After years of waiting, the central bank of Brazil has finally authorized Meta‘s WhatsApp merchant payment system, the latest illustration of how the Brazilian payment market is fast evolving.

Last week, the regulator cleared the way for the tech giant. Users can now pay for goods and services at stores through its messaging application.

WhatsApp is hugely popular in Brazil and Latin America. In the latest earnings calls, Meta executives said the Brazilian market, with a population of 215 million, was one of the company’s most important.

The payment feature builds on Brazil’s existing peer-to-peer payment system, which has been running since 2021. However, the central bank had frozen Meta’s intention to roll out the same feature for store payments.

Now, the bank clears the way for merchants to collect these. Brazilians can pay directly with their credit cards through WhatsApp. The tech giant is partnering with heavyweights in the financial industry, such as Mastercard and Visa.

A ‘huge progress’ in the financial system

Although Meta’s peer-to-peer transfers have not gained as much scale, some believe releasing shop payments could make a difference.

“Today is a happy day for us. We completed every regulatory step,” Guilherme Horn, Head of WhatsApp, Latin America, wrote in a LinkedIn post. ” Paying to businesses via WhatsApp will have a huge impact for everyone, bringing simplicity to users while helping small and medium-sized businesses increase their sales.”

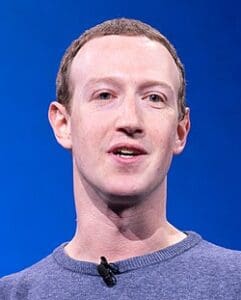

“People will be able to pay small businesses right on WhatsApp,” Meta’s Mark Zuckerberg celebrated while broadcasting on Instagram. “Excited to roll out this soon.”

To authorize WhatsApp, the central bank suspended a measure on Meta that prevented such payments from taking a closer look at it, José Luiz Rodrigues, a director at ABFintechs, said.

“The central bank’s approach was perfect,” he wrote. “It took an extremely important decision that shows the regulator’s concern to promote innovation safely. This is definitely huge progress for the Brazilian financial system.”

A challenge to Pix?

Certainly, clearance from the central bank comes years after Pix was released in Brazil. When WhatsApp first disclosed its intentions years ago, some argued it could threaten the central bank’s brand-new instant payment system.

The green light comes at a time when Pix is firmly established among Brazilians. According to official data from the central bank, more than half the Brazilian population used it at least once.

“We are seeing the transformation of the famous messaging app, so present in our daily lives, into a payment channel in the palm of Brazilians’ hands,” said Marcelo Tangioni, Mastercard Brasil’s president. “This is innovation!”

The company has partnered with most local acquiring companies. This includes Cielo, Rede, Fiserv , Getnet Brasil and, Mercado Pago.

There is no date for the launch to take place.