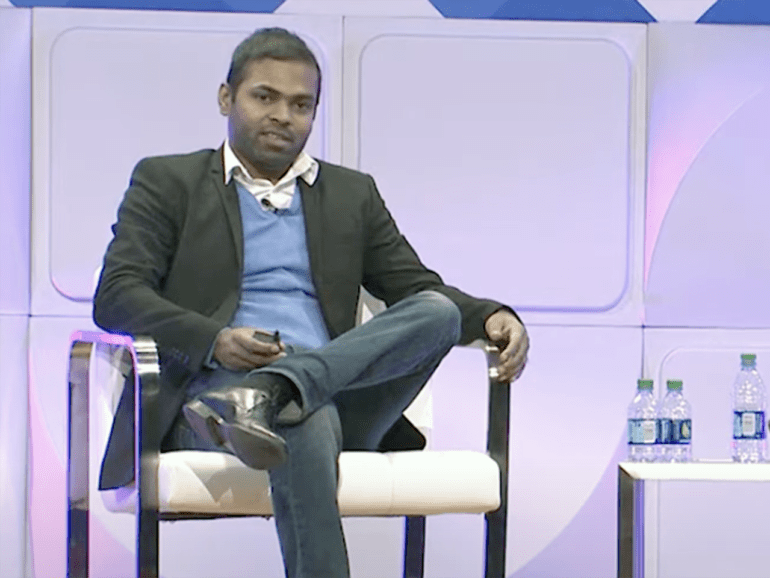

Snehal Fulzele is an experienced hand at seeing a market inefficiency and addressing it with technology.

What he did for solving lender-niche bias at Cloud Lending Solution, he is now doing to bridge the gap between legacy institutional infrastructure and the world of cryptocurrency at Cion Digital.

Debuting at this year’s Money2020, Cion Digital helps entities looking to expand into the digital asset ecosystem to be fully ‘crypto ready.’

Those groups can deploy new compliant payments, finance, and lending systems that bridge the gap between TradFi and DeFi.

The Cion Digital Blockchain Orchestration Platform accelerates integration, provides optionality, prevents technical debt from the onset, and removes friction from creating blockchain-based innovative real-time payment and financing.

It facilitates real-time money movement using blockchain technology while offering ready-to-use solutions and rapid integration to leading crypto exchanges, DeFi protocols, and aggregator services.

“We wanted to create a simpler way for institutions to quickly and seamlessly connect with the complex and ever-changing world of decentralized finance,” Fulzele, who serves as Cion Digital’s CEO, said.

Senior industry leaders

“We brought together very senior fintech leaders who’ve helped banks, payments, and lending institutions adapt and evolve as digital and cloud have transformed finance systems. Our leaders understand payments, banking, and lending incredibly well and know institutions need solutions that quickly evolve their existing financial systems for the new digital economy and prevent them from being disrupted.”

Joining Fulzele are Cloud Lending alums Chris Boas, who serves as EVP and GM for APAC, and head of sales Jim Donatelli.

His co-founder is Fred Brothers, who held executive roles at FIS and eCommerce Strategy and was a Cardlytics board member.

Also onboard are CMO Katie Robinson, who has worked at Alliance Data and FIS, and Arpit Agrawal, the EVP of Engineering and GM for India, who was previously with Blockchain Simplified.

Fulzele came up with the idea for Cloud Lending Solutions after having conversations with key industry players who said they approve low percentages of applications they received.

What intrigued him was that often it wasn’t the creditworthiness that stopped the application from going forward. It could have been anything from the lender using exclusionary operating parameters to the borrower needing less than the minimum loan they offer.

Lenders were unnecessarily freezing themselves out of good business prospects due to limited technology.

In 2018 Cloud Lending Solutions was sold to Q2 Holding for $140 million. Fulzele said Q2 was attracted to Cloud Lending Solutions’ lending solutions, matching Q2’s online banking suite. He stayed on as GM of the lending side until late 2020.

‘Fintechs lead with innovation’

“So during that time, predominantly we deployed the technology in the fintech world now, in the more traditional banks and credit unions,” Fulzele said.

“So it just shows how fintechs lead the innovation, and then your more traditional institutions, they just follow. They typically stay on the sidelines, really looking at what works, what doesn’t work, and they come in.

“They will eventually come in, and they will adopt what’s good in those technologies. And I think that’s what I personally experienced in that transition from fintech being our primary core customer to being banks and trade unions becoming our primary customer now.”

Fulzele is once again bringing novel technologies, this time decentralized protocols and cryptocurrencies, to established institutions, who are once again watching the innovations from the sidelines. He talked to many of them and saw they recognized plenty of potential in blockchain technology, but they didn’t know how to start.

“They didn’t know how to go about it because it’s such a new world,” Fulzele observed. “Distributed ledgers and the way you write code in the world of blockchain is very different than how you do it in a traditional, programming world. So, although the promise is there, they didn’t know how to think about bridging that connect and domain gap.

“And that’s where we feel like there’s an opportunity for science to come in and simplify the world of blockchain so that the traditional institutions can essentially participate in the corporate crypto economy without really having to blow through millions of dollars or having to hire dozens of blockchain engineers. So that’s where we come in. That’s the opportunity we are after. We are essentially anticipating a need for the next 10, 15, 20 years that blockchain-based solutions like cryptocurrencies and securitizations of digital assets become mainstream, and we want to be the technology layer that can help established businesses participate in those changes.”

Evolution of percpetion

Fulzele has seen an evolution in how the industry views blockchain’s ability to change finance over the past decade.

In the beginning, not unlike how people viewed P2P and crowdfunding as revolutionary systems that would leave legacy operations in the dust, so they described blockchain as a panacea for all of the inefficiencies and operational problems institutions face.

Because of its distribution, people envisioned blockchain would unite institutions into a single network, but that is a near-impossible task, Fulzele suggested.

“Even though the end result may seem amazing, it is just not practical. It’s just really not practical because every single business has operational issues. It’s just a hard problem to solve.”

But what businesses addressed were all sorts of issues whose solutions built on public blockchains like Ethereum, he said. We have decentralized finance, NFTs, and money-moving applications that create new opportunities while improving existing systems. And those solutions are best applicable to only one institution, Fulzele believes.

Take, for example, structured debt, he said. Complex transactions can take a year due to dealings with multiple investors, ratings agencies, and special purpose vehicles. Then you have to define terms and distribution and work with trustees.

“It’s just a complex world,” Fulzele admitted. “But it’s centered around one transaction. Now that’s a great application of blockchain.”

Cion Digital clients are often involved in multiple streams like unsecured consumer loans, merchant financing, and POS financing, Fulzele said. With millions of collective end-users, these institutions see opportunities to sell cryptocurrency-based products to their existing customer bases, including those with thin files