The implementation of CBDCs is inevitable if you believe the emerging industry consensus.

With more services becoming digital and more trade and transactions done across borders, digital currency seems to be the perfect solution to streamline the digital revolution further.

It is not to be taken lightly as implementing a new global monetary system is no small feat.

Although nations are testing CBDCs, some in their final stages, there is still a long way to go.

The arrangements for cross-border settlements and foreign exchange transactions are becoming less adapted to current demand. Transactions are complex, slow, and expensive, involving multiple intermediaries and infrastructures.

In April 2019, trading in FX markets reached $6.6 trillion per day, $1.5 trillion more than three years earlier, according to the Bank of International Settlements (BIS) Triennial Central Bank Survey.

There is a need to streamline these transactions, increasing year over year and reducing the associated cost, time, and multiple intermediaries.

RELATED: An Ode to Privacy: a vision for a U.S. ‘freedom coin’

DLT will drive agenda

For many, the answer lies in the use of Distributed Ledger Technology (DLT) and, with it, digital currency.

DLT, a protocol that enables the secure functioning of a decentralized digital database, ensures impartial and trustworthy transactions based on immutable data in a network of multiple entities across multiple locations.

Its nature reduces the need for multiple trusted third parties for validation and record updating. All parties have access to the same network and streamline the transactional process.

CBDCs have the advantage of being backed by central banks, with their value fluctuating at the same rate as fiat currency.

They also differ from digital cryptocurrencies because they are traceable and controlled by the central bank and, in this sense, are centralized, raising privacy issues for some.

Given this, multiple nations are now testing the viability of CBDCs, using specific use cases to assess the best form of implementation into the modern-day monetary system.

Retail vs. wholesale

The subject of CBDCs cannot be approached without going into the Retail vs. Wholesale debate. Many nations that have already fully launched CBDCs, such as Nigeria, have focused on retail. However, many still in testing or exploratory stages favor a general CBDC such as China and the European Union or a wholesale focus like Switzerland.

Retail application opens the CBDC out to the general public and for usage outside of financial institutions in such contexts as business to business (B2B) and Business to Consumer (B2C), in most cases working alongside fiat currencies in digital payments. Financial institutions would only use wholesale CBDCs.

“Electronic payments overtook physical cash in 2016, and the gap has been growing ever since. It’s been hastened by the pandemic, but it was a trend that was there already. On the wholesale side, payments have been effectively electronic for a very long time. Central bank reserve accounts already provide a digital version of central bank money.” said William Lovell, Head of Future Technology at the Bank of England (BoE), during a webinar on the need for a CBDC in the UK organized by the Digital Pound Foundation (DPF).

Open to Wholesale

In the January 2022 report issued by the House of Lords, although generally negative regarding the early implementation of CBDCs, there was a relative openness to usage in a wholesale context.

It was stated, “While the wholesale operations of the monetary system are already highly efficient, principally through the Real-time Gross Settlement system (RTGS), and there is ongoing improvement work, a wholesale CBDC may help to enhance efficiency in securities trading and settlement further.”

In opposition to this initial distinction, there are views that global usage will be generalized with time.

“I think there’s a starting point… sometimes we start in the retail space and see there are a lot of applications in wholesale, sometimes it will spill over into cross border, and I think what we typically see is that the distinction isn’t the best one and maybe there’s more of a need to look at general-purpose digital currency used across the board for both retail and wholesale application,” said Accenture’s Digital Assets, Custody & CBDC Lead and Global MD Blockchain and Multiparty Systems, John Vellissarios.

Vellissarios was heavily involved in the Jura Project in the DPF webinar on Digital money and cross-border payments.

“I think in a lot of cases retail isn’t the biggest issue to solve, I think there are other areas, it’s difficult for consumers as well to see the difference between central bank money and normal money…and this clouds the debate around this topic.” he continued.

In a separate interview with Jannah Patchay, Policy Lead of the Digital Pound Foundation and Originating Member, she stated her view on the use of digital currency.

“There is likely to be different roles that are played by different forms of digital money, CBDC, and privately issued stable coins — and there may be many different ways to provide different functionality as well.”

