Last week, the Wall Street Journal reported crypto exchange Genesis is seeking a cool $1B handout after shutting down redemptions and new originations. On Monday, Bloomberg reported that the firm still needed the investment or it would face bankruptcy.

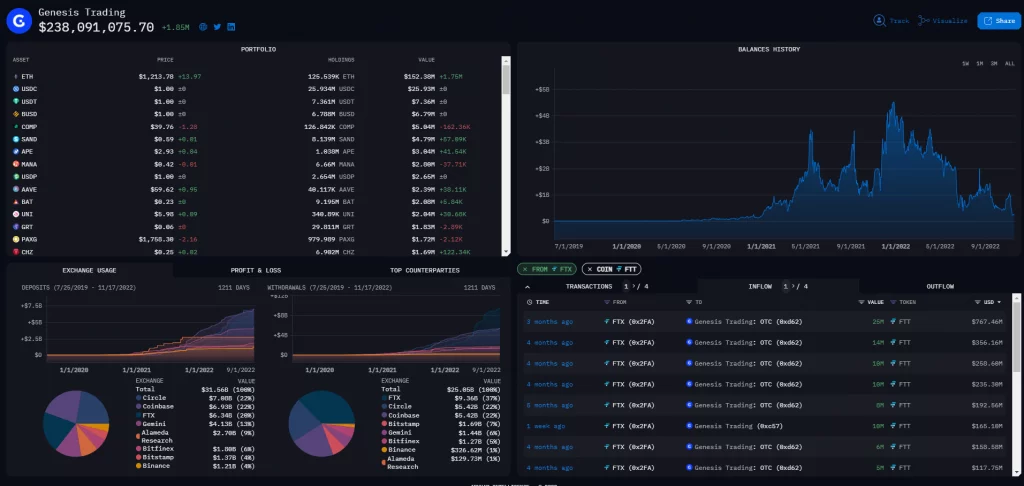

The latest in the levered crypto avalanche, Genesis Global Capital, an institutional lender, had $2.8 billion in active loans at the end of Q3 2022, according to the firm’s website. Last week, the firm reported it had $175 M locked up in an FTX trading account.

In the past year, the firm made multiple bad lending bets. According to court documents reported by WSJ, Genesis also lent $2.4 billion to Three Arrows Capital. Digital Currency Group (DCG), the parent company of Genesis, had a $1.2 billion claim against the now-bankrupt hedge fund.

According to the WSJ, the firm never received the funds but said it was in positive conversations.

“In a fundraising document, the Wall Street Journal reported Genesis was facing a “liquidity crunch due to certain illiquid assets on its balance sheet.”

According to the Genesis website, The Financial Times called the firm the “biggest trading desk” for professional investors in cryptocurrency markets in 2020.

Mondays, am I right?

