The results of TransUnion’s new global credit study challenge industry perceptions and give direction to serving new-to-credit consumers.

JoinedSep. 30, 2021

Articles238

Tony is a long-time contributor in the fintech and alt-fi spaces. A two-time LendIt Journalist of the Year nominee and winner in 2018, Tony has written more than 2,000 original articles on the blockchain, peer-to-peer lending, crowdfunding, and emerging technologies over the past seven years. He has hosted panels at LendIt, the CfPA Summit, and DECENT's Unchained, a blockchain exposition in Hong Kong. Email Tony here.

While many got swept up in the early days of the DeFi asset hype machine, others who saw its true potential began quietly plotting the path the space would need to get there.

As more states enact their own disclosure laws for commercial finance providers, the regulatory burden will only increase on those companies.

Results from MoneyLion's first Personal Financial Wellness Study confirm the growing influence of digital sources in our financial lives, but the steep drop-off of knowledge among millennials and Gen Z consumers.

While Web3 and the crypto world bring provide some unique situations, when insurance providers assess their risk, they go back to the basics. That is, if they touch it all.

Sift’s latest quarterly report describes how the growing problem of real and fraudulent online disputes threatens many a bottom line.

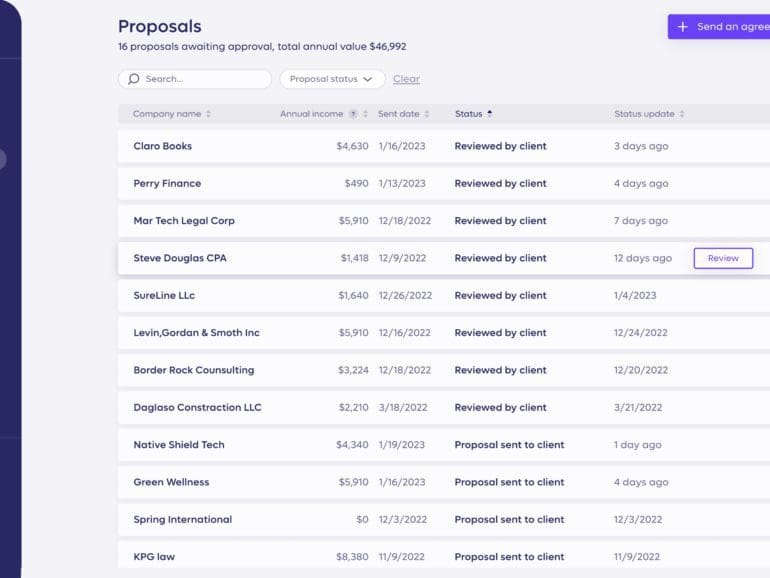

Anchor cofounder and CEO Rom Lakritz has long been troubled by billing inefficiencies. Now that technology exists to solve it, he’s the perfect man for the job.

Fintechs are among the sectors contending with a shortage of cybersecurity professionals, where the global shortage is 2.72 million. This comes as the global cost of cybercrime in 2021 was pegged at $6 trillion.

Peach Finance founder and CEO Eddie Oistacher expects the company’s latest innovation, Self-Service Portfolio Migration to become the apple in many a lender’s eye.

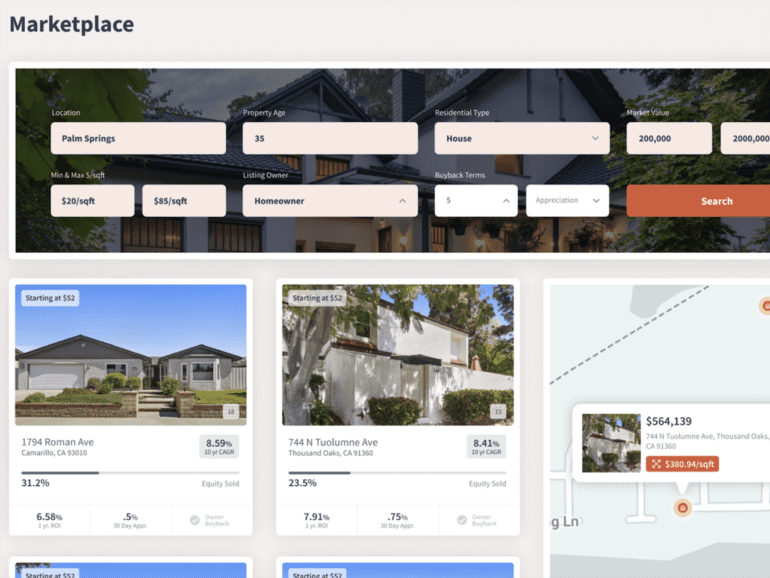

Vesta Equity is a home equity marketplace that allows homeowners to access their equity without borrowing while providing tokenized, residential real estate investment opportunities. And it works because of its owners’ faith in the future of blockchain technology and Web3.