Gensler said his biggest worry about the equity market was competition and consolidation. While retail investing has taken off, the PFOF that enables it is ripe for conflict of interest.

JoinedAug. 16, 2021

Articles225

Wednesday morning Goldman Sachs, not looking to be left behind, announced it would be acquiring GreenSky for $2.24 billion.

The firm joins Shopify and Paypal in the burgeoning fintech payments race.

The new system is unique, creating a closed network outside of the giants that make POS possible.

The Walmart Litecoin fake post brought the coin price from $175 up to $231.

Someone, or a group of people, likely made a lot of money on a pump and dump. According to Coinmarketcap, the coin's trading volume tripled from $2.4 billion to $6.3 billion in the hour after the article went live.

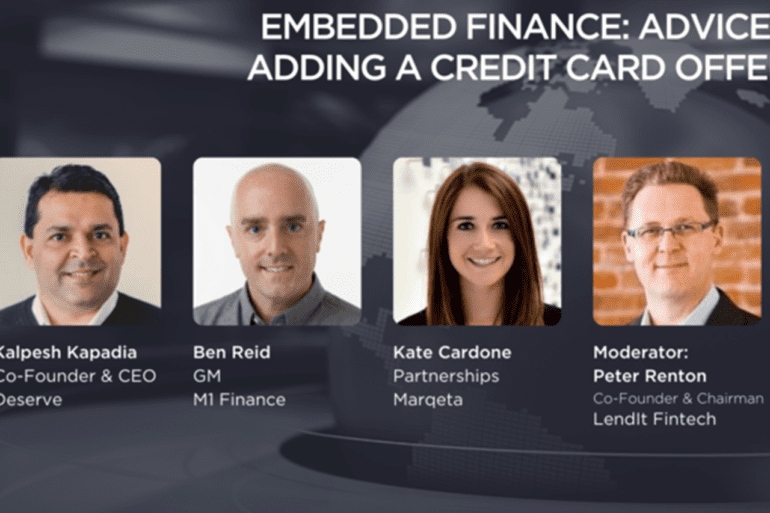

Three embedded finance experts joined the Lendit TV live session on Tuesday afternoon to advise firms looking to onboard Credit Card Offerings.

The embedded finance gig is booming, with everyone from Plaid to Cross River, and giants like Apple, Amazon, Paypal, and Google offering some form of payment option.

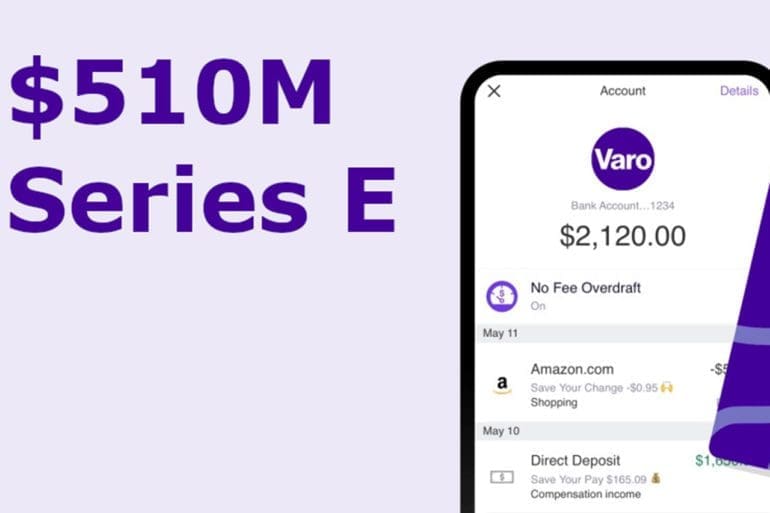

The company has tripled its revenue and added new products like the Varo Advance personal credit advance announced in October last year.

The product lets users get small amounts of credit, starting from a feeless $20.

Founded after incubating in the Y combinator class of 2019, Jeeves is a cross-boarder card and payments company aiming to slash fees for startups that operate over multiple borders.

As a company founded as completely remote, Jeeves has employees all over the world and understands the issues that come with it.

Launching soon, Nerve joins the family of neobank newcomers — why are so many fintechs and community bank partners trying it out?

Paypal Mafia buy now pay later fintech the talk to the town having snagged the biggest e-commerce market in the world.

Certain customers will be able to use an Affirm pay later option at checkout, Amazon said in a press release.

In this week's LendIt TV session we learned about the state of central bank digital currencies (CBDCs) with experts from the USA, Europe, and China.

Since before bitcoin blew up in 2018, leading financial minds the world over have been researching the implications of institutionally created currencies for use as digital cash, to settle interbank deposits, and for monetary policy development.