In a recent survey, payments platform, Pay Near Me, found an alarming generational divide in bill paying.

One-third of respondents aged 18-29 years, representative of a quarter of the population, have said they pay bills late. This reduces as the age group gets higher.

Pay Near Me provides a platform to streamline the bill payment process and address issues for multiple industries. The survey results come from a year of research asking 2,300 people 32 questions about their bill-paying habits.

“The bill payment industry is lagging behind other payment interactions,” said Anne Hay, Vice President and Head of Marketing at Pay Near Me.

“If organizations are not offering wallet usage, reminders via text message, and they’re not making their bill payment, experience mobile-centric, there will be a huge disconnect for younger generations.”

“This is a group that is very mobile-centric, and organizations are not servicing this age group the way they can and should be. They’re actually making it harder for them.”

Bill payment disorganization at the root

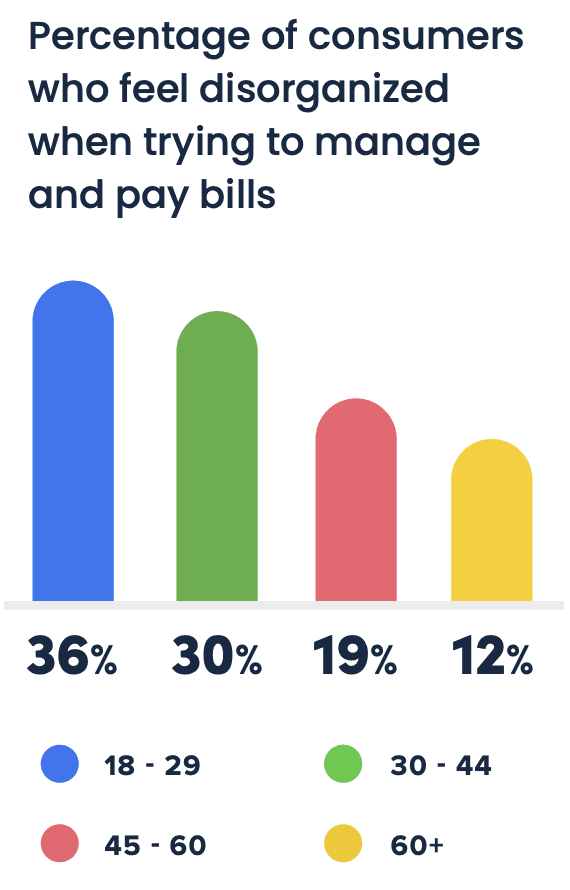

A clear result finds disorganization is the most prevalent reason behind the delay in bill payment. Of all the respondents in the 18-29-year-old category, 36% reported feeling disorganized when bill paying, with 54% suggesting that keeping track of due dates is the root of the problem.

Traditionally, bills would arrive in the mail in paper form—the ever-growing pile serving as a constant reminder of those not paid. The progression of services to digital platforms, with options to opt-out of paper bills, has resulted in a gap in the bill payment experience.

“The biggest source of the disorientation is just a general lack of the bill pay experience they’re afforded, as opposed to folks who maybe are more traditional,” said Hay.

“If they’re not getting something that’s prompting them about a due date, companies are relying on them to go sign into a website. Some send one email stating a bill is due. It’s no surprise that a very mobile-centric group would miss that.”

“They’re not getting messages via reminders, or maybe wallet notifications, very mobile-centric things. The experience needs to be tied to where this age group already does their everyday duties and prefers to actually do things like banking on their phones.”

Other causes of stress included remembering login details, problems keeping track of payment amounts, and issues navigating web pages that weren’t user-friendly.

So why not autopay?

In the 18-29-year-old group, 83% had set up automatic payments for at least some of their bills. This was the largest percentile of all the respondent groups.

