NEW YORK, N.Y. — Reflective of the times in the wake of the mini-banking crisis of early 2023, Steve McLaughlin‘s outlook for the fintech market wasn’t entirely positive, but the entrepreneurial spirit was still there for his closing keynote speech at Fintech Nexus USA 2023.

“It turns out that even when the market is tough, and even when everyone’s licking their wounds, and quote-unquote, ‘no one’s getting capital,’ if you have the right business ball on the right day and in the right situation, there is capital going to certain companies,” said McLaughlin, the fintech entrepreneur and banking stalwart who founded his fintech boutique bank FT Partners in 2002, while describing a recent quest for investment in a client company.

“We just raised $125 million. It was massively oversubscribed for a company at $2.5 billion and literally no revenue. Not because they lost all the revenue … the optimism around the story was quite high. Even though we got turned down by many, many investors, we still got multiple investors to come in, and some are still banging on the door because the story itself was quite interesting.

“A lot of it is you have to kind of willpower yourself to success into capital, which is what they and we did in that case on the M&A front.”

‘Market has blown up a bit’

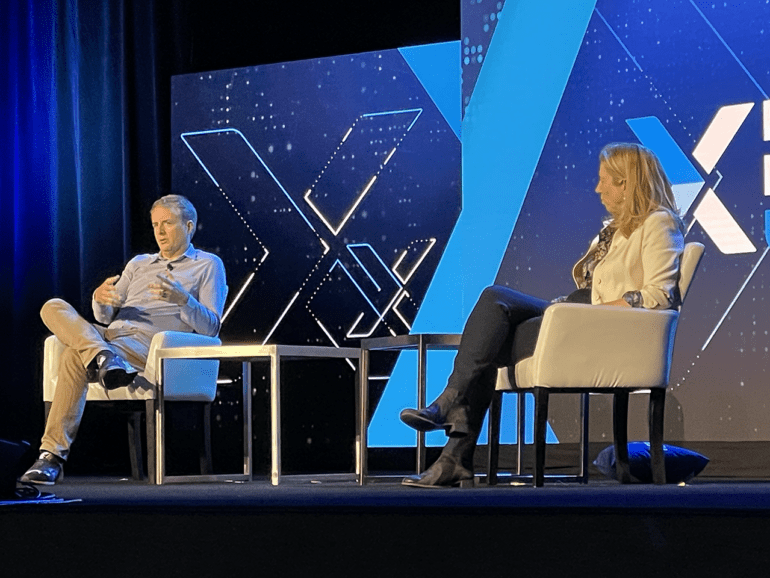

Still, McLaughlin told Oak HC/FT‘s Patricia Kemp, fielder of questions with McLaughlin on stage at the Javits Center, the “market has blown up a bit,” and the financial forecast is “pretty rough right now.”

“We produce a lot of data and information, and we have a tremendous amount of insight on what the activity is,” said McLaughlin. “When you look at all the bar charts of how financing activity went up, and M&A activity went up and how it’s kind of come down. And every quarter, it just keeps going down and down and down.

“What you don’t realize is the bars were this high before, and now they’re this high, but what’s in the bar that was that high is a bunch of down rounds, inside rounds, inflated rounds, death deals, cannabis equity deals, a bunch of hot company deals for AI-driven companies and things like that. And there’s not that much in there at all related to a $50-million round for a company growing 35 percent, burning $20 million. You’re not seeing investors chase after those kinds of deals right now, even if it’s a really good and healthy company to some extent.”

There’s that ‘creative’ word again

Still, there’s that word ‘creative’ suggesting investors are looking for opportunities, said McLaughlin.

He used the example of Global Payments selling Netspend to Rev Worldwide via Searchlight Capital, calling it “really creative deal-making.”

“You’re seeing some really interesting things happen on the M&A front, but you aren’t seeing tons of irregular-way M&A,” McLaughlin said. “I do know multiple deals coming down the pike that are sort of regular-way good deals, and all that kind of stuff, too. We’ve been involved in a bunch of them. But it’s creative time, quite frankly.”