Two of the leading marketplace lending platforms reported some more bad news this week as the industry continues to struggle to gain any positive momentum.

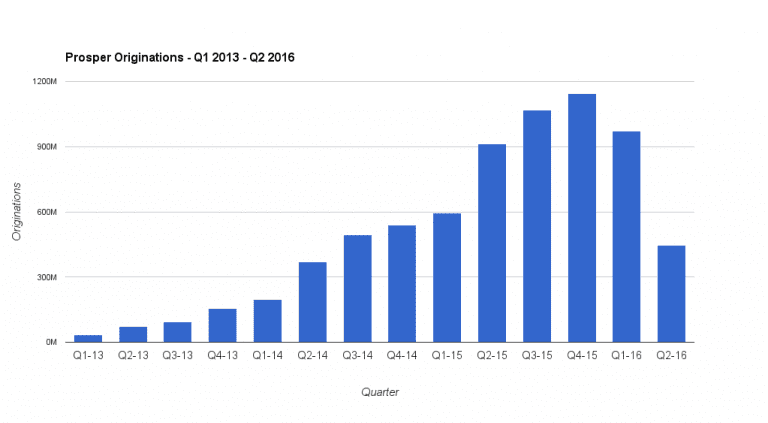

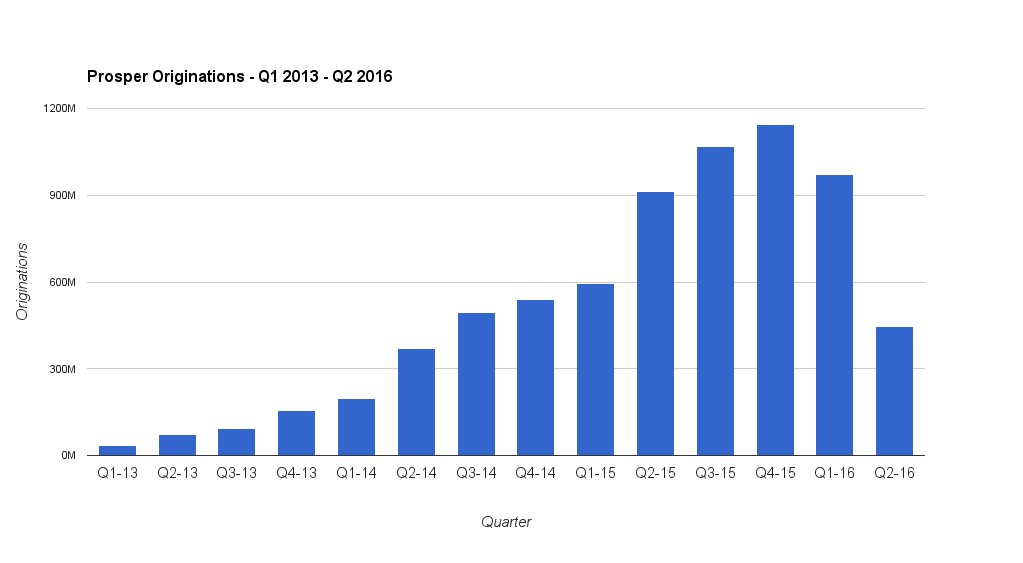

First, we had Prosper. Late Monday Prosper released their results for the second quarter. As expected it was not pretty. Originations were down more than 50% from Q1 as they were hit hard by the general pullback from investors. Total originations in Q2 were $445 million down from $973 million in Q1 and also down from $912 million in Q2 2015. Prosper laid off 28% of its workforce in May and at that time management said that Q2 would be a significantly down quarter. But to be down more than 50% was more than most people expected. Below is a chart showing the quarterly originations back to the beginning of 2013 when the current executive team took over.

Obviously, this drop in originations led to a corresponding drop in revenue. Total revenue fell from $49 million in Q2 2015 to $27 million in Q2 2016. The loss was also much larger. The total loss for Q2 was $36 million compared with $6 million in the same period last year. A big contributor to this increased loss was a one time restructuring charge of $14 million related to the layoffs. The company has $29 million in cash and equivalents and a total of $85 million in liquid assets on their balance sheet.

There is no way to really sugar coat this – these numbers are not good. The slow down in the capital markets and the problems at Lending Club have hit Prosper hard. The one positive Prosper has right now is the reported $5 billion deal that is on the table. Clearly, the company needs this deal to close to help them get back on track. The $5 billion over two years is an additional $625 million in new loans a quarter on average. There will likely be a ramp up period but that deal alone would get Prosper back over $1 billion a quarter in the foreseeable future. Given the fact that it has not closed yet and we are over half way through the quarter, it will likely not have much impact on Q3 numbers. So, we could see another light quarter before things really turn around at Prosper.

In their July performance update Prosper shared that their loans continue to perform well with an average estimated return to investors now at 7.4%. Delinquencies are also trending lower than in previous quarters. So, thankfully, there is no issue with loan performance, Prosper just needs more investors.

Avant Parts Ways With 30% of its Workforce

The other bad news story of the week concerns Avant. Again, this was not unexpected as the company announced earlier in the summer that they would offer buyouts to all 760 employees. The Wall Street Journal reported yesterday that around 30% of the staff have taken the company up on this offer. While Avant does not publish quarterly financials the article quoted an investor letter that said the company had revenue of more than $100 million for the quarter and broke even on an adjusted basis.

Avant has a different business model to other marketplace lenders. One of the key differences is that they have historically not charged fees to borrowers and instead relied on selling loans at a premium to investors. However, given the difficult capital markets environment Avant will now charge an administrative fee on new loans. Fees will amount to between 1.75% to 3.75%. According to the Wall Street Journal Avant is also requiring borrowers to have more income relative to loan size and has also been shrinking the loan terms and size of loans.

It hasn’t been all bad news from Avant. It was announced earlier this week that the company had renewed its $392 million warehouse facility with JP Morgan Chase and Credit Suisse. At the same time they announced a successful $255 million securitization with the lowest yields that we have seen from Avant to date.

Conclusion

It is very clear that 2016 will go down as the worst year in the history of the marketplace lending industry. While these two stories this week were both expected it still doesn’t make their reality any less pleasant, particularly for those people who are now out of a job.

Will this mark the bottom or is there more bad news to come? While I don’t expect good news to suddenly become the norm I do think we are at or very close to the bottom. From here I expect to industry to start to recover albeit in a more gradual and sustainable way.