In the long take this week, I try out a contrarian point of view on personal finance chatbots. Trim, a savings chatbot, just withdrew support from Facebook Messenger. While lots of other chatbots are still invested in conversational banking, what could we take away from the counterfactual of chatbots failing to get B2C traction? What is the impact on the rest of the platform wars waged by Amazon, Google, and Tesla for connected homes, cars, and the Internet of Things?

InformedIQ helps lenders find opportunities in today’s challenging environment while others pull back. The main difference is who embraces AI.

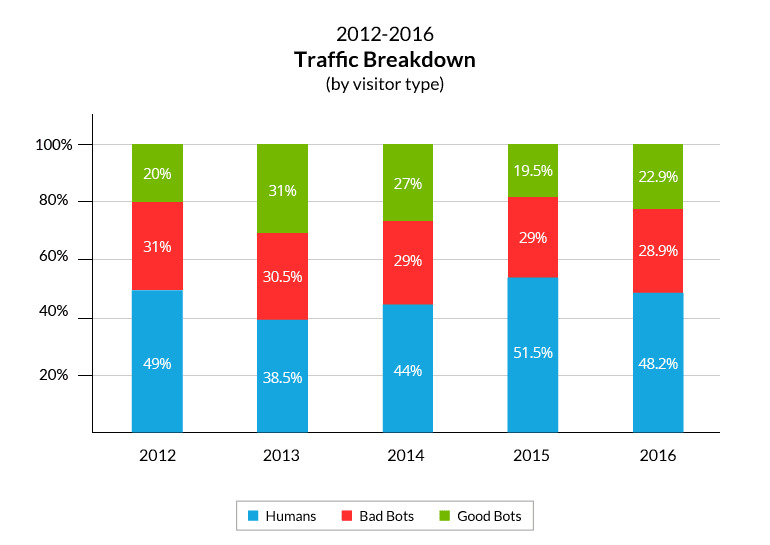

Sift's latest Digital Trust and Safety Index describes how artificial intelligence (AI) is fuelling a fraud surge that will challenge retailers and financial institutions.

AI GPT, is known for its "generative" attributes, but the transformer model underlying its evolution could make the biggest impact.

artificial intelligencebig techdigital transformationenterprise blockchainidentity and privacyIndiaregulation & compliancetelecom & infrastructure

·This week, we look at:

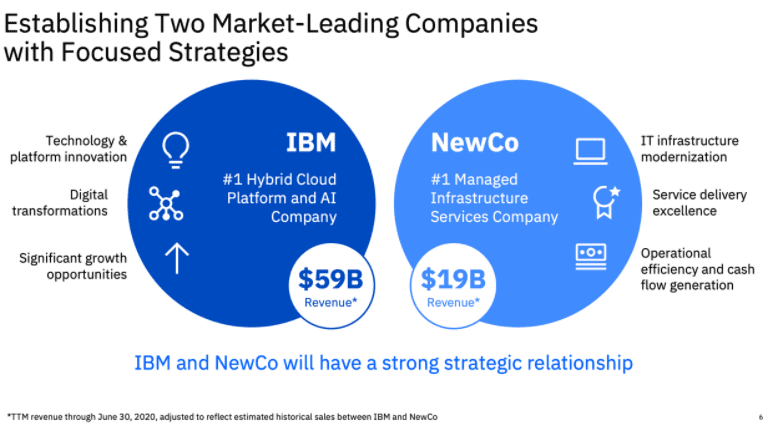

IBM spinning out its managed services division with $18 billion of revenue in order to focus on hybrid cloud and digital transformation

Reliance Jio, the Indian mobile telecom provider with 400 million users, contemplating financial services with backing from Google and Facebook

The role that technology infrastructure plays in the delivery of financial services

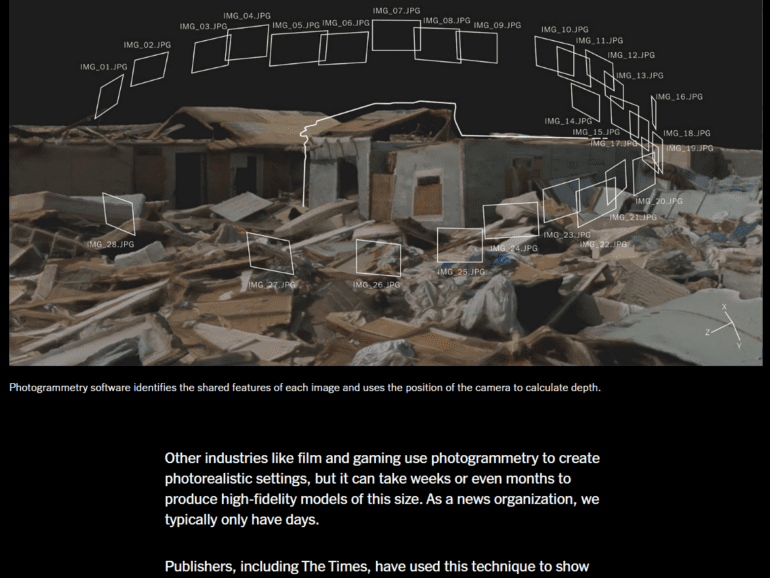

Within a decade, the form factor for computing will radically change from staring at screens with flat imagery, to participating in embedded virtual worlds with fully navigable, hyper-realistic environments. Those environments will be filled with software agents, some hybrid human and others entirely AI, that are entirely unrecognizable as anything but real to 90% of the population.

The Securities and Exchange Comission punted again on allowing a passive Bitcoin ETF to enter the market. It failed to approve the VanEck SolidX Bitcoin Trust, instead opting to open a commentary period to address several questions around Bitcoin price formation and the health of the exchanges. A similar outcome faces the Bitwise Bitcoin ETF. You can tell I am not a fan of this waffling, and there are two core reasons: (1) the years-long delay and uncertainty is responsible for financial damage to both traditional and crypto investors, and (2) the premise of the objections misunderstand the environment of the Internet and the way our world is shaping up in the 21st century.

This week, we look at:

What it means to ask questions and find answers

From asking simple questions that result in neobanks and roboadvisors. Who will win — Schwab or Robinhood?

To asking macro questions about the finance / high-tech competition. Who will win — Goldman Sachs or Google?

To asking profound questions about the nature of the work, and the art of finding your own questions.

We can't formulate the questions for you. But we can give you a framework of needs for both the individual, and the organization.

The questions that you ask are the answers that you will get.

artificial intelligenceaugmented realityCryptodecentralized financeenterprise blockchainMetaverse / xRnarrative zeitgeistNFTs and digital objectsregulation & complianceventure capital

·In this conversation, we talk with Jamie Burke of Outlier Ventures. This is a fascinating and educational conversation that covers frontier technology companies and protocols in blockchain, IoT, and artificial intelligence, and the convergence of these themes in the future. Jamie walks us through the core investment thesis, as well as the commercial model behind shifting from incubation to acceleration of 30+ companies. We pick up on wisdom about marketing timing and fund structure along the way.

·

Lendbuzz blends its founders’ early experiences with AI to disrupt traditional assessment methods and widen the pool of credit-worthy individuals.