Nubank and Banco Inter are moving away from the local stock exchange, while other Brazilian fintechs skip the market altogether.

JoinedJun. 9, 2022

Articles219

David is a Latin American journalist. He reports regularly on the region for global news organizations such as The Washington Post, The New York Times, The Financial Times, and Americas Quarterly.

He has worked for S&P Global Market Intelligence as a LatAm financial reporter and has built expertise on fintech and market trends in the region.

He lives in Buenos Aires.

Credit granted by fintechs in Brazil reached 55 billion reais in 2021, up tenfold in the 2016-2021 period, according to Serasa Experian.

E-commerce is quickly catching up in Latin America, providing fertile ground for digital payments to proliferate.

Last month, PicPay launched peer-to-peer lending for companies, a major innovation in a bid to enhance the product suite.

Three years after a prosperous US IPO, uncertainty in global markets has taken a toll on XP, with its share down 50% year to date.

A survey by Fiserv indicate the growing use of modern payment methods in Brazil such as Pix, QR codes and online shopping.

The rise in interest rates has led to banks and fintechs cutting down on lending. For companies like Stori, that is an opportunity.

Despite the bear market, Kushki's CEO argues that LatAm founders are used to dealing with recurring crises.

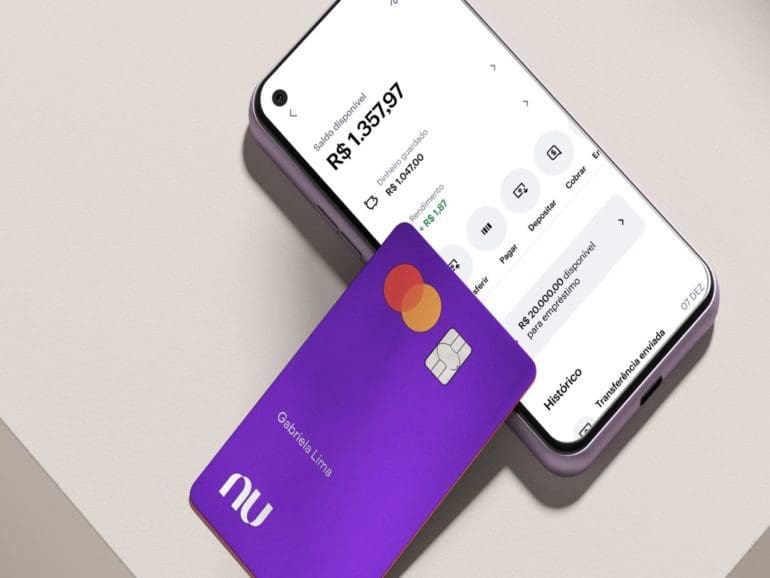

Two years after its launch in Mexico, Nubank is making progress amid a highly concentrated banking industry.

Pix has led to a dramatic acceleration in financial inclusion, Carlos Brandt, head of Pix at the central bank, said at Fintech Nexus LatAm.