“I think if you think about CBDC as something new that’s being created that misses a lot of the point in many ways it’s a kind of logical evolution of money….It is essentially built on layers of infrastructure over many decades to something that’s digital native where we can look at what are the requirements of money for today and the future and, given the technology that we now have, what are we able to build in terms of the money of the future?” she continued.

The current global state of CBDCs

Currently, 87 countries, representing 90% of global GDP, are exploring the use of a CBDC. Of these, nine countries have fully launched, and 14 are in the pilot stage and preparing for a full launch.

Nigeria is the latest fully launched CBDCs and the first outside the Caribbean. The e-Naira was launched in October 2021 with an initial mint of 500 million ($1.21 million).

Although currently only available to bank account holders, the second rollout will include access to all residents using their national identity number, with the digital wallet accessible via a phone app.

The focus of the e-Naira was retail, so much of the rollout to date was focused on consumers.

The pandemic led to the closure of many of the bank’s branches, excluding many Nigerians, especially those living in remote areas. Many adult Nigerians do not have a bank account, around 58 million people according to reports in 2020.

However, most do have access to mobile phones, making digital wallets a viable alternative. With many Nigerians receiving payments from abroad, a remittance value reported by the World Bank as over $17.2 billion in 2020, the CBDC also allows cheaper, faster, and more secure payments from overseas.

Traceability a strength

The traceability of the CBDC is also aimed at reducing illicit business within the county, reducing fraud, and monitoring transactions.

In Bhutan, Asia, Ripple has launched a project associated with the Bhutan Royal Monetary Authority (RMA) that tests a general purpose CBDC that works for wholesale, retail, and cross-border payments.

With the use of a singular platform, the CBDC is distributed from the central bank to commercial banks and consequently to users as an alternative to fiat currency with hopes to offer increased financial inclusion with a target of 85% by 2023.

The CBDC makes use of Ripple’s private XRP ledger piloted in March 2021, which makes it “120,000 times more energy-efficient than proof-of-work blockchains,” according to the Ripple announcement, running per the nation’s pledge to remain carbon neutral.

Another nation that is pioneering in developing a CBDC is China with its e-CNY. Although not fully launched, a pilot version was released in multiple Chinese cities to Chinese citizens through lotteries during the second half of 2021.

China has invested six years into the research and testing of its digital currency and opted into producing a currency for both retail and wholesale usage.

Chinese e-CNY launched during Olympics

Although initially only available to Chinese citizens, the People’s Bank of China (POBC) launched the e-CNY to global users during the Chinese winter Olympics.

The Chinese public is already generally well versed with digital payment options, with Alipay and WeChat leading the way. In 2020 WeChat reported a revenue of 1.6 trillion RMB in annual transactions.

Although this could be seen to enable the usage of CBDCs, some experts have understood this to be a friction point, as there is no real gain for users to switch to the e-CNY.

Despite this, by the end of 2021, the POBC reported that more than 260 million people had e-CNY accounts, and total transactions had reached nearly 90 billion yuan ($14 billion). This is set to increase further with the January 2022 launch of the e-CNY wallet application on iOS and Android stores.

The POBC launched the Multiple Central Bank Digital Currency (m-CBDC) Bridge Project in January 2021, testing cross-border payments with Thailand, Hong Kong, and the United Arab Emirates for wholesale payments.

After this testing period, at the end of 2021, they moved into the second phase with the Hong Kong Monetary Authority (HKMA), including linking e-CNY with Hong Kong’s Faster Payments System (FPS).

This next phase includes increasing efficiency surrounding payments of citizens when visiting the countries as tourists.

“In the future, when mainland tourists use digital renminbi to shop in Hong Kong, currency exchange will be done between two wallets and local merchants will collect money in Hong Kong dollars, so there will be no currency substitution,” said Mu Changchun, the director of the Digital Currency Institute (DCI) of the People’s Bank of China (PBoC).

What are European and UK efforts?

In Europe, although progressing in their development and announcing the possibility of a digital euro launch as soon as 2023, continue in their investigation stage to address critical issues regarding design and distribution.

