In this conversation, we chat with Paul Rowady is the Founder and Director of Research for Alphacution Research Conservatory and a 30-year veteran of proprietary, hedge fund and capital markets research, trading and risk advisory initiatives. Alphacution is a digitally-oriented research and strategic advisory platform focused on modeling and benchmarking the impacts of technology on global financial markets and the businesses of trading, asset management and banking. This data-driven approach allows Alphacution to reverse-engineer the operational dynamics of these market actors to showcase the most vivid and impactful themes among the field of available research providers and platforms.

This week, we look at:

Lending Club, the peer-to-peer lending innovator, turning off peer-to-peer lending after having a bank in its pocket

Consolidation of the UK's largest crowdfunders, CrowdCube and Seedrs, and their limited economics

The scale of the Morgan Stanley and Eaton Vance deal, creating a $1.2 trillion asset manager

The struggle of peer-to-peer models more generally, and whether the blockchain movement can overcome the Prisoner's Dilemma

A few delicious morsels for us today, connecting ideas between the automation of the institutional art world, and the rise of non-fungible token art. We are surprised by how things are clicking.

We caught up recently with Lori Hotz of Lobus. Lori used to work in the wealth and investment management businesses of Wall Street (Lehman, Lazard) and comes to art with a background of asset allocation and investment assets. One core narrative in wealth management has of course been roboadvisors and digital wealth, and the automation of the financial advisor process. Whether you are doing client experience, CRM, financial planning, trading, or performance reporting, there are now lots of platforms for everyone from mass-retail to ultra-high-net-worth and family office advisors.

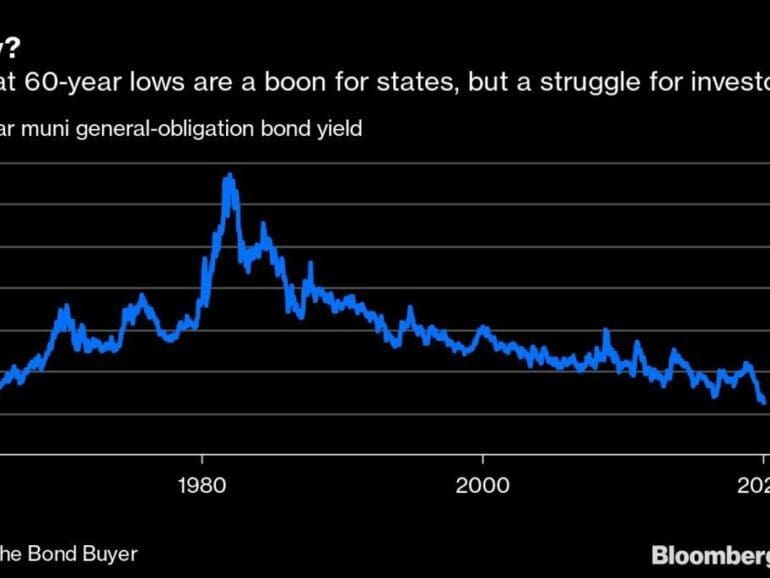

I reflect on ConsenSys acquiring a broker/dealer focused on municipal bonds, and why we believe that blockchain-native platforms are a fantastic fit for this $4 trillion asset class. Can direct holding of franctional munis enable deeper community participation and usage of common resources? Are there new sources of liquidity to unlock? At the same time, there are real dangers. I compare the evolution of digital lenders and their funding sources against the current possibilities in municipal bond markets. We also look into the reasons that some innovative Fintechs have failed to achieve their stated missions, and what can be learned and done better.

You work. You get money. You take money and invest it. If you are lucky, it becomes larger. Otherwise, it becomes smaller. If you have a lot of money, you can either start a company or not. If you start a company, you invest in your own ability to influence outcomes and in your own transformation function. There are other, personal utility functions also being satisfied in executing the transformation function. Alternately, you focus on the work of getting capital into other companies. For this allocation and selection work, you are rewarded. To this, you can add the capital of others, until you are doing selection on their behalf.

This week, we cover these ideas:

The Acorns SPAC deal, including its valuation and detailed metrics

The growth levers and obstacles for point-solutions as they scale into the millions of users and hundred of millions of revenues

What a $50 billion fund should do to roll this stuff up

It is looking like a pretty good time to go consolidating individual financial product footprints. Leaving aside whether consolidated companies are good or bad for some particular reason, the simple observation is that there are just far too many point-solution brands out there. Too many to be left alone to operate. And now a number of them are going to be public, which means that a number of them are going to be up for sale.