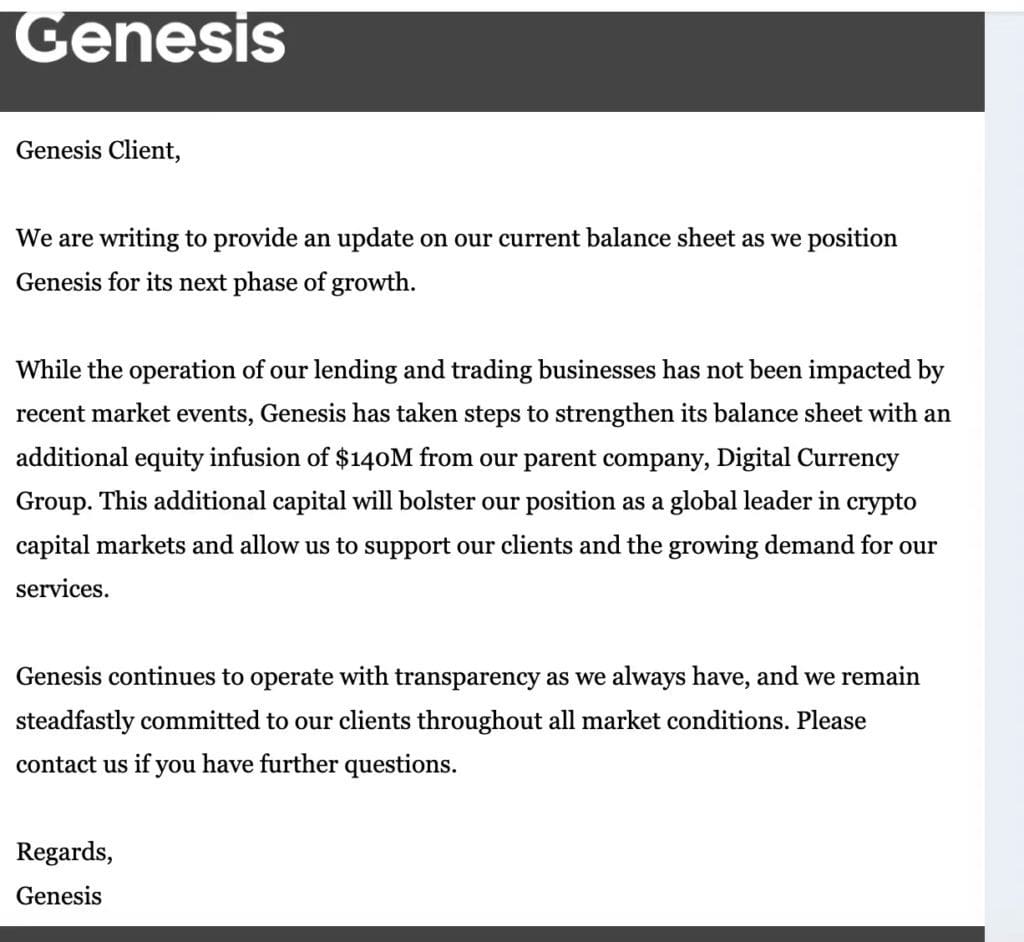

Bloomberg progressed the Genesis rumor mill; reporting insiders said the firm expects to declare bankruptcy if it cannot raise more funds. Investment emails found last week showed Genesis received a small lump sum of $140M in cash from DCG.

Last week, Genesis shut down loan and futures trading but said its spot market trades would be unaffected.

“Our #1 priority is to serve our clients and preserve their assets. Therefore, in consultation with our professional financial advisors and counsel, we have taken the difficult decision to temporarily suspend redemptions and new loan originations in the lending business,” the firm said in an announcement Wednesday.

“This decision impacts the lending business at Genesis and does not affect Genesis’s trading or custody businesses. Importantly, this decision has no impact on the business operations of DCG and our other wholly owned subsidiaries,” Amanda Cowie, VP of communications and marketing at DCG, said in a release.

Jason Yanowiz, Co-Founder of crypto news company Blockworks, said if the firm is out of money, this could mean more than just the end of FTX.

Where’s the fire?

Why are $170m in assets stuck in FTX, causing a new crisis? The firm also held a massive amount of FTT coins. CryptoSlate reporter Oluwapelumi Adejumo posted Research in Genesis transactions through Arkham Intelligence. In the past three months, the firm received more than $1 B in FTT tokens, $932M from FTX, and $140M from Alameda research.

DCG is one of the largest cryptocurrency conglomerates in the world, valued last year at $10 billion in an asset sale. The firm covers all sector aspects, representing asset management, media, and trading, with controlling stakes in Genesis, Grayscale trust, and CoinDesk. The firm also invests in 165 companies, from Ripple to Coinbase Global.

On Monday, DCG began scrubbing its website of about and our team sections. On the news, cryptocurrency markets reached their lowest point in two years, while public company stock sank. Coinbase share price reached a level not seen since 2018 on fears all exchanges may be exposed to the industry’s overall accounting and lending devastation.