Fintech is expensive. Fintech is everywhere. If you are a thinking about starting a financial services company, and it does not have technology at its core — don’t. You will lose to someone similarly positioned building a more augmented business. Fintech is the global competition for regulation, talent, and macroeconomic supremacy. Fintech is the trade war between the US and China. Fintech is Facebook and Amazon. Fintech is the next bubble to burst. Fintech has burst already.

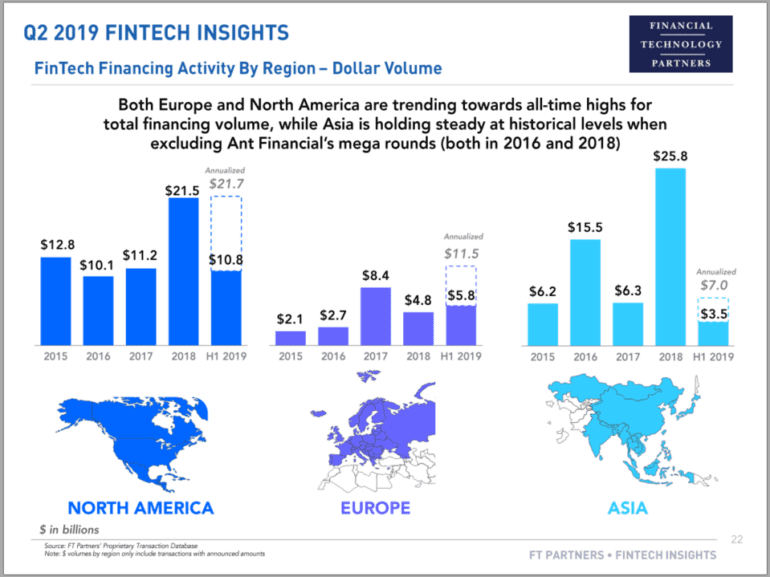

Rhetorical flourish aside, I think we can paint a good picture of the macro environment in the industry, and see where both investments and returns are flowing. The stellar FT Partners quarterly research report is out, and you can see continued health in the sector. In terms of North America, we can expect over $20 billion in venture financing this year again — much of it flowing to data aggregators, banking-as-a-service entrants, and insurtech (e.g., Plaid, Lemonade). In Europe, over $10 billion could be invested this year, doubling that of 2018 and driven by the sector’s leadership in integrated digital banking (e.g., Revolut, N26).