The digital banking shift, digital payments, cryptocurrencies and artificial intelligence (AI) are critical factors behind escalating global financial crime compliance costs that exceed $200 billion. Those are among the findings in LexisNexis Risk Solutions’ True Cost of Financial Crime Compliance Study for 2023.

Global neobanks have focused on the regional ecosystem as the fintech sector gained decent size and scale in the past few years.

Debit card and financial education app GoHenry, designed for kids aged 6-18, has a simple mission: make every kid smart with money.

Gold Token investment is on the rise, 2022 has already seen a 4% increase compared to Bitcoin's 18% decrease. The asset is seen as low risk, resisting inflation, but is this really the case?

Grasshopper, which relaunched a year ago and reported significant growth in 2022, will use MANTL’s completely digital commercial deposit origination process to create a more-favorable customer experience.

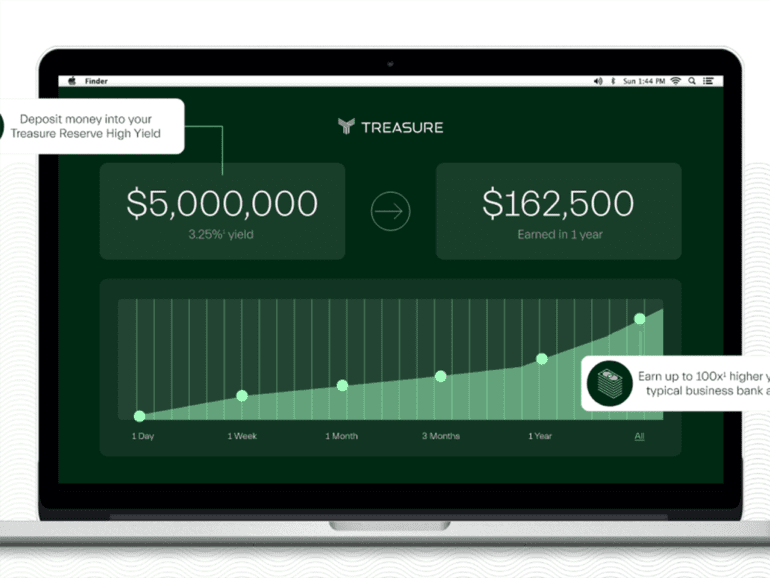

Treasure Financial announced a partnership with Grasshopper Bank for businesses to invest their treasury cash for high returns.

We launched our latest LendIt Fintech survey last week, and we are already seeing a compelling variety of opinions on the big questions facing the industry.

Digital bank G10 is the first of its kind in a Brazilian favela, low-income areas which together account for roughly 17 million citizens.

Just a few years ago, Banking as a Service (BaaS) was a term hardly ever heard in Latin America outside...

Financial institutions have access to a vast amount of customer data, including account information, transaction history, and credit scores. However, much of that data is siloed by different payment platforms and networks and out of reach when fraud teams need it most. Banks can address this data drought problem by finding ways to modernize their tech stack, getting creative with existing rails, and leaning on providers to gain scale.