The report found that the traditional playbook of developing branches and building relationships may count "for little in a world where a mobile phone is the principal' real estate', and word-of-mouth – often via social media – becomes the most powerful form of validation."

JoinedAug. 16, 2021

Articles225

The paper, published by the President's Working Group on Financial Markets, argued that regulation must address defi money laundering and terrorism financing to create broader investor protection.

'Nu's valuation is not crazy. In fact, they are valuing each customer at about $1,000, whereas U.S. and European neobank valuations put their customers closer to $2,000.'

On Thursday, online lender Enova International posted a $52 million profit on $320 million in revenue, up 57% from the same time last year. In addition, total originations increased 26% sequentially to a record $856 million. Despite the good news, the stock saw only a 4% rise before falling back toward its downward trend this month.

Many of these firms have aimed to go public in the vague "end of 2021/ early 2022/ when we have enough money" time frame while participating in increasingly rare-letter funding rounds.

The crypto firm enables users to buy and sell crypto, earn credit rewards on their accounts, and send money peer-to-peer: it will open up the Mastercard network to the cryptocurrency world.

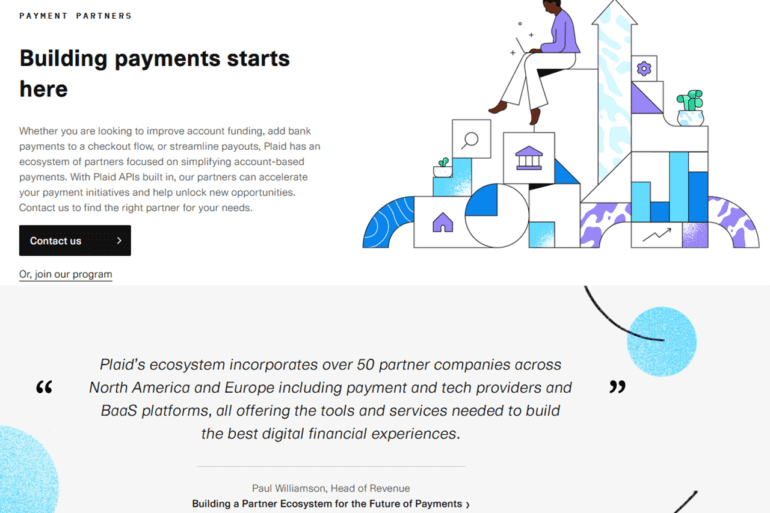

Instead of joining a major payments provider, Plaid aims to disrupt the Visa, Mastercard, and Amex payment empire. Partners like Square, Dwolla, and new arrivals to the Plaid ecosystem Checkout.com and Marqeta are members of the new program, building payment capabilities for the new age of fintech.

The paper found 34 percent of Americans are considered financially healthy: leaving out 187 million who are still getting by or vulnerable.

Investors will be able to gain exposure to bitcoin through the fund, without direct exposure to the volatile currency that traded over $62,000 over the weekend alongside this and other pro-crypto news. On Tuesday morning, the ProShares ETF went live under the ticker BITO at around $40.

The new platform gives startups free access to the suite of security options: what would typically amount to hundreds of thousands of hours of in-house compliance work.