Last month Binance announced the launch of their crypto to fiat card in the Argentinian market in partnership with Mastercard.

The card joins an already mature market. With inflation reaching 64% in August and projected to reach over 70% by the end of 2022, more are turning to crypto to retain the monetary value of their income and produce new revenue sources. It is estimated that over 2.4 million people in Argentina own crypto, making up 5.2% of the population.

Maximiliano Hinz, Binance’s Director of LatAm, explained that customers were increasingly asking for ways to spend the earnings obtained from crypto investment, which led Binance to create the card.

“The card brings a solution for the people,” he said. “In the past, people didn’t have any way to spend their cryptocurrencies.”

“Binance has made it easy to buy crypto; that’s our main goal. Customers could sell it and get the money back, but sometimes people don’t want to sell it despite needing to spend it on things.”

“With the card, the customer can spend the amount they need, and they don’t need to sell their whole amount of crypto.”

Not their first foray into crypto-fiat cards

This isn’t Binance’s first crypto-to-fiat card. In September 2020, the company partnered with Visa to bring the European market the same product.

Boasting low transaction and processing costs, as well as worldwide coverage, the company also announced cashback facilities launching in the summer of this year.

In January 2022, Visa announced that the use of crypto-linked cards, like the one partnered with Binance, had generated $2.6 billion of revenue in its fiscal first quarter. This was 70% of the company’s crypto volume for the whole fiscal year of 2021.

Visa CFO Vasant Prabhu told CNBC at the time of the announcement, “To us, this signals that consumers see the utility in having a Visa card linked to an account at a crypto platform.”

“There’s value in being able to access that liquidity, to fund purchases and manage expenses, and to do so instantly and seamlessly.”

The Argentinian landscape for crypto

In the face of an unstable economy with inflation reaching dizzying heights, many Argentinians have chosen cryptocurrencies to avoid the issues of the Peso.

According to a report published by Morning Consult, 32% of adults in Argentina say they buy and sell cryptocurrencies regularly, making it one of the seven top adopters worldwide.

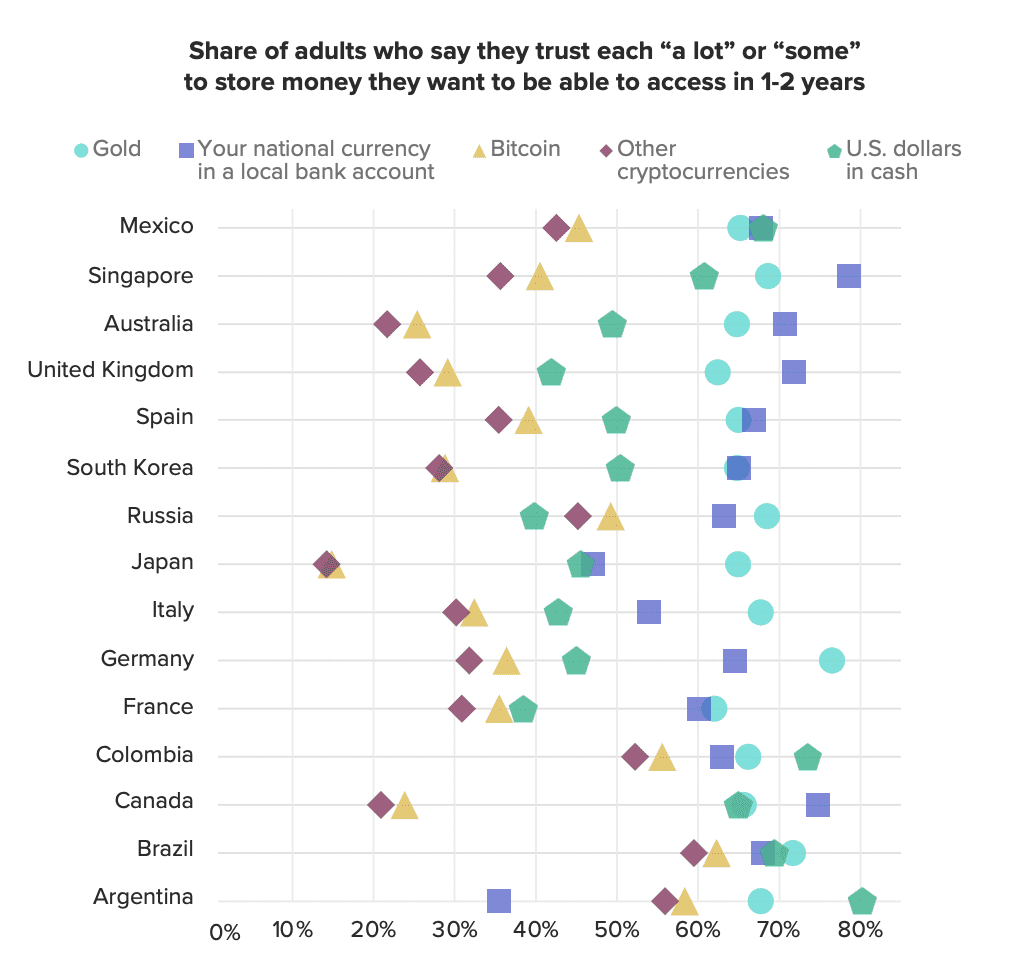

Trust in banks is at an all-time low, with many believing the risk of cryptocurrencies to be less than that of their own currency. According to the report, just under 60% of adults trusted crypto to store wealth for up to two years, compared to 35% who preferred local banks. This was an exception to the global trend that saw cryptocurrencies as the highest-risk wealth store for respondents.

“Money here is like ice cream,” Marcos Buscaglia, an economist in Buenos Aires, said to the New York Times earlier this year. “If you keep a peso for too long, it melts in terms of how much you can buy with it.”

Argentina currently makes up over 5% of Binance’s global client base, making it the third largest demographic. Adoption is also increasing, showing growth of 22% in the last month.

“Argentina has always been a very important country for us at Binance,” said Hinz. “We have a very mature following in terms of crypto adoption. So it was easy for us to let them know this problem exists.”

“There’s a lot of people that save their salaries in crypto. They can now use it easily, where it’s a seamless path to use crypto to buy groceries or pay for gas. People will no longer need to sell crypto to get pesos and buy things. So the people that are full crypto or are saving crypto have this solution and can benefit from it.”

Joining local success with crypto cards

Other professionals in the LatAm crypto space are not convinced the card will change much for the crypto community in Argentina.

A source told Fintech Nexus, “Binance has a large following in Argentina, and they may have success with the card, but there are already many local offerings which solve this problem.”

Lemon, Buenbit, and Belo have partnered with Visa and Mastercard to create similar crypto to fiat cards, launched over 2021 and early 2022.

Lemon Card has seen particular success, offering 2% cashback rewards for card usage. The company initially planned to release 50,000 cards but has now been reported to have issues with over 3 million.

Binance has announced similar advantages, offering up to 8% cashback. Their strong position in the market could mean increased adoption of these local offerings.