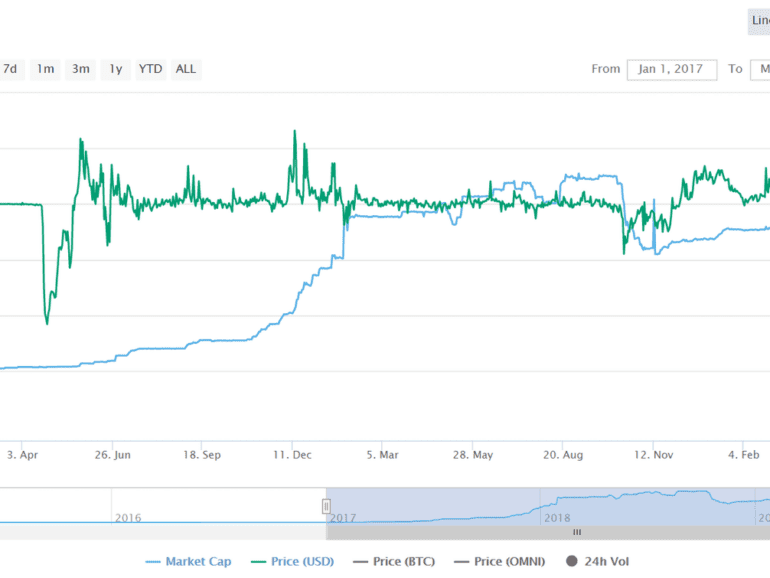

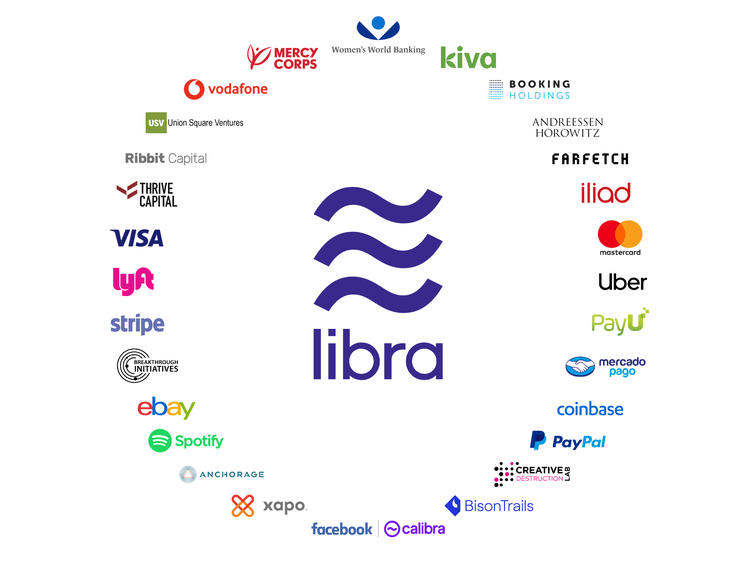

There is poetry in the symmetry of this situation. Bitfinex is looking to raise $1 billion in capital to support the most popular stablecoin Tether, which it controls. Facebook is reportedly looking to raise $1 billion in capital from First Data, Visa and Mastercard and other payments companies to shore up its own stablecoin asset. Poetry is where the similarities end, and all these devils are in the details.

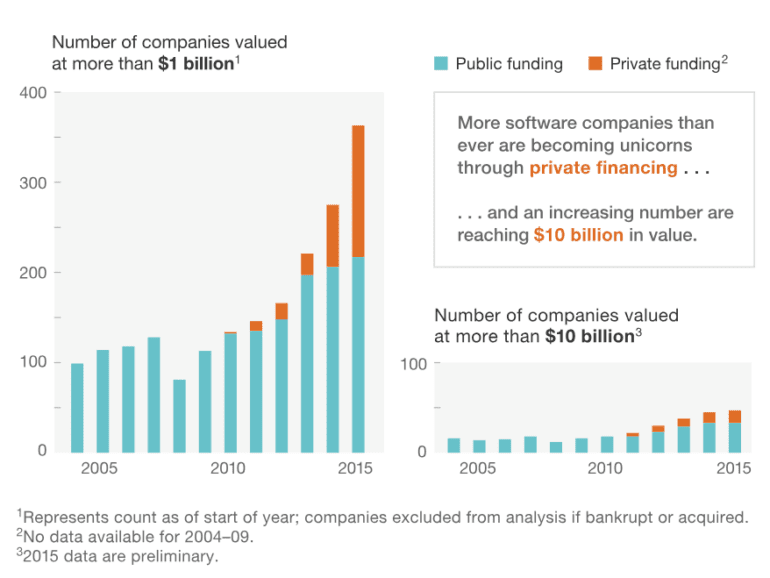

The world is on fire with talk about Uber going public. First, let's talk about who makes money and when. It is becoming a truism that companies are going public much later in their vintage, and as a result, the capital that fuels their growth is private rather than public. The public markets are full of compliance costs, cash-flow oriented hedge fund managers, and passive index manufacturers -- not an environment for an Elon Musk-type to do their best work. Private markets, on the other hand, are generally more long term oriented with fewer protections for investors. This has a distributional impact. Private markets in the US are legally structured for the wealthy by definition and carve-out. As a retail investor, your just desserts are Betterment's index-led asset allocation. As an accredited investor, you get AngelList, SharePost and the rest. I am yet to see Uber on Crowdcube. Therefore, tech companies are generating inequality both through their functions (monopoly concentration through power laws, unemployment through automation), and their funding.