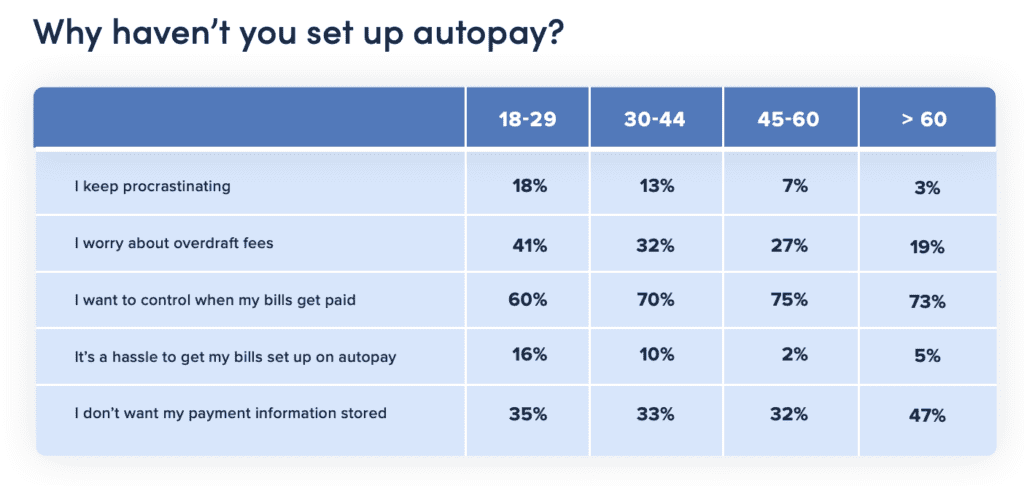

The most significant concern for all the age groups was a desire to maintain control of when payments go out and how they are paid. This accounted for 60% of 18-29-year-olds who said they had not set up autopay.

“There is modern payment tech, like Pay Near Me offers, which allows consumers to set their payment schedules and payment types. That flexibility helps with the control issue of autopay.”

“Their second concern is around overdraft fees,” said Hay. “Of all the age groups, this group worried most about overdraft fees. Maybe not surprising, given income levels, as they may be watching more closely than older counterparts who may have higher income levels.”

The percentile of this concern reduced as age increased.

Another issue that arose for all age groups was their payment information being stored, showing a slight distrust for the technology surrounding online bill payment.

Issue exacerbated by the pandemic

During the pandemic, digital adoption of financial products met new highs. The use of digital wallets in e-commerce jumped from 6.5% in 2019 to 44.5% in 2020.

“E-commerce is pushing them that way, but the consumers are also naturally moving that way. Consumers across the board are now much more reliant on things like QR codes, and everything is driven from their mobile devices,” continued Hay. “The pandemic just catapulted the industry quicker towards the digital transformation. I think billing organizations thought they had a bit more time to adjust, but now they have to catch up.”

“If you break down bill payment, you have online lenders who may be a little bit more sophisticated in how they’re offering repayment options. But on the other end of the spectrum, your utilities and your local taxes still send a paper bill, and some only take checks. There is a whole industry that is far behind.”

“I don’t think it’s that they don’t want to, I think it’s difficult to do, and priority has to be put on it in terms of resources.”

