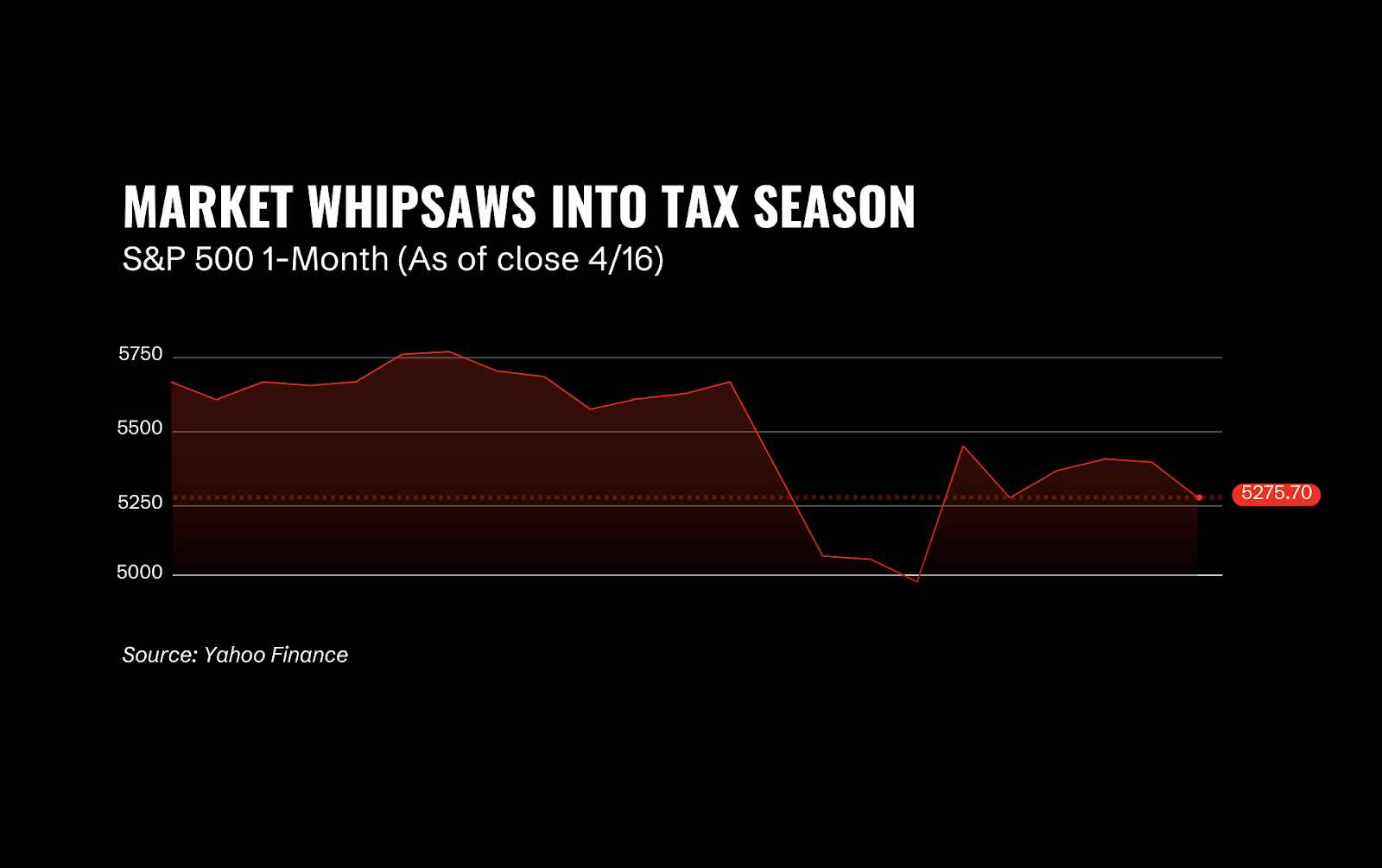

Five Questions with Fifteenth during tax week It’s Tax Week in America, and as the IRS contemplates its next moves...

JoinedMay. 30, 2017

Articles5,244

Comments63

·

As the IRS confronts cuts and restructuring, fast-moving AI identity fraud is a growing threat. Can the agency meet the...

·

Fintech investor Simon Wu discusses the rising popularity of the secondary exit strategy, and staying disciplined amid the AI frenzy...

Murmurings from Fintech Meetup and HumanX It is amazing to me, how many meetings — even in a meeting I...

·

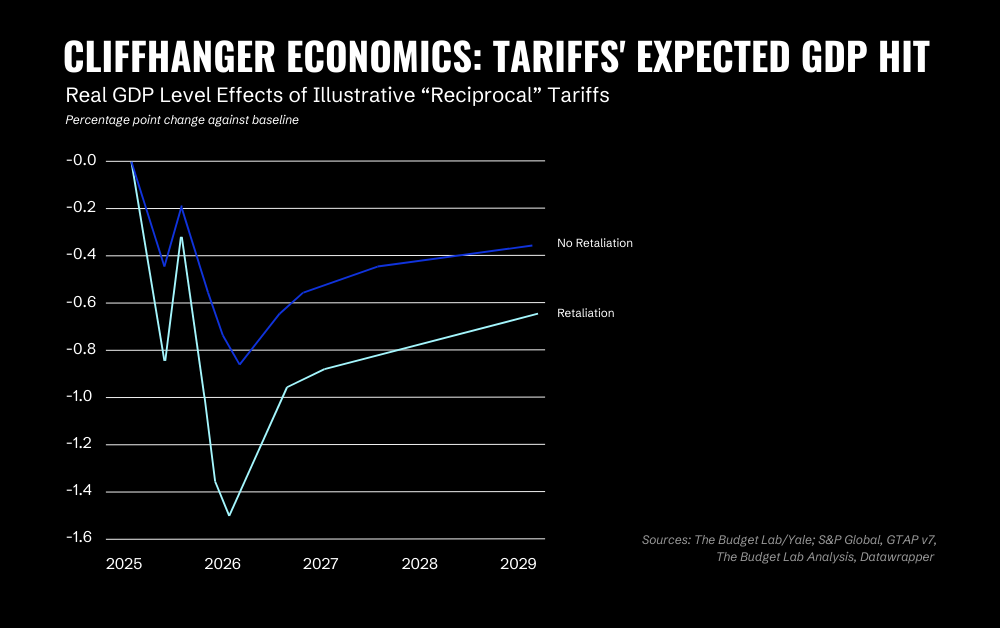

At 12:01 AM ET on Tuesday, a U.S. tranche of 25% tariffs went into effect against Mexican and Canadian imports,...

Three questions for Canaan Partners’ Dana Warren and Brendan Dickinson Given the stop-start nature of tariff imposition and other major...

Why Orum eyes debit cards as the rails for more market share The adage “If you build it they will...

·

Today marks an exciting new beginning for Fintech Nexus, the leading fintech media company, as it relaunches under new ownership...

The borrower of 2024 is more demanding than ever before. They want instant loan approvals and a frictionless checkout process....

[Upcoming: June 5th] Instant Payments Orchestration: An Essential Tool Now for Lending and Factoring

In today’s on-demand economy, instant payments are moving from a nice-to-have to a must-have. In the small business space, in...