Shares of Nubank have weakened since its initial public offering, losing some $20 billion in market value since it went public.

The results of a recent Axway survey on open banking in America bode well for its adoption stateside. More than half, 55%, have heard of open banking, with 32% believing they have a decent understanding of it.

We launched our latest LendIt Fintech survey last week, and we are already seeing a compelling variety of opinions on the big questions facing the industry.

Credit card fraud rates are rising, and while bad behavior will never go away, research from Security.org shows that some progress is being made.

Consumer sentiment is changing towards online banking in the UK. We explore the potential reasons why official figures have shown a downward trend in customers willing to recommend their online bank and banking app over the last 4 years, and how the rise in online fraud is a key contributing factor.

Latin America's digital bank Nubank reported a record net income in Q4 as it continues to grow in Mexico, Colombia and Brazil.

Blockchain-enabled structured finance platform Intain announced the addition of a 'verification agent module' with UMB as its first customer.

Many companies use artificial intelligence and machine learning to deliver services in consumer fintech, but TIFIN uses those tools to drive the personalization of wealth management

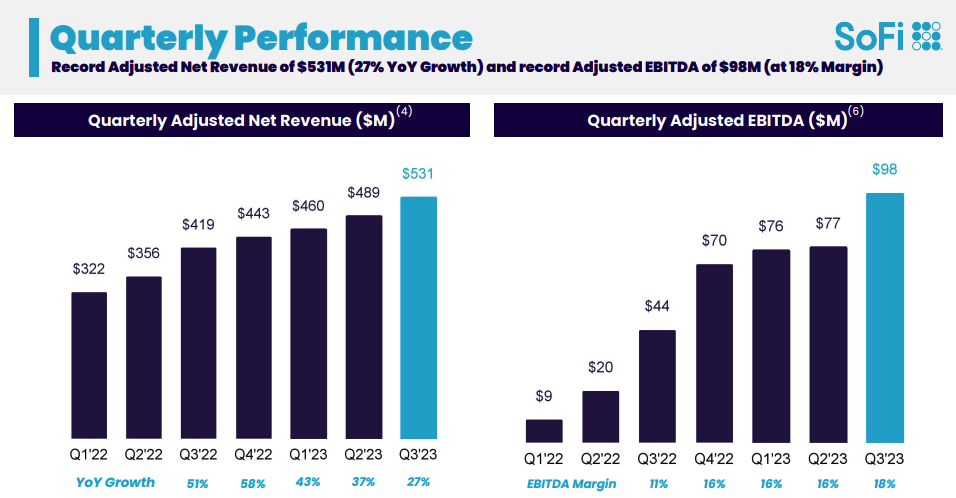

SoFi reported their financial results for Q3 2023 and showed considerable improvements across all areas of their business.

In a long awaited move, the CFPB proposed a rule to improve consumer access to their financial data and drive the shift to open banking.