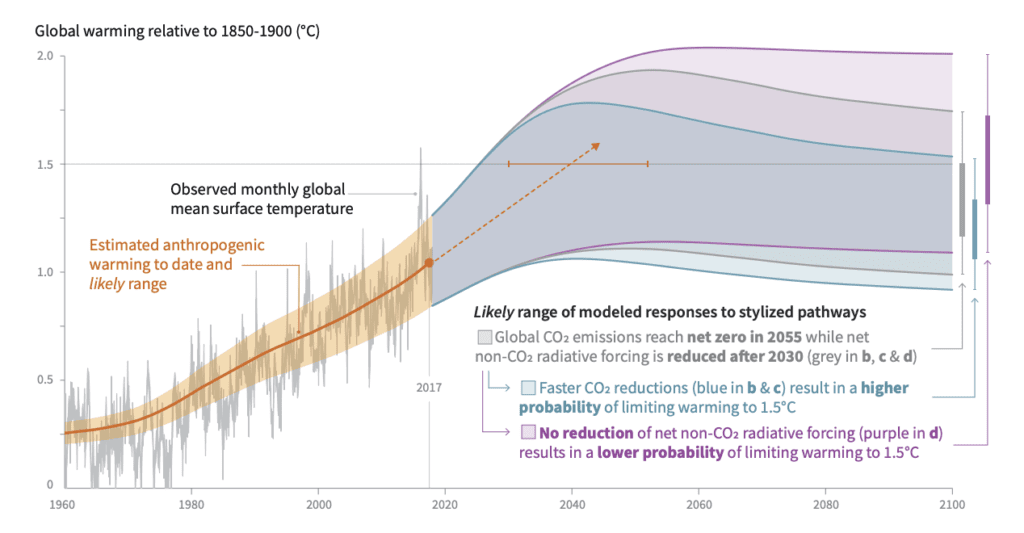

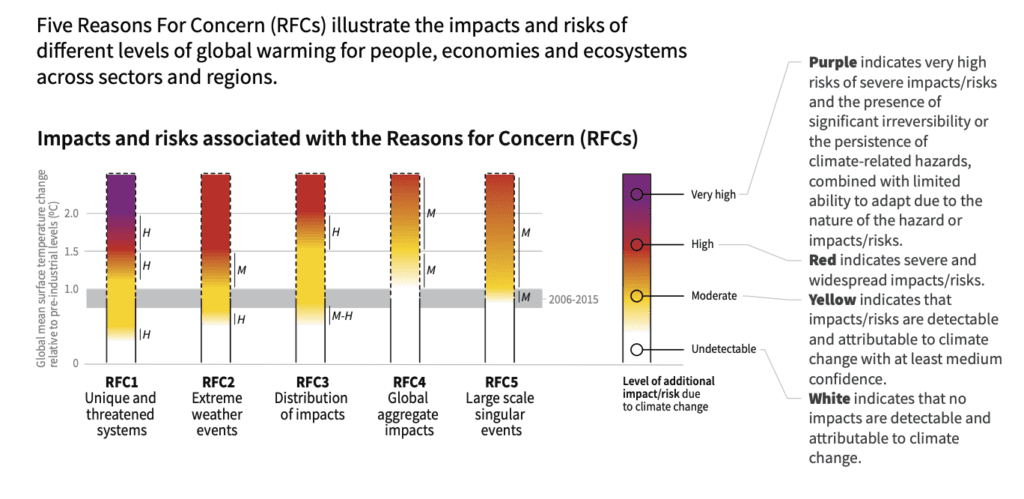

As global warming becomes an ever more prominent issue, its associated effects pose an increased risk to businesses and financial institutions. Although there has been a global target set to reach net-zero by 2050, emissions from the pre-industrial to the present are likely to instigate warming effects for millennia, causing continuing long-term changes to the climate system.

The associated risks are already being observed. Ranging in severity according to geography, level of development, and sector, many adapt activities to account for environmental changes.

For financial institutions, risks are also significant. Climate-related risk drivers could pose issues with the value of financial instruments in portfolios increase volatility and heighten losses. The IPCC states, “Future climate-related risks would be reduced by the upscaling and acceleration of far-reaching, multilevel and cross-sectoral climate mitigation and by both incremental and transformational adaptation.”

To mitigate such risks, the Basel Committee (BC) has issued principles for effective management and supervision. Aimed primarily at banks for inclusion within the Basel framework, it marks one of the first coordinated attempts on a global level to support the management of climate-related stressors.

Climate risk-related disclosures insufficient

The EU has been relatively efficient in regulating businesses with a more climate-influenced focus. Since 2018, large companies have had mandatory disclosure requirements for climate-related risk management. Despite this, there have been problems with compliance.

