In this conversation, we go through the essentials of Decentralized Finance with Kerman Kohli, who is a serial entrepreneur and the writer of the DeFi Weekly newsletter. We discuss the mechanics of issuing stablecoins, decentralized lending, decentralized exchange, automated market makers, and the increasing complexity of synthetic assets that have grown the sector to nearly $7 billion in August of 2020.

WhatsApp launches payments in Brazil and is unceremoniously shut down by the central bank a week later, MasterCard buys Finicity to protect itself against Visa’s recent acquisition of Plaid, Checkout.com continues its largely silent meteoric rise in payments, Softbank-backed and DAX 30 index component Wirecard “loses" $2 billion from its balance sheet and files for insolvency, Upgrade raises $40 million at a $1 billion valuation to extend its personal credit offering.

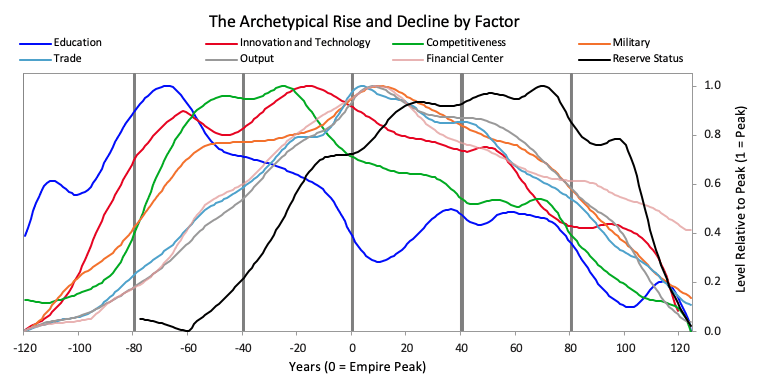

This week, we engage deeply with Ray Dalio's economic research about American Empire, capitalism, and the structure of money and credit. His clear ideas and model of the macro economy help connect the dots between emerging schools of thought, like Modern Monetary Theory and Market Monetarism, and the scarcity-focused philosophies of Gold and Bitcoin. This exploration will give you tools for understanding the $2 trillion printed by the US government, as well as potential associated impacts on finance and society.

A digital world needs digital money, and a few influential players are actively working to build it. China's BSN initiative and Facebook's Libra embody the East's public sector led approach to building and owning the internet of value and the West's private sector led (and public sector challenged) attempt at cheaper commerce on the web. While the nature of the approaches may be different, the data and privacy considerations are eerily similar. For all of our past episodes and to sign up to our newsletter, please visit bankingthefuture.com. Thank you very much for joining us today. Please welcome Lex Sokolin.

central bank / CBDCChinacovid pandemicmacroeconomicsregulation & compliancesmall businessstablecoins

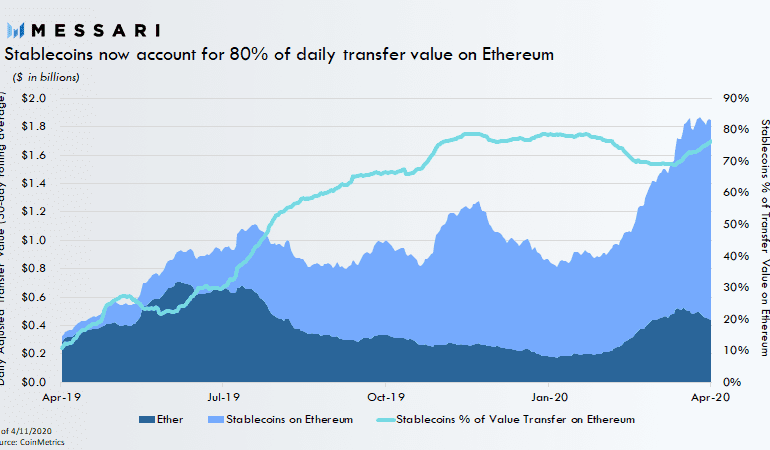

·This week, we look at cash -- blockchain cash. The war for money is just starting to ramp up, as Facebook Libra explains its new regulated plan, the Chinese national Blockchain Service network goes live, Ethereum stablecoins reach historic market caps in the billions, and the Financial Stability Board recommends to go heavy on global stablecoin arrangements. In 2008, Bitcoin threw a rock through the window of the financial skyscraper, and today we are starting to see the cracks. As the US government runs out of $350 billion in small business bail-out money and gets ready to print more, where do you stand?

I anchor around the issues Libra is seeing in trying to develop a money, and what alternate strategies are available. We also analyze elements of a JP Morgan 2020 blockchain report, which highlights the differences between running a financial products (like a money) and a financial software (like a payments processor). In light of this necessary pivot for the regulated Facebook, we look again at Ethereum's decentralized finance ecosystem and the types of challengers it has created for Jack Henry, Finastra, Envestnet, TradeWeb, and other infrastructure providers.

I examine the rising relevance of Central Bank Digital Currencies. We look at the World Economic Forum policy guide to understand different versions of CBDCs and their relative systemic scale, and the ConsenSys technical architecture guide to understand how one could be implemented today. For context, we also dive into a very different topic -- Lithium ion batteries -- and show how a change in the cost of a fundamental component part (e.g, 85% cost reduction in energy, or financial infrastructure) opens up a massive creative space for entrepreneurs.

