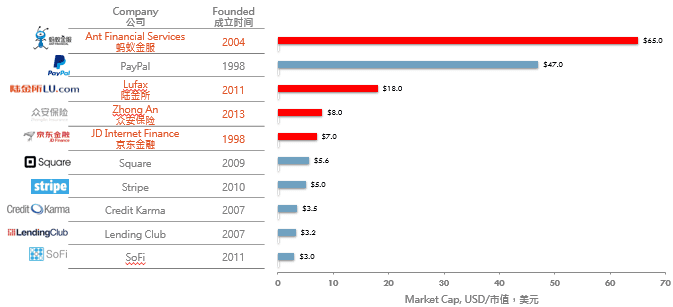

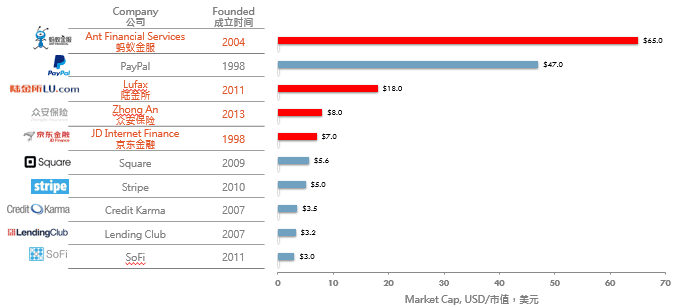

China is the biggest market in fintech but the world just doesn’t know it yet. It is true, take a look at the chart above. Chinese companies, ranked by market cap, dominate fintech with 4 of the top 5 fintech companies in the world. The largest company, Alibaba’s Ant Finance, recently closed the world’s largest private funding round for an Internet company at $4.5 billion. The third largest company, Lufax, is the world’s best example of a fintech company incubated inside a large scale financial services company (Ping An Insurance).

I often talk about insurance tech as the next big category and ZhongAn Insurance is the world’s largest and fastest growing online insurance company. Finally, ecommerce giant JD.com has created an entirely new Internet Finance division and has raised $1b from an investor group led by Sequioa to focus on building a full stack fintech company that includes supply chain small business lending, consumer lending, wealth management, payments, equity crowdfunding, insurance, and securities and brokerage businesses.

This list doesn’t even include private companies like CreditEase or new entrants like real estate behemoths Greenland and Dalian Wanda, online travel companies like Ctrip and Qunar, phone maker Xiaomi, digital media companies like Sina, Sohu, and Phoenix Finance, Internet pivots like RenRen and Shanda, and huge conglomerates like HNA Group. Seriously, everywhere you turn in China you find a new company with an Internet Finance strategy.

Here are a few US-Chinese Fintech partnerships just in the last few weeks:

DriveWealth Brings Robo-Advisory to China in New Partnership with CreditEase – June 8

CreditEase and DriveWealth announced a partnership in June 2016 to launch ToumiRA, a robo advisor product which will be made available to CreditEase’s current customers. The new ToumiRA product will allow investors to access US equities through DriveWealth.

Robinhood Teams With Baidu to Offer U.S. Stock Trading in China – June 1

RobinHood, which prides itself on free stock trading partnered with Baidu. Baidu now offers their clients a mobile app called StockMaster to trade US stocks and ETFs without paying brokerage commissions.

Leading Chinese Platform CreditEase Makes First Investment on Avant and Prosper – May 31

CreditEase, a fintech firm that has their own marketplace lending business in China under the company Yirendai (NYSE: YRD) made investments in US based marketplace lenders Prosper and Avant. They are allocating $50 million total between the two firms at a time when institutional money has been harder to come by stateside.

Saxo Bank Announces Landmark Partnership with Lufax – May 24

Lufax is a household name in internet finance in China with a large client base. With this partnership between Saxo Bank and Lufax, Lufax will utilize trading technology of Saxo Bank’s SaxoTraderGO, a multi-asset trading platform. This will help clients of Lufax to access capital markets across the globe.

Chinese billionaire Chen’s Shanda buys 11.7 percent of LendingClub – May 24

At a time when some investors are skeptical of Lending Club, one Chinese firm has invested a significant amount in the company.

China’s Huatai Securities To Buy AssetMark From Private Equity Owners – April 13

In April 2016, Huatai Securities announced the $780 million purchase of AssetMark who has $29.3 billion in assets under management. With the purchase of AssetMark, Huatai Securities will have access to advisory services offered by AssetMark as well as investment and portfolio management.

So why is this happening? Why does everyone in China think that fintech will be larger than ecommerce? Answer: it is because of their market structure.

First, China is transitioning into a consumption economy. The legacy banks and financial companies were built to finance infrastructure. These big banks have always lent to big companies to build bridges and skyscrapers, not to small businesses or consumers. They are not designed to service individuals and they are not well prepared to service the consumption economy.

Second, most of China’s population has no affiliation with a bank and will access financial services for the first time through fintech companies. For instance, the People’s Bank of China, the central bank, operates the national credit bureau, which includes data on about 300 million people, less than 25% of the total population. That means that about 1 billion people, or about 75% of China’s population, are “underbanked” meaning that they have poor access to mainstream financial services normally offered by retail banks. Meanwhile, according to a recent McKinsey study on personal financial services in China, more than 70% of respondents would consider opening an account with a pure digital bank, nearly the same number would consider making a digital bank their primary bank.

So the country is shifting towards a consumption economy and there is this collision of a massive underbanked market with new digital services that is resulting in the total transformation of the Chinese retail financial services market.

As a result, there is a clear path for fintech companies to go mass market and dominate financial services in China. In the US, the largest retail financial services brands are Bank of America, Chase, Wells Fargo, etc. In China there is a good chance that those brands will be fintech companies like Ant Financial, Lufax, and ZhongAn, which are all poised to go public over the next ~18 months.

When these IPOs happen, the world will finally realize that China is indeed the largest fintech market.

Jason Jones is a partner at Lend Academy and a co-founder of LendIt. He has spent a lot of time in China this year as the LendIt team prepares for their LendIt China 2016 executive tour and conference.