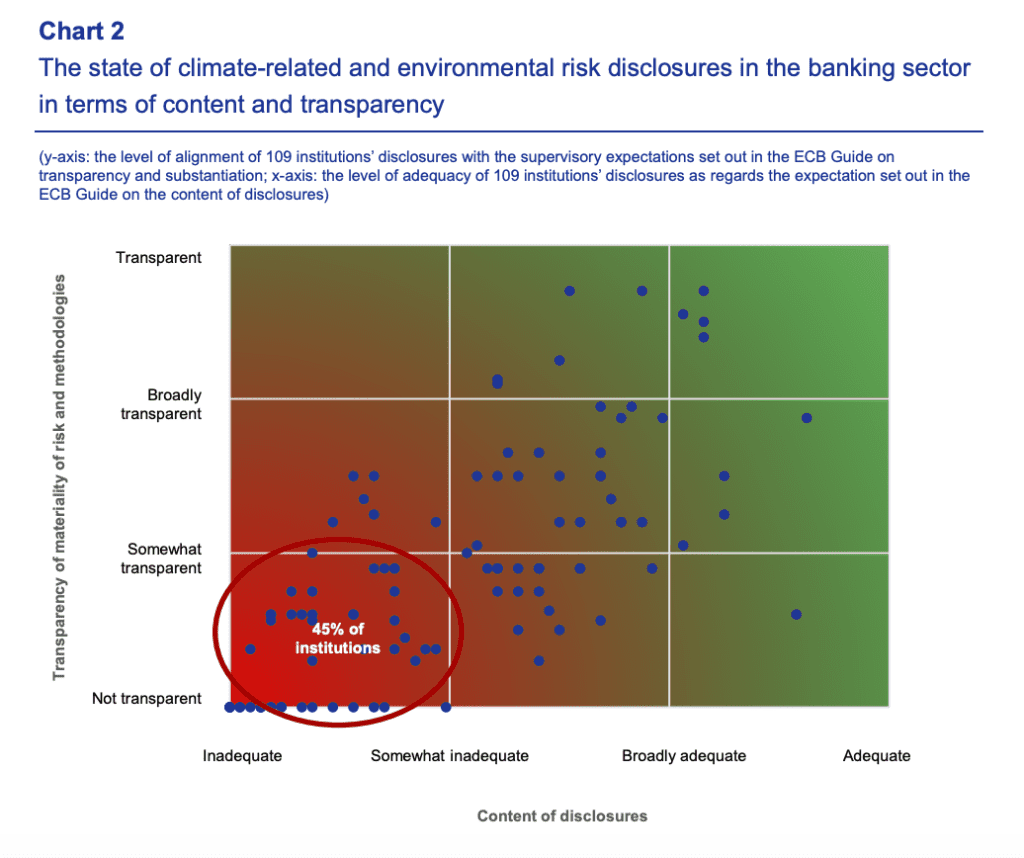

In March 2022, the European Central Bank (ECB) issued a report assessing institutions’ climate-related and environmental risk disclosures. The aim is to increase the transparency of companies’ risk profiles and form part of a multi-step approach to improvement over two years.

The report was the second conducted and the final proposed report before a scheduled climate risk stress test in Q2 2022 and a pilot program of on-site inspections towards the end of the year.

The results of the March survey were dismal. It was found that 45% of institutions’ disclosures were deficient in content and lacked transparency in methodology, despite the issuance of ECB guidelines in 2020. Surprisingly, this was an improvement on the year before but continues to be misaligned with the ECB’s expectations.

Continued focus on assisting in the management of climate-related risk is seen to be critical. As more jurisdictions regulate the space, larger advisory committees such as the BC are starting to respond.

Addressing the issue holistically within the Basel Framework

The BC hopes to improve banks’ management of climate risks through the existing Basel Framework.

The Basel framework consists of three pillars: minimum capital requirements (Pillar 1), supervisory review (Pillar 2), and market discipline (Pillar 3). The principles aim to consider all three pillars, approaching the issue holistically as quickly as possible.

In the report outlining the 18 principles for managing climate risks, the committee’s guidelines state there is a degree of flexibility within the Basel framework, allowing for the additional principles. Additionally, they found that “supervisors and banks could benefit from the BC’s guidance to foster alignment in supervisory expectations for addressing these risks.”

The principles were formulated after assessing the current member banks undertaken in 2020-2021. Although primarily aimed toward large internationally active banks and financial authorities in BC member jurisdictions, smaller banks and authorities in all jurisdictions are expected to benefit.

The member banks span multiple continents, in areas that may be affected by climate change at different rates. The flexibility of the principles allows banks of different sizes to respond according to their specific need or capacity. Banks are advised to maintain a dynamic approach allowing for ongoing changes that could reach far beyond the usual two-to-three-year capital planning horizon.

Increased financial stability is the main focus of the BC’s guidance, strengthening the practices, supervision, and regulations regarding climate-related risks. There is no obligation for banks to comply. However, given the increasing instability associated with heightened risks, it could be in their best interest to do so.

Some guidelines suggest allocating a specific workforce tasked with overseeing efficient disclosure and risk management. It is evident in ever-increasing certainty that climate-related risks are a factor that will affect financial institutions significantly. Despite the likelihood of increased investment to comply with all the principles, this focus on financial stability through climate risk mitigation could create substantial long-term value.

RELATED: