The popularity of crypto is rising. Stablecoins have presented a significant opportunity for settlement, but how should banks respond? This, and more were discussed at Fintech Nexus 2022.

JoinedFeb. 2, 2022

Articles419

In the future of consumer finance in the face of digital disruption, one thing is key - meeting the customer where they are. This has led Marcus by Goldman Sachs to create an effective strategy in the face of the rising age of digital-native fintechs.

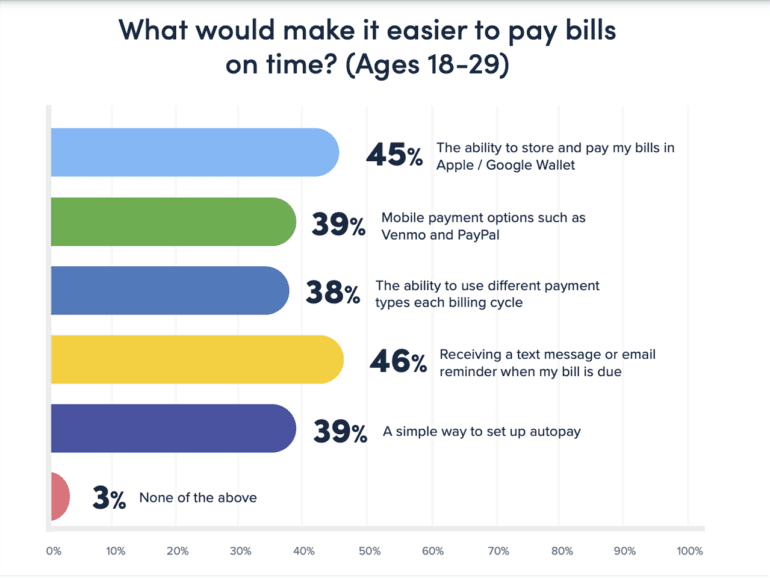

Pay Near Me has found adults aged 18-29 are more likely to pay their bills late. By asking why, their survey unveiled the next big opportunity for bill payments.

To further strengthen its offering to SMEs, lending platform, October, has acquired Credit.fr. The partnership spells an exciting future of development within Europe.

Venture capital fund, Kindred, has a community driven approach. Their "equitable venture" model and focus on founders is about to hit the fintech sector. Hard.

Gimi, in a partnership with ABN Amro has released a financial literacy app for children. According to its founder, the effects could go far beyond economic benefits.

Steven, the Swedish expense sharing app, has recently released a card to support the platform as they evolve further, addressing the need to split household bills.

There is increased focus on UX Design but few understand its importance. Going beyond visual design, for many fintechs, UX can spell success or failure. We took a dive into UX with Design Accelerator's Federico Spiezia, understanding the value it brings to a business and how it can be measured.

LTG Bank is the latest traditional institution making the step towards crypto integration. Partnering with SEBA Bank, their roll-out is symptomatic of increasing global demand for crypto assets.

Gamification is increasingly being used in financial products with great success, but to what cost to the customer?