Jump is an electric bike that is being distributed by Uber, and it just happened to be launching 350 of them in the London borough of Islington. You can rent a bike for 5 minutes at £1, and pay £0.12 per minute thereafter. That's generally cheaper than a taxi, on average more expensive than a public bike subscription. So why am I going on an on about these bikes? Two things come to mind as jumping off points for deeper discussion: (1) the incentives and tactics of economic organisms under capitalism to gather and retain attention, and (2) the monopoly powers of Uber and Facebook, leading to the impact of Libra's cryptocurrency on open competition, as well as the public responsibilities of supra national corporations.

Finance is everywhere, and everywhere is finance. Smart city supply chains, self driving car insurance, video game real estate markets -- no matter which frontier technology you touch, it will have embedded implications on the delivery of financial services. And why wouldn't it? Like the use of language, finance is a human technology that allows societies to coalesce and compete with one another (in the Yuval Harari sense). It lifts people out of poverty and into entrepreneurship through microloans, providing generational sustenance for their families. And of course it also throws them into pits of corruption and greed, as they drink too deeply from the rivers of securitization and political power.

But enough poetry! I want to talk about augmented reality, attention platforms, and the re-formulation of payments and lending propositions in a global context.

Fighting Chinese Artificial Intelligence with lasers and American Crypto with European Central Banks

How do the Americans and the Chinese have such different ethical takes on privacy, self-sovereignty, media, and the role of government? We can trace the root cause to the DNA of the macro-organism in which individuals reside, itself built over centuries and millenia from the collective scar tissue of local human experience. But there is more to observe. The technology now being deployed in each jurisdiction -- like social credit, surveillance artificial intelligence, monitored payment rails, and central bank cryptocurrency -- will drive a software architecture into the core of our societies that reflects the current moment. And it will be nearly impossible to change! This is why *how* we democratize access to financial services matters. We must be careful about the form, because we will be stuck with it like Americans are stuck with the core banking systems from the 1970s. But the worry is not inefficiency, it is programmed social strata.

big techChinacivilization and politicsfixed incomegovernancemacroeconomicsnarrative zeitgeistphilosophySocial / Community

·I've seen a whole bunch of headlines this past week about how Facebook is launching its version of the "Supreme Court", as if that were an app feature. The oversight board is meant to police controversial content decisions, and have the power to overrule Zuck's judgment on political matters. Its charter is drafted as if Facebook's 3 billion users were citizens of an Internet nation. Add to this the insanity over WeWork's failing IPO plans, where the CEO has been personally named in the amended filing documents with clear checks on demonstrated abuses of power. We are drifting into a Twilight Zone episode where modern corporations act as if they were feudal states run by divine kings negotiating with their nobility over a Magna Carta. Which is actually sort of where we are.

Uber has entered finance! The end is nigh! The boogeyman is here!

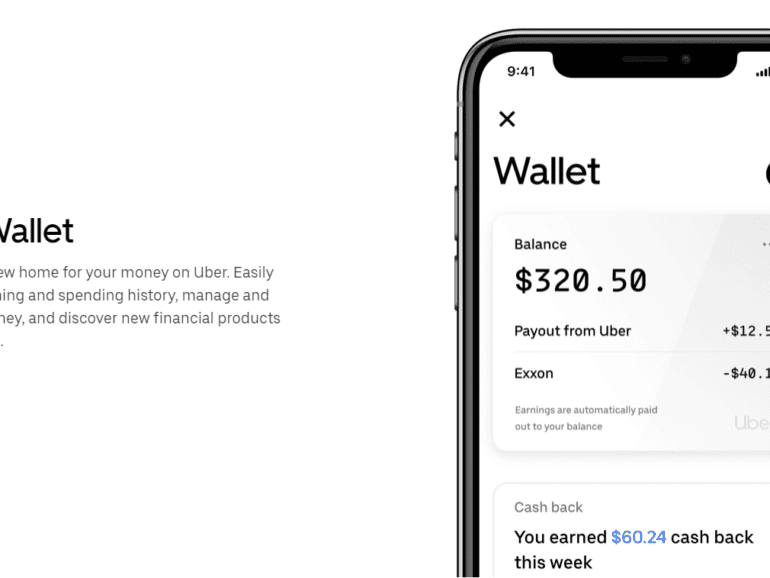

Oh. So what's involved? There's a debit card and a "debit account" powered by Green Dot, the same bank that's behind Apple Pay's person to person service. That means that Uber isn't a bank, but is renting shelf space on one. There's a wallet that will be integrated into the Uber app, within the driver's experience. So tracking your earnings and spending will be a feature that is part of the app -- not unlike what Amazon has had for years for merchants. There is a credit component, letting drivers withdraw money against their payckeck. And there's a Barclays credit card, private labeled for Uber, riding on the VISA rails.