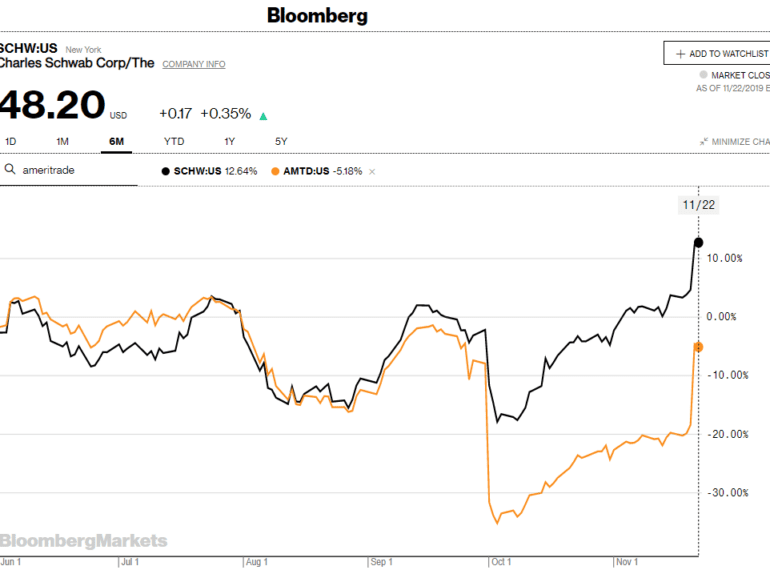

Well this morning started out as a bit of a bummer! See -- Charles Schwab to buy TD Ameritrade in a $26 billion all-stock deal. The $55 billion market cap Schwab is gobbling up the $22 billion TD Ameritrade at a slight premium. Matt Levine of Bloomberg has a great, cynical take on the question: Schwab lowering its trading commissions to zero is actually what wiped out $4 billion off TD's marketcap a few months ago. For Schwab, the revenue loss from trading was 7% of total, while for TD it was over 20%. Once Schwab dropped prices, TD started trading at a discount and became an acquisition target. You can see the share price drops reflected below in the beginning of October.

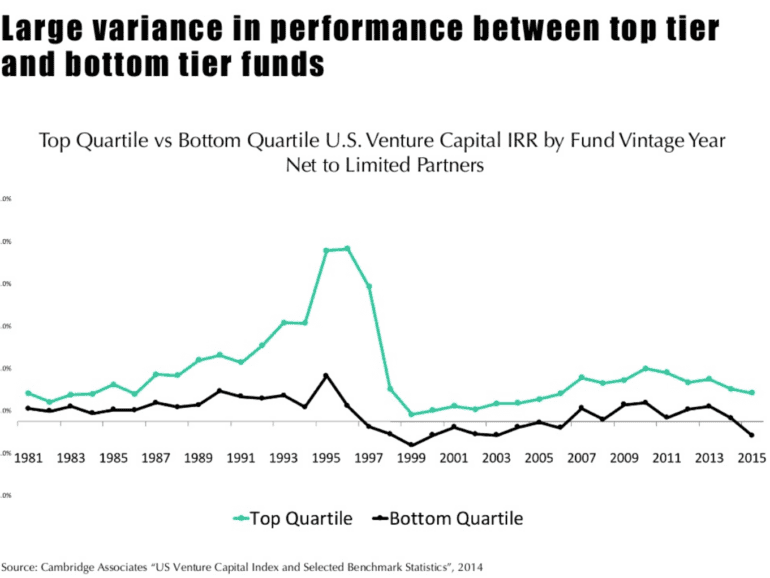

We look at why venture capital investors are slowing down, and the dynamics of how their portfolios work under duress. We talk about the incentives of limited partners to derisk exposure, the implication that has on cash reserves, new deals, and fundraising. We also touch on how the various Fintech themes are responding to an increase in digital interaction while seeing fundamental economic challenges. Shrewd competitors will be able to consolidate their positions and gain share during the crisis, but that will have to come from the balance sheet, not intermittent growth equity checks.

No More Content