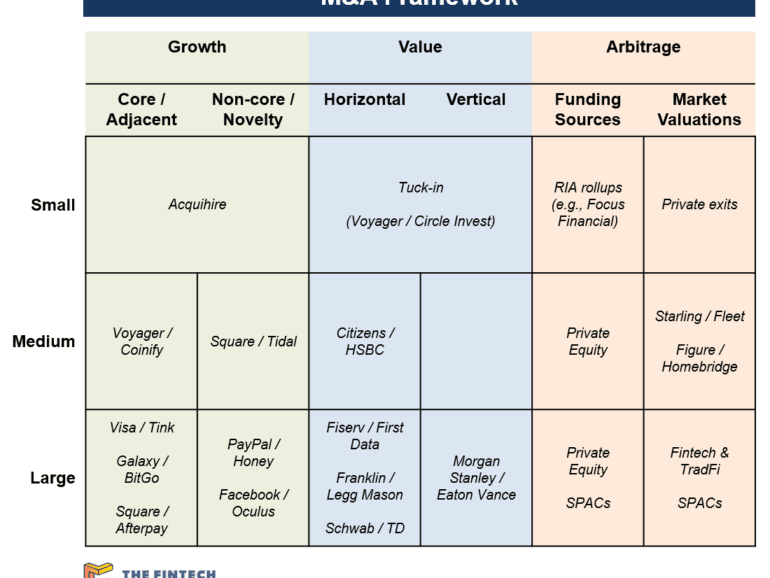

In this analysis, we explore an overarching framework for the M&A activity in the fintech, big tech, and crypto ecosystems. We discuss acquihiring, horizontal and vertical consolidation, as well as the differences between growth and value oriented acquisition rationales. The core insight, however, is about the arbitrage between the fintech and financial services capital markets, as evidenced by the recent transactions for Starling and Figure.

In this conversation, we chat with Kevin Levitt who currently leads global business development for the financial services industry at NVIDIA. He focuses on global trends in accelerated compute and AI for consumer finance – including fintech, retail banking, credit card and insurance. Prior to joining NVIDIA, Kevin served as Vice President of Business Development at Credit Karma, and Vice President of Sales for Roostify.

More specifically, we touch on the role data plays in the financial industry, how the needs of financial institutions have changed, the age of big data, the definitions between artificial intelligence and machine learning, how to train an AI algorithm, the reasoning behind the incredible amount of parameters machine learning solutions consume, the fundamental purpose of AI/ML in financial services, what NVIDIA’s platforms comprise of, and lastly the future of AI/ML.

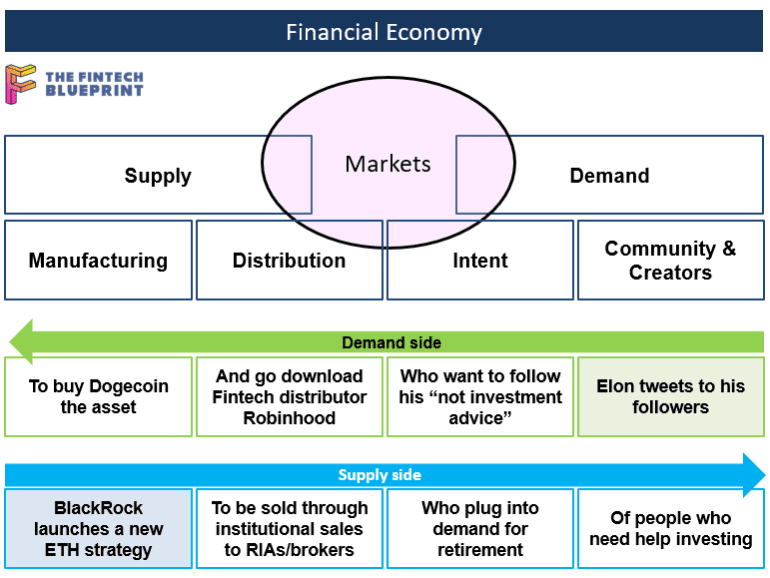

Square upgrades Cash App into a payment processing powerhouse, completing the loop between the consumer and merchant side of the house. Goldman Sachs acquires GreenSky, adding a lending business at the point of intent. This analysis connects these symptoms into a framework explaining the increasing integration between commerce and finance, and the increasing role that demand generation plays. That in turn explains how the attention and creator economies interconnect with financial services.

We discuss the Facebook pivot into the metaverse and its rebrand into Meta. Our analysis touches on the competitive pressures faced by the company from big tech players, other ecosystem builders, and limits to growth for a $1 trillion business that likely motivated this refocus. We further dive into network effects around platforms, and why super apps and financial features are attractive, and how owning the hardware is a required defensive strategy. Lastly, we discuss these development through the crypto and Web3 lens, deeply disappointed with Facebook trying to domain park a generational opportunity with a centralized solution.

Big tech's dominance over the tap-to-pay sector may be stifling innovation through rules imposed by digital wallet leaders.

BigTech has entered the sights of regulators worldwide, in a bid to boost competition. But perhaps small business stimulation is better.

No More Content