Additional testing was also carried out with the Jura Project, which concluded in December 2021.

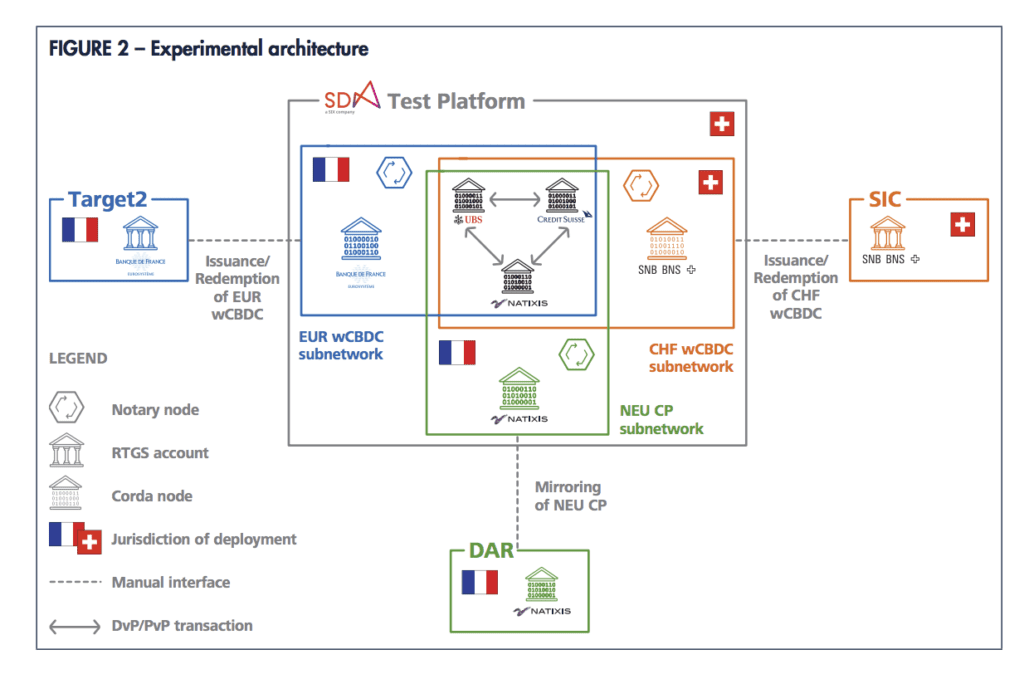

The project was a collaboration between the Banque de France (BdF), the Bank of International Settlements Innovation Hub (BISIH), and the Swiss National Bank (SNB), as well as representatives from Accenture, Credit Suisse, Natixis, R3, SIX Digital Exchange (SDX) and UBS.

The project aimed to test wholesale interbank cross-border payments by exploring the direct transfer of Euros and Swiss Francs using a single DLT operated by a third party.

Experiments were conducted in a near-real setting using tangible value assets under current regulatory requirements and used both payments versus payment (PvP) and delivery versus payment (DvP) mechanisms.

After the project, tokenized asset and foreign exchange trades were settled efficiently and safely with a proposed solution design that addressed current problems with the system and revealed new opportunities for foreign exchange and securities.

The accompanying paper released on Dec. 8, 2021, stated, “Jura explores a new approach including subnetworks and dual notary signing, which may give central banks comfort to issue wCBDC on a third-party platform and to provide non-resident financial institutions with access to wCBDC.”

‘Changed the architecture’

“What Project Jura has done is completely change the architecture of how international payments can be conducted….it has allowed us for the first time to do a foreign exchange transaction in central bank money outright, not using the prevailing corresponding bank model but to allow central bank money to serve a certain medium for an international transaction. That’s quite significant because the aim is to extend the safety that central bank money currently provides only for domestic transactions to the international sphere and thereby help to allow international payments to be afforded the same conditions and safety of domestic transactions,” said Dr. Ousmene Mandeng, Accenture’s Global Economic and Financial Strategy Lead.

The United Kingdom lags in developing a digital pound in stark comparison, with government officials uneasy about its application.

