how the needs of financial institutions have changed, the age of big data, the definitions between artificial intelligence and machine learning, how to train an AI algorithm, the reasoning behind the incredible amount of parameters machine learning solutions consume, the fundamental purpose of AI/ML in financial services, what NVIDIA’s platforms comprise of, and lastly the future of AI/ML.

Instead, we are going to tap again into a new development in Art and Neural Networks as a metaphor of where AI progress sits today, and what is feasible in the years to come. For our 2019 “initiation” on this topic with foundational concepts, see here. Today, let’s talk about OpenAI’s CLIP model, connecting natural language inputs with image search navigation, and the generative neural art models like VQ-GAN.

Compared to GPT-3, which is really good at generating language, CLIP is really good at associating language with images through adjacent categories, rather than by training on an entire image data set.

In this conversation, we have a really cool conversation on fintech, crypto assets, payments and all the things around it with Ivan Soto-Wright, the CEO and Co-founder of MoonPay.

More specifically, we discuss Liability-driven Investment (LDI), the proliferation of AI in personal finance to drive sound decision-making, innovation in finance is following the same trajectory that resulted in VOIP for the telecommunication industry, the geographical maze of crypto KYC, payment networks, and crypto payment processing.

You work. You get money. You take money and invest it. If you are lucky, it becomes larger. Otherwise, it becomes smaller. If you have a lot of money, you can either start a company or not. If you start a company, you invest in your own ability to influence outcomes and in your own transformation function. There are other, personal utility functions also being satisfied in executing the transformation function. Alternately, you focus on the work of getting capital into other companies. For this allocation and selection work, you are rewarded. To this, you can add the capital of others, until you are doing selection on their behalf.