Many Americans saw their financial health decline in 2022, according to the Financial Health Network's Financial Health Pulse report.

JoinedSep. 30, 2021

Articles237

Tony is a long-time contributor in the fintech and alt-fi spaces. A two-time LendIt Journalist of the Year nominee and winner in 2018, Tony has written more than 2,000 original articles on the blockchain, peer-to-peer lending, crowdfunding, and emerging technologies over the past seven years. He has hosted panels at LendIt, the CfPA Summit, and DECENT's Unchained, a blockchain exposition in Hong Kong. Email Tony here.

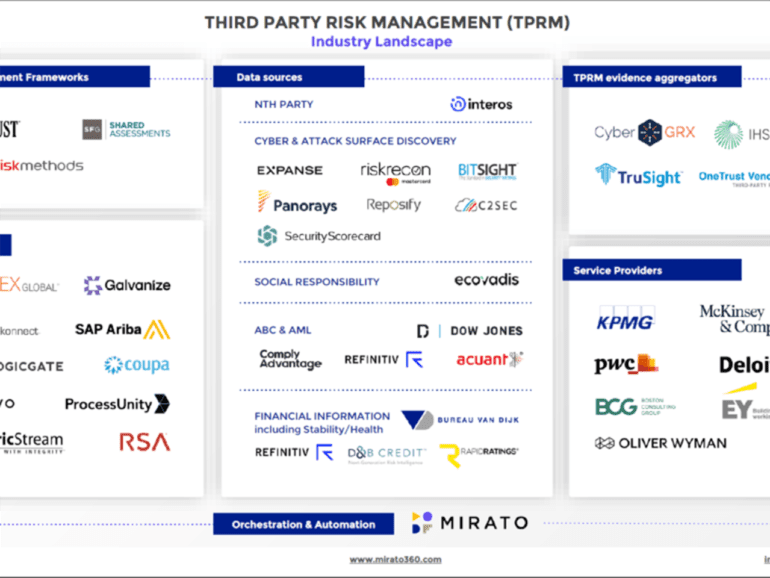

Mirato simplifies the third-party risk management process with its Industry Landscape Map placing vendors into the most relevant categories.

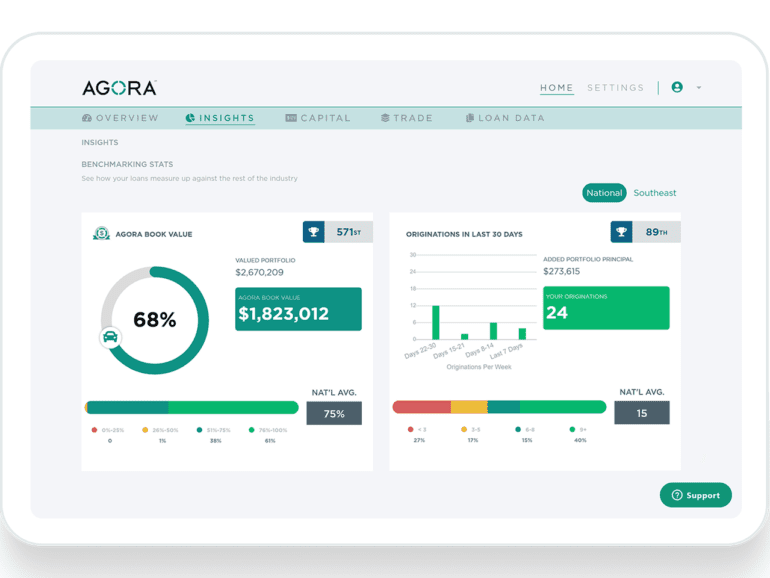

Agora Data helps any size of auto dealer compete with the big corporations by providing affordable financing at more reasonable rates.

Borrowers can complete the entire process without talking to a human being.

Creating a responsive chatbot is hard work, but it is a must if financial institutions want to attract and retain younger clients.

Companies face more pressure to detail the environmental footprints of their investments, thanks to regulations and the ESG trends.

VC3 brings decentralized autonomous organizations (DAO) to venture capital by using the power of a very selective crowd.

People with higher credit scores are more likely to have grown up in an environment where they learned how to use credit to their advantage.

Household debt continues to rise, proof that more families are struggling to make ends meet, fintech industry executives believe.

Borrowell's Rent Advantage is the latest example of a fintech using technology and a fresh perspective to solve a longstanding imbalance in the credit markets.