The use of buy now, pay later (BNPL) services has exploded over the past few years, and only now are we beginning to learn the impact of that boom.

JoinedSep. 30, 2021

Articles237

Tony is a long-time contributor in the fintech and alt-fi spaces. A two-time LendIt Journalist of the Year nominee and winner in 2018, Tony has written more than 2,000 original articles on the blockchain, peer-to-peer lending, crowdfunding, and emerging technologies over the past seven years. He has hosted panels at LendIt, the CfPA Summit, and DECENT's Unchained, a blockchain exposition in Hong Kong. Email Tony here.

Cryptix AG takes a holistic approach to building the “people's financial marketplace,” benefiting all, based on blockchain technology.

Many companies use artificial intelligence and machine learning to deliver services in consumer fintech, but TIFIN uses those tools to drive the personalization of wealth management

New technologies are needed to meet customer expectations and their desire to pay in more ways than before.

One of the benefits of technologies like artificial intelligence and optical character recognition (OCR) is their ability to free up humans to concentrate on more complex and high-value issues.

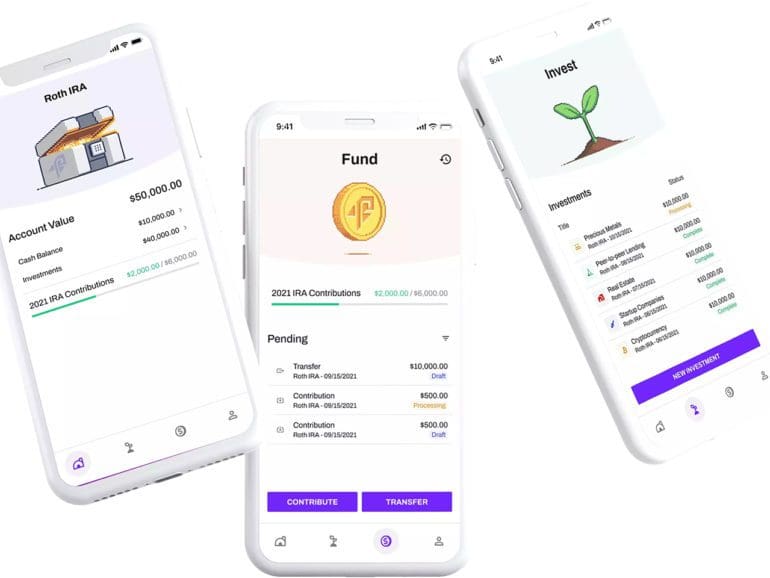

People can unlock the power of their IRA and 401K accounts by gaining the ability to purchase private and alternative investments.

A great place to look for a future roadmap of blockchain is gaming and entertainment, a pattern that has long existed.

With advancements in technology and the right product design, retirement plans can certainly be designed for business owners.

Minterest follows a disciplined approach in developing its decentralized finance lending protocol, one born from its founder's experience.

Nanda Kumar's relationship-based pricing model with SunTec makes even more sense in today's era of hyper-personalization.