We asked the CEOs of several consumer lending fintech leaders three questions about what is in store for 2024.

PositionChairman

JoinedOct. 8, 2010

Articles2,906

Comments3,014

Peter Renton is the chairman and co-founder of Fintech Nexus, the world’s largest digital media company focused on fintech. Peter has been writing about fintech since 2010 and he is the author and creator of the Fintech One-on-One Podcast, the first and longest-running fintech interview series.

A look back at the most popular fintech stories, podcasts and cartoons of 2023.

Fintech Nexus Newsletter (December 21, 2023): Small business lenders must get ready for Section 1071

In Congress, anything that helps small businesses typically comes with bipartisan support. But section 1071 of Dodd-Frank is a little complicated.

The Chief Digital Banking officer and Revolut U.S. CEO, Sid Jajodia, talks about the challenges of creating the world's first global digital bank.

The CFPB has just released a 90-page report on the use of overdraft and Non-Sufficient Fund fees and it paints a bleak picture for those consumers that are struggling financially.

This is happening even though the CFPB has been attacking these kinds of "junk fees" over the last couple of years.

With the trial of Sam Bankman-Fried in the spotlight last month it is easy to forget that there is still the massive FTX bankruptcy that has to be sorted out.

The next step in that process has now been revealed in the form of a proposal. At this stage, it is just a proposal that must be approved by creditors before it can go to the bankruptcy judge. But the major creditor and consumer groups have agreed to the plan outline.

The buy-now-pay-later industry continues to grow in popularity. And part of the reason is consumers are starting to understand that most of BNPL stands outside the traditional credit scoring system.

We are moving to a world of instant payments but how we get there is still uncertain.

A blockchain-based payments system designed for central banks has just completed its first live transactions with the Bank of England. Created by Fnality, the system processed live payments from member banks, Lloyds, Santander and UBS.

The Federal Home Loan Banks have been around since 1932 but their mission has changed from support for affordable housing to liquidity provider for banks. This has had a profound impact on the financial system.

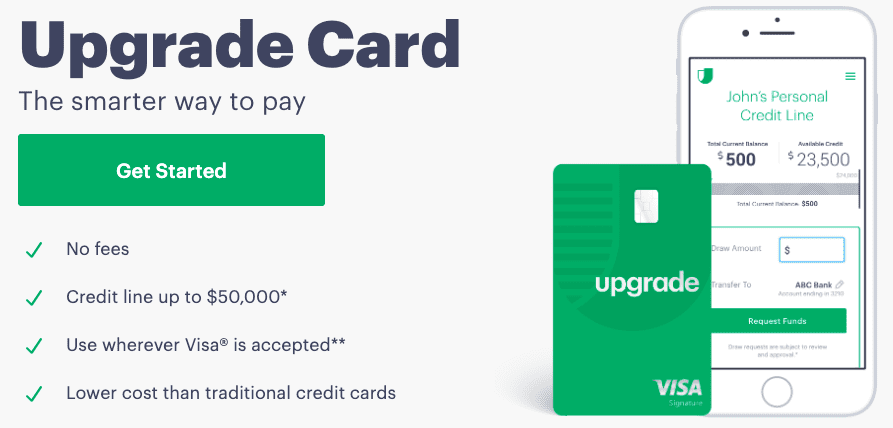

Upgrade continues to break new ground in consumer fintech.

When the Upgrade Card launched in 2019, it was the first credit card ever to marry the benefits of a revolving line of credit with a fixed-rate installment loan.