Block showed resilience to challenging macroeconomic conditions in their earnings call yesterday, February 23, 2023.

However, much of CEO Jack Dorsey’s opening remarks were focused on the investment framework of the business going forward.

“Block and each of our ecosystems must show a believable path to Gross Profit Retention of over 100% and Rule of 40 on Adjusted Operating Income,” said Dorsey. “This is an ambitious goal, especially at our scale, and one we aren’t meeting today.”

He explained that going forward, there were three main areas the company would focus on.

- Ensure investments are focused on customer retention and growth. – Dorsey highlighted the company’s different ecosystems’ ability to deliver positive growth retention, affected only by macroeconomic pressures. To ensure a continued focus, he said Block would be assessing the customer journey and identifying areas of improvement to continue acquisition and retention.

- Account for ongoing costs of the business, including stock-based compensation. Dorsey’s focus was the hallowed Rule of 40, where the company would be targeting the sum of its gross profit growth and Adjusted Operating Income margins to be at or above 40% over the long term. This would be applied to Block as a whole as well as the individual ecosystems.

“A growth plus margin framework provides flexibility for products and businesses at different stages of maturity,” said Dorsey. “It’s a useful and universal formula for evaluating each of our ecosystems with different growth trends and margin profiles today and for those we might launch in the future.”

- Utilize industry-standard conventions that are simple to communicate and understand. Dorsey said the two previous points of focus provide the company with a clear framework to communicate and balance customer and investor interests.

“We believe this investment framework will ultimately enhance our ecosystems around the world and our ecosystem model by allowing each business to make holistic decisions around their teams and roadmaps in parallel. It ensures the decisions of one ecosystem won’t constrain the others,” he explained.

Gross profit surpasses Wall Street expectations.

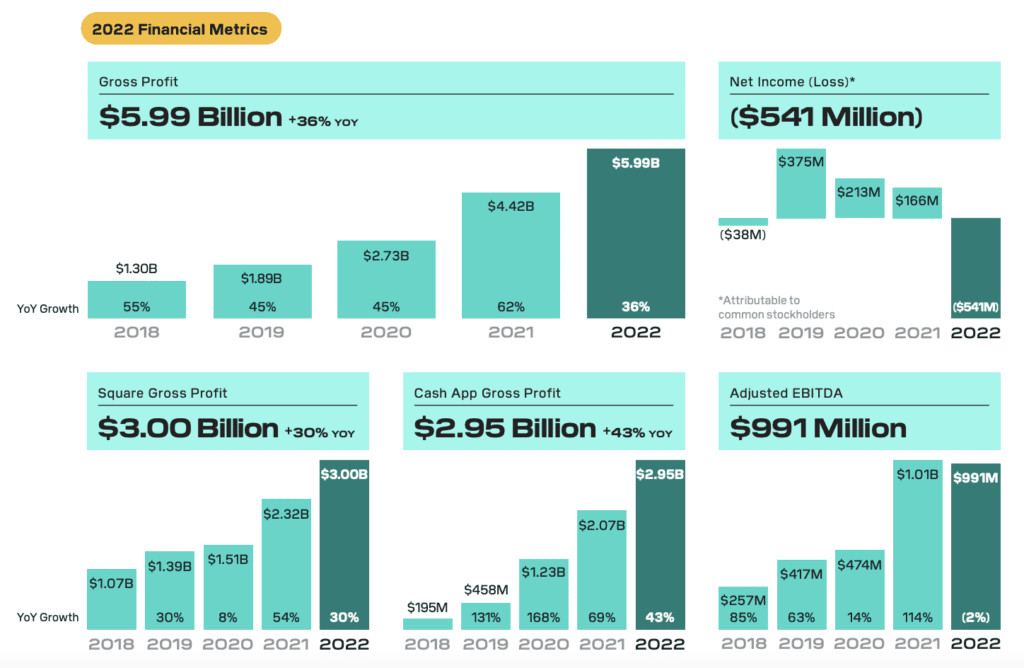

The gross profit of the company grew 40% year over year to $1.66 billion. Excluding their BNPL platform, Afterpay acquired in early Q1 2022, gross profit was up by 24% to $1.46 billion.

While gross profit was up, the company reported a net loss for the year of $541 million, down significantly from 2021, which showed a net income of $166M. Net income had been dropping consistently since 2019.

Adjusted EBITDA remained close to 2021’s figures, dropping by 2% to $991 million. Quarterly, Q4 2022 was up 53% on the previous year but was down by $46 million from Q3.

Figures largely surpassed Wall Street expectations; however, adjusted earnings per share fell slightly short at $0.22 per share, compared to the expected $0.28.

The two individual ecosystems of Square and Cash App showed ongoing growth in gross profit.

For Square, the company stated an ongoing focus on the omnichannel experience citing evidence to believe this approach is likely to help with customer retention going forward. The report showed 44% of Square’s gross profit came from sellers that used four or more monetized products.

Cash App had taken on a different approach, with the company focusing on seven pillars of development: Community, Commerce, Crypto, Financial Services, Global, Operating System, and Trust. They stated they had made progress in Community, Financial Services, and Commerce, which had contributed significantly to gross profit growth.

The development of the Cash App Card, peer-to-peer gift cards, separate balances for savings, and the acquisition of the BNPL platform are said to have influenced this progress.

For 2023, Block has set its expectations on £1.3 billion for adjusted EBITDA and an adjusted operating loss of $150 million. Already in January and February 2023, the company has reported a 33% year-on-year growth in gross profit.

RELATED: Fintech Ticker Table