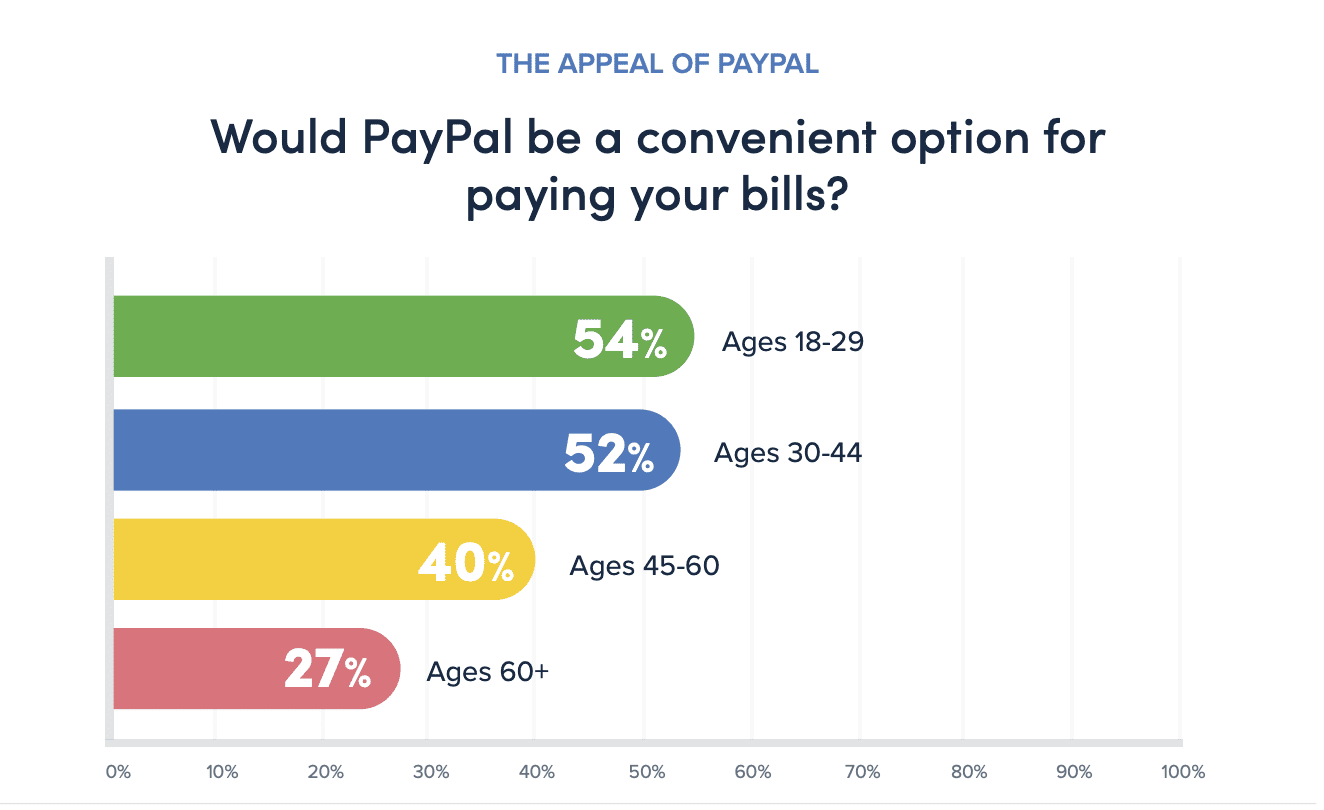

Many respondents voiced a need for modern payment types such as Venmo, Paypal, and CashApp, which are currently rarely offered for certain bill types.

“We’re starting to see an increase in the ask for PayPal and Venmo, as those become more popular payment types,” continued Hay. “Across the board, there are a lot of filling organizations that don’t offer that as an option.”

“Respondents in this age group had indicated PayPal and Cash App as two payment types they would like to use if they had the option. Nobody offers Cash App right now. Pay Pal hasn’t reached wide adoption yet. So there are these two payment types, one that no one even offers, that this age group says, I want to use this for bill payments.”

“The top three were debit card, Cash App, and PayPal. Debit card is pretty accepted. But the other two squarely sit in that mobile payment options category.”

Next steps for billing organisations

There is a distinct gap in the bill payment industry which is set to become more prominent as more mobile-centric generations reach adulthood. There is, therefore, an apparent need to act.

According to Hay, there are three possible main courses of action for billing organizations:

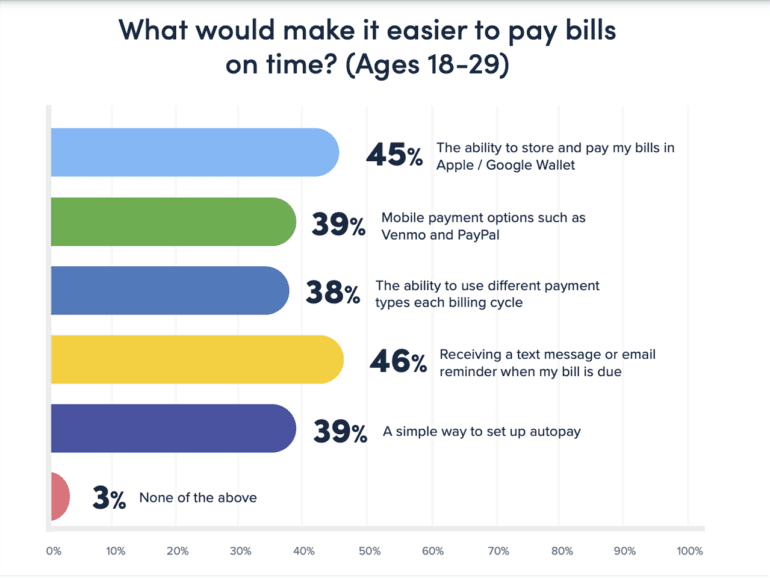

- Incorporating a mobile-centric approach, including integrating mobile wallets such as Apple and Google pay.

- The use of “stress-free reminders”, reduces log-in frustration through the use of personalized URLs directing the customer straight from the due date notified to the payment page.

- More advanced, personalized autopay, considering the customer’s need for control and customization.

“It’s a difficult process to do,” she said. “But there are companies like PayNearMe who are taking that off the shoulders of the billing organizations and handling everything. We have a full end-to-end payments platform that allows billing organizations to manage every touchpoint around the payment experience.”

“The report has shown that there’s an opportunity to make that whole process a lot easier. And for the billing organizations. It’s certainly going to help their bottom line, and payments coming in the door will be more reliable and probably less delayed.”