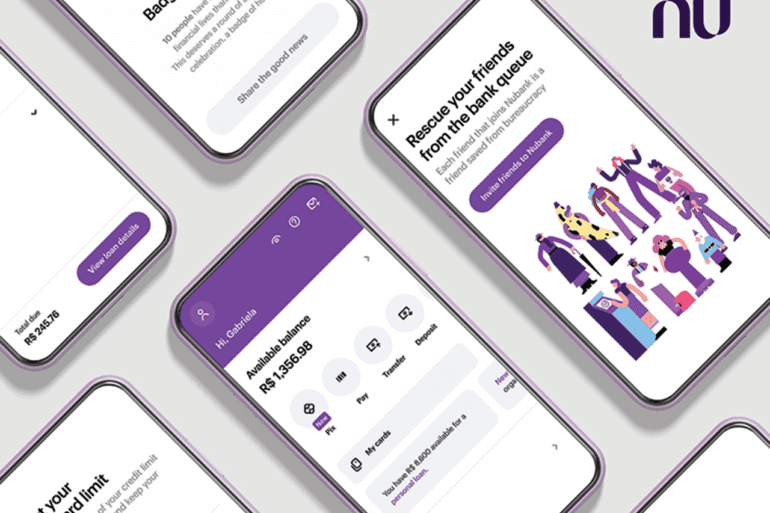

'Nu's valuation is not crazy. In fact, they are valuing each customer at about $1,000, whereas U.S. and European neobank valuations put their customers closer to $2,000.'

There are more offerings today for kids and teens to get started managing their finances.

The firm has helped members save upwards of $7 billion to date through retirement savings, investing, and rainy day fund planning.

The Cion Digital Blockchain Orchestration Platform accelerates integration, provides optionality, prevents technical debt from the onset, and removes friction from creating blockchain-based innovative real-time payment and financing.

Avanti now needs FDIC insurance and acceptance into the Federal Reserve payments system to function as a bank and offer stable coin services.

Flow Networks helps connect the world's biggest payment systems to the consumer at the moment of payment. They use that period to connect with customers via gamification in ways that build retention.

While in the past new fintechs would grow to the point that a bank acquired them, it is becoming more and more the case that fintechs are the ones doing the shopping.

David Velez founded Nubank in 2013 with the idea of taking on big banks in Brazil and leveraging technology to change how financial products are served in the country radically.

While there will likely be a change in how organizations use sanctions as a tool, their increased use looks to continue.

In one parameter, data show that 80% of USA consumers and 82% of Canadians use a payment or banking service connected to their primary accounts.