By leveraging the benefits of artificial intelligence and looking at cash flow issues from the consumer’s perspective, Beem has grown to be one of the 50 most-downloaded financial apps in the world.

Fighting Chinese Artificial Intelligence with lasers and American Crypto with European Central Banks

How do the Americans and the Chinese have such different ethical takes on privacy, self-sovereignty, media, and the role of government? We can trace the root cause to the DNA of the macro-organism in which individuals reside, itself built over centuries and millenia from the collective scar tissue of local human experience. But there is more to observe. The technology now being deployed in each jurisdiction -- like social credit, surveillance artificial intelligence, monitored payment rails, and central bank cryptocurrency -- will drive a software architecture into the core of our societies that reflects the current moment. And it will be nearly impossible to change! This is why *how* we democratize access to financial services matters. We must be careful about the form, because we will be stuck with it like Americans are stuck with the core banking systems from the 1970s. But the worry is not inefficiency, it is programmed social strata.

In this episode, we connect with serial founder Ohad Samet, CEO of TrueAccord. Ohad has been working in fintech machine learning for a decade and a half, applying multi-dimensional mathematics to consumer finance. The result? A more empathetic approach to the traditionally gnarly problem of debt collection.

artificial intelligenceaugmented realityCryptodecentralized financeenterprise blockchainMetaverse / xRnarrative zeitgeistNFTs and digital objectsregulation & complianceventure capital

·In this conversation, we talk with Jamie Burke of Outlier Ventures. This is a fascinating and educational conversation that covers frontier technology companies and protocols in blockchain, IoT, and artificial intelligence, and the convergence of these themes in the future. Jamie walks us through the core investment thesis, as well as the commercial model behind shifting from incubation to acceleration of 30+ companies. We pick up on wisdom about marketing timing and fund structure along the way.

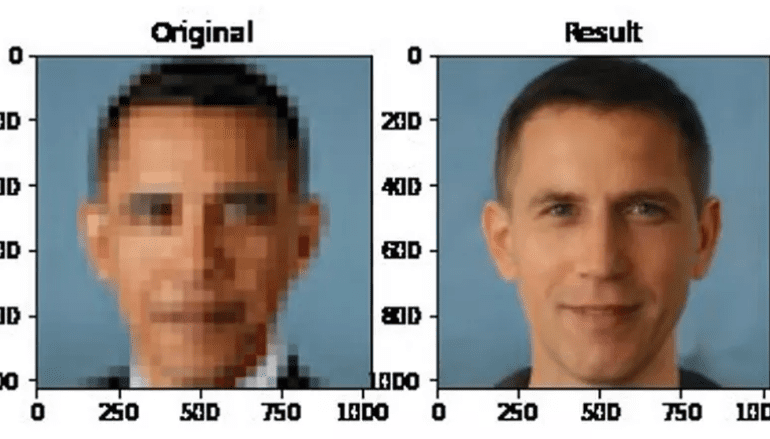

What we know intuitively, and what the software shows, is that the pixelated image can be expanded into a cone of multiple probable outcomes. The same pixelated face can yield millions of various, uncanny permutations. These mathematical permutations of our human flesh exit in an area which is called “latent space”. The way to pick one out of the many is called “gradient descent”.

Imagine you are standing in an open field, and see many beautiful hills nearby. Or alternately, imagine you are standing on a hill, looking across the rolling valleys. You decide to pick one of these valleys, based on how popular or how close it is. This is gradient descent, and the valley is the generated face. Which way would you go?

You work. You get money. You take money and invest it. If you are lucky, it becomes larger. Otherwise, it becomes smaller. If you have a lot of money, you can either start a company or not. If you start a company, you invest in your own ability to influence outcomes and in your own transformation function. There are other, personal utility functions also being satisfied in executing the transformation function. Alternately, you focus on the work of getting capital into other companies. For this allocation and selection work, you are rewarded. To this, you can add the capital of others, until you are doing selection on their behalf.

Findings from a new Google Cloud survey on sentiment around generative AI among banking executives.

No More Content