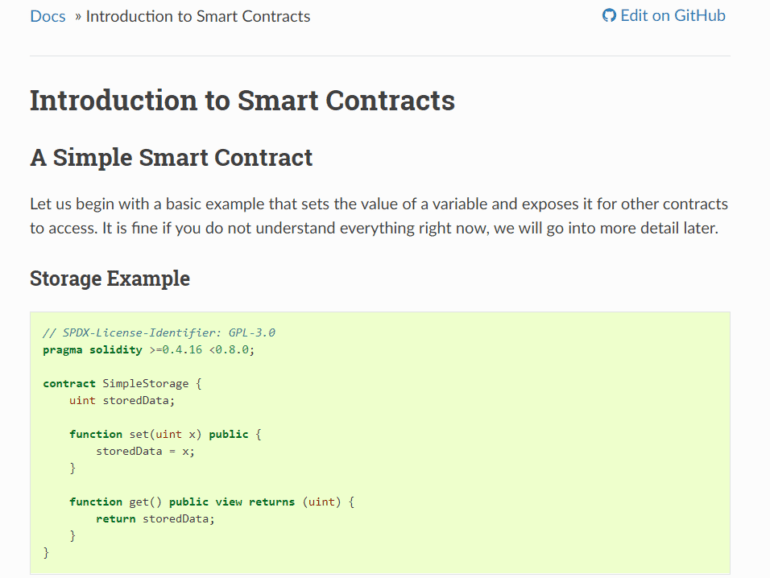

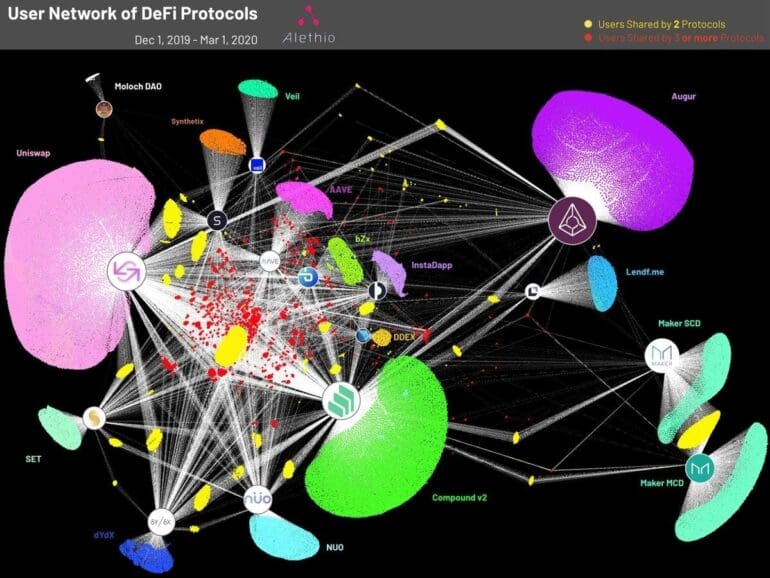

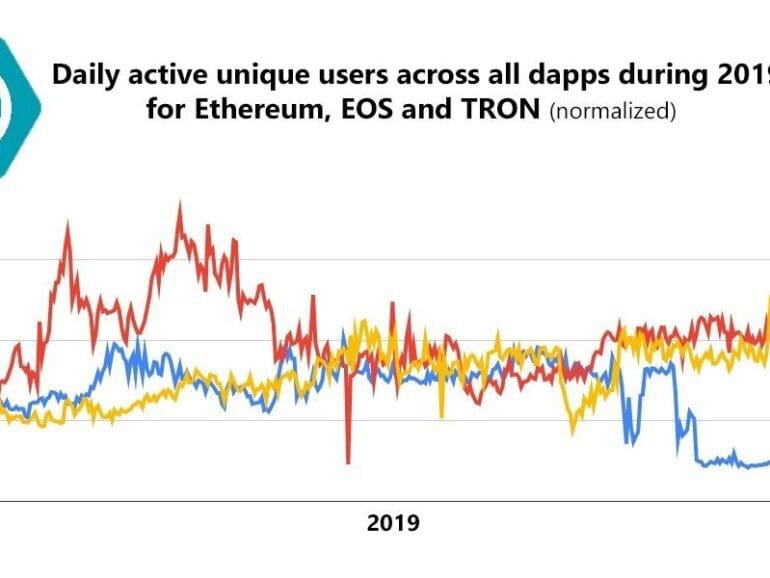

In the long take this week, I revisit decentralized finance, providing both an overview and 2019 update. The meat of the writing is the following long-range predictions for the space in the next decade -- (1) the role of Fintech champions like Revolut and Robinhood as it relates to DeFi, (2) increasing systemic correlation and self-reference in the space, which requires emerging metrics for risk and transparency, and (3) the potential for national services like Social Security and student lending to run on DeFi infrastucture, (4) the promise of pulling real assets into DeFi smart contracts and earning staking rewards, and (5) continued importance of trying to bridge into Bitcoin. Here's to an outlandish 2020!

I look at the similarities between the NYSE building out direct listing products to augment or replace IPOs, and Central Banks considering launching consumer-facing digital currencies. In each case, the value chain of the respective financial sector is compressing, as the underlying manufacturers of financial product move closer to the consumer. I also highlight how a few blockchain-native alternatives to trading and rebalancing software are developing, and the reasons to get excited about things like Set, Uniswap, and Aragon.

No More Content