It was an explosive year for BNPL industry leaders like Afterpay, Affirm, and Klarna.

It felt like everyone was getting into the BNPL game briefly, as in-person retail locations started adding the option after e-commerce adoption and bank-tech partnerships sprung up.

Alongside the enthusiasm for pay in four, news came out that some customers who were splitting payments came to regret their purchases, and regulators have taken notice.

All that combined: how did competition between the top consumer debt contenders heat up over the long-awaited holiday shopping spree?

BNPL holiday firesale

Early results, estimated by PayPal CEO Dan Schulman, said in November that the BNPL option through the world’s oldest fintech jumped 400% year-over-year on the post-thanksgiving Black Friday alone.

“We did some 750,000 transactions in one day on Black Friday,” Schulman said.

Paypal recorded $1 billion in volume through BNPL in November. That was only the beginning.

While we await fourth-quarter earnings, 42matters, a tech company that built an App Watchlist platform to track mobile product usage, created a curated guide comparing the best of the industry. Here is what they found:

The Top 5 BNPL apps on mobile from December to Jan. 6, 2022

1: Klarna

Easy pay in four shopping easy payments, “zero credit impact.” Claims 40M+ users but has reported high losses.

- Total Downloads: 10,000,000+

- Android Downloads Over the Last 30 Days: 2,836,070

- iOS Downloads Over the Last 30 Days: 2,505,710

2: Afterpay

Buy online and pay later and shopping deals. Block (formerly Square) announced the acquisition of Afterpay for $29 billion in August.

- Total Downloads: 1,000,000+

- Android Downloads Over the Last 30 Days: 336,040

- iOS Downloads Over the Last 30 Days: 484,493

3: Affirm

“Split purchases into easy monthly payments.” A major exclusive deal for Amazon Shopping was announced in September.

- Total Downloads: 1,000,000+

- Android Downloads Over the Last 30 Days: 411,849

- iOS Downloads Over the Last 30 Days: 318,260

4: Sezzle

A Canadian BNPL that was founded in 2019. Despite the success, the stock was hit hard after initial buying friends over the summer, down 50% since.

- Total Downloads: 1,000,000+

- Android Downloads Over the Last 30 Days: 175,823

- iOS Downloads Over the Last 30 Days: 49,692

5: Zip (previously Quadpay)

Split any purchase into four installments. No interest, no hard credit check.

- Total Downloads: 1,000,000+

- Android Downloads Over the Last 30 Days: 96,771

- iOS Downloads Over the Last 30 Days: 91,411

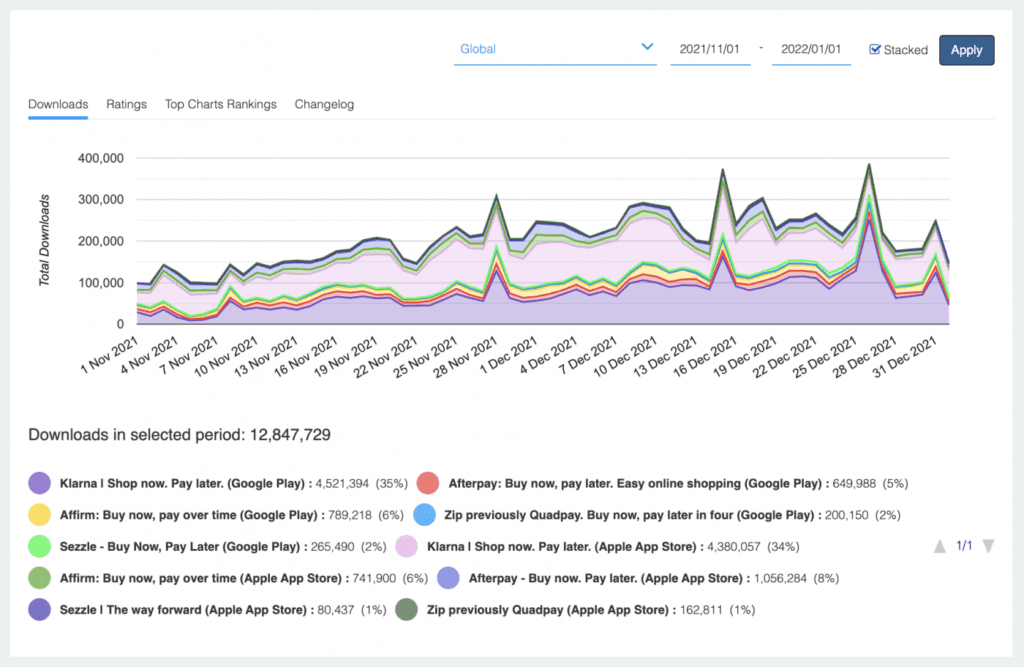

Downloads between Nov. 1, 2021 and Jan. 1, 2022

Klarna was easily the most popular of the five Android apps, generating some 4.5M downloads in the selected time frame. Next came Affirm (789,218 downloads), Afterpay (649,988), Sezzle (265,490), and Zip (200,150).

Likewise, Klarna led the iOS apps with 4,380,057 downloads, followed by Afterpay 1,05M, Affirm 0.74M, Zip 162,811, and Sezzle 80,437.

But more remarkable is the fact that these BNPL apps seemed to trend in near-complete lockstep, spikes around Black Friday (Nov. 26), Cyber Monday (Nov. 29), mid-December, and Boxing Day (Dec. 26).

Final thoughts

Klarna, Afterpay, Affirm, Zip, and Sezzle still make up roughly 70% of the market, and these download numbers are only part of the picture.

The purchases with BNPL on the Amazon and PayPal ecosystems or through partnerships like Affirm and Apple are not included.

While the consumer product helped pump Christmas buying, regulators started asking questions. In December, the CFPB sent out letters to top BNPL firms in the US, asking how they could give out short-term small-dollar loans with limited commitments or credit checks.

The findings of the new credit option are not back yet, but one thing is for sure: consumers buy more when they have a BNPL option at checkout, and the product is still inspiring new members to enter the space.

It also might end up just a regular credit-checked small loan product: this past week, Equifax announced it would begin recording BNPL reports on their credit system in 2022.