There are more offerings today for kids and teens to get started managing their finances.

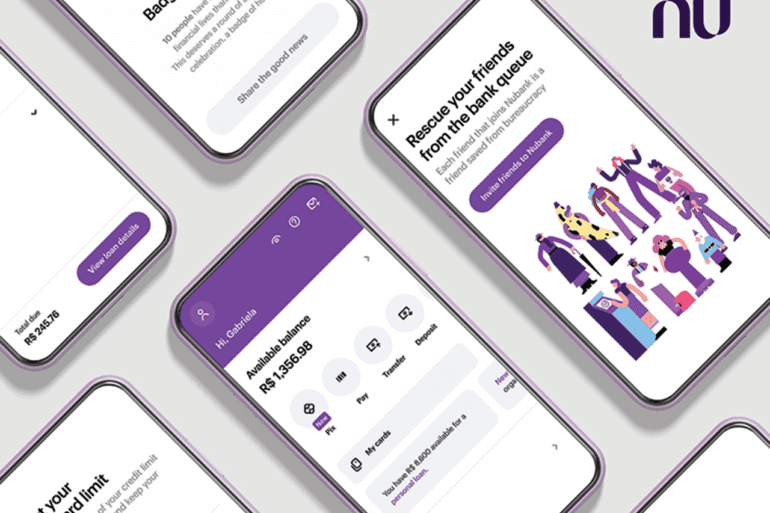

'Nu's valuation is not crazy. In fact, they are valuing each customer at about $1,000, whereas U.S. and European neobank valuations put their customers closer to $2,000.'

Many of these firms have aimed to go public in the vague "end of 2021/ early 2022/ when we have enough money" time frame while participating in increasingly rare-letter funding rounds.

It's not a new thing. PFOF has been a contentious issue for more than 30 years. But, with the rise of feeless retail trading options since 2018, PFOF is back in the news.

LendIt Fintech has teamed up with leading fintech firm Amount to put together a survey asking banks and fintechs about launching a BNPL credit product.

Launching soon, Nerve joins the family of neobank newcomers — why are so many fintechs and community bank partners trying it out?

One of the world's biggest payment processors, Visa made a clear statement: like credit cards and online banking before, NFTs and blockchain are the waves of the future.

Overdraft fees have suddenly become a hot topic in banking circles. And it is about time. A couple of years...

Cross River Bank has been at the center of fintech for more than a decade. They started working with fintech...

LendingClub reported Q4 earnings today and their recovery from the depths of the pandemic continues. Loan originations were up 56%...