In March 2020, The Bank of England (BoE) released a discussion paper on CBDCs centered on the opportunities, challenges, and design, intending to discuss whether the opportunities outweighed the risk and design a proposed model.

‘Maintain monetary and financial stability’

The report focused on the Bank of England’s “primary objectives to maintain monetary and financial stability” and designing a CBDC that supported them, and alternative areas to improve payments in the UK were also explored.

Reactions to the paper showed a strong agreement that the bank should explore the implementation of a digital pound.

In response, HM Treasury and the BoE launched a task force in April 2021, focused on exploring a digital pound and its implementation alongside traditional fiat currency usage, involving various forums for collaboration with the private sector. Aside from this, groups such as the Digital Pound Foundation (DPF) have been formed to further aid in designing a digital pound.

“There are many different organizations…I think their roles vary to some extent depending on the locale, but there are some general common themes… The common themes are the desire to advocate first of all the development of a digital currency and for an environment that’s conducive towards them but also from the DPF perspective a healthy and diverse ecosystem for these new forms of digital money,” said Jannah Patchay.

Kalifa Review

In February 2021, the Kalifa Review of UK fintech also reviewed the implementation of CBDCs, suggesting that the wholesale CBDC would be the “easiest option,” offering advantages such as zero exposure risk, increased resilience, and less system downtime.

For retail, it was here that a new hybrid model was suggested where “the CBDC is a claim on the central bank but intermediaries on board and handle the retail payments.”

This suggestion was made to offer the most flexibility and opportunity for innovation.

After review, the House of Lords’ Economic Affairs Committee published a report titled Central Bank Digital Currencies: a solution in search of response? in January 2022.

As the title suggests, the report was unfavorable towards implementing CBDCs, although it recognized potential benefits in wholesale usage.

The report’s findings concluded that the risk of breaches in cyber security was too high to justify the benefits that could be achieved by other means.

Despite this, the BoE and HM Revenue have yet to decide the viability of CBDC implementation and continue their exploration.

In late November 2021, they announced the launch of a consortium for 2022 to evaluate the next steps.

According to the DBF webinar, a possible launch would be “no earlier than the second half of the decade,” according to William Lovell, BoE Head of Future Technology.

What is the future?

In the future, Innovate Finance’s Head of Policy, Adam Jackson believes there is a need for balance to promote continued innovation and competition in this field.

“The risk is that they (create a CBDC) at the expense of the private sector and the expense of innovation, so it’s also got to be done in a way that promotes competition. You could have an entirely private sector-driven stablecoin world, but that could be dominated by three big players that would not promote innovation and might be detrimental to consumers. Equally, you could have a state-run CBDC that crowds out any private sector.”

This is an opinion echoed by many, with hybrid models suggested by many focus groups and nations across the globe.

Aside from developing CBDCs, there have also been projects working with fiat currencies. Building on the traditional RTGS transaction, RTGS Global has created a financial infrastructure that enables streamlined cross-border payments without using DLT and digital currencies.

With the use of bilateral atomic settlement, RTGS Global claims to achieve “Instantaneous fiat currency liquidity exchange in central bank funds, point to point, globally 24/7/365” for many cross-border wholesale applications, eliminating current friction points and reducing the cost of transactions.

“I think specific use cases will drive specific change,” commented Dave Sissens, CEO of RTGS Global.

“The key here is use cases, what is the money being used for, and why would a person use a CBDC versus the stable coin or fiat…interoperability between fiat and digital is critical moving forward,” said James Wallis, Vice President of RippleX.

“The capabilities are more important than the immediate issues that it can address. In some jurisdictions, it does provide immediate solutions for specific issues….but it’s also what can CBDC provide as a platform for innovation in the future and how can a CBDC be an enabler for the transition to a more digital economy… that’s why I think it’s really important to explore CBDCs and promote the exploration and experimentation” said Jannah Patchay.

“For me, it’s an inevitability more than a choice,” She concluded. “For those jurisdictions that are not giving it due consideration, then there is a real danger that they will be left behind in the global economy and marketplace.”