Hear ye, hear ye, beware the disruption and tremble under its glory!

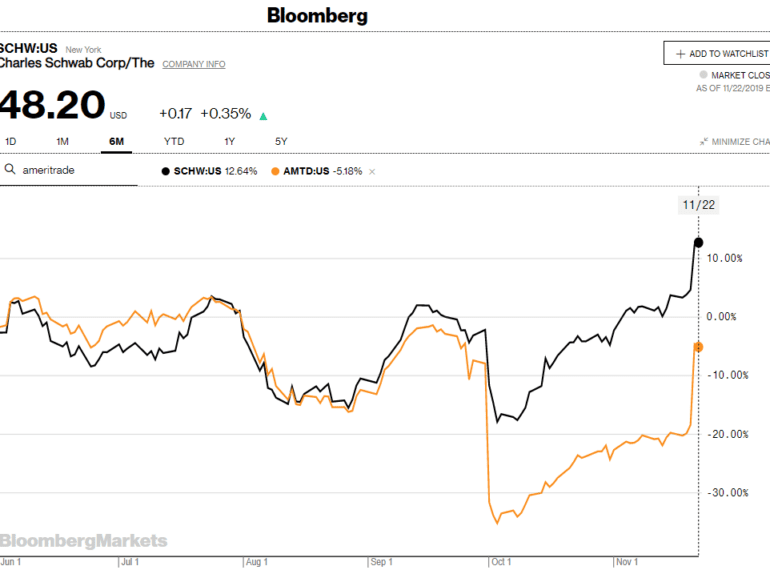

Well this morning started out as a bit of a bummer! See -- Charles Schwab to buy TD Ameritrade in a $26 billion all-stock deal. The $55 billion market cap Schwab is gobbling up the $22 billion TD Ameritrade at a slight premium. Matt Levine of Bloomberg has a great, cynical take on the question: Schwab lowering its trading commissions to zero is actually what wiped out $4 billion off TD's marketcap a few months ago. For Schwab, the revenue loss from trading was 7% of total, while for TD it was over 20%. Once Schwab dropped prices, TD started trading at a discount and became an acquisition target. You can see the share price drops reflected below in the beginning of October.

WhatsApp launches payments in Brazil and is unceremoniously shut down by the central bank a week later, MasterCard buys Finicity to protect itself against Visa’s recent acquisition of Plaid, Checkout.com continues its largely silent meteoric rise in payments, Softbank-backed and DAX 30 index component Wirecard “loses" $2 billion from its balance sheet and files for insolvency, Upgrade raises $40 million at a $1 billion valuation to extend its personal credit offering.

OpenAI, backed with $1B+ by Elon Musk & MSFT, can now program SQL and write Harry Potter fan-fiction

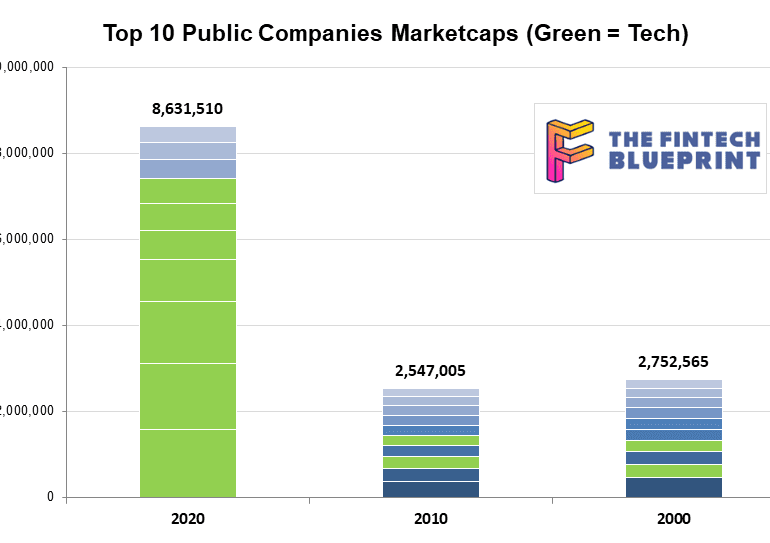

This week, we look at a breakthrough artificial intelligence release from OpenAI, called GPT-3. It is powered by a machine learning algorithm called a Transformer Model, and has been trained on 8 years of web-crawled text data across 175 billion parameters. GPT-3 likes to do arithmetic, solve SAT analogy questions, write Harry Potter fan fiction, and code CSS and SQL queries. We anchor the analysis of these development in the changing $8 trillion landscape of our public companies, and the tech cold war with China.