Hyper-automation in business processes and financial services deliver significant value as technologies improve.

JoinedSep. 30, 2021

Articles237

Tony is a long-time contributor in the fintech and alt-fi spaces. A two-time LendIt Journalist of the Year nominee and winner in 2018, Tony has written more than 2,000 original articles on the blockchain, peer-to-peer lending, crowdfunding, and emerging technologies over the past seven years. He has hosted panels at LendIt, the CfPA Summit, and DECENT's Unchained, a blockchain exposition in Hong Kong. Email Tony here.

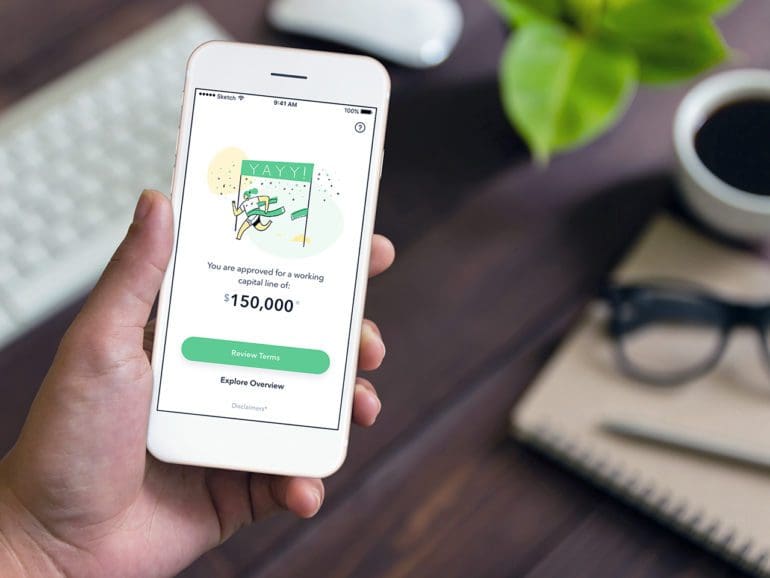

Kabbage developed partnerships with banks that saw its technology power small business lending in seven countries.

As the growing value of cryptocurrencies generated increased media attention, the IRS began watching the space more closely.

A new report suggests the pandemic has spurred the financial services and banking industries to accelerate change.

Hope is the author of Open Banking and the rise of Banking-as-a-Service, a recent Temenos whitepaper that dives into these issues.

The trick is in breaking the American economy into many sub-sectors and taking a granular, forward look into the commercial loan book.

While more people are interested in crypto, most prefer to hold them within a bank, the results of a new survey show.

Identiq provides a higher level of risk analysis for buy now, pay later (BNPL) customers by leveraging tech that has been around for decades.

Knowing how technologies work and the paths typical payments take has helped MyChargeBack develop an effective system to protect participants.

Cognito CEO Alain Meier said the soaring demand for such checks results from more people moving more aspects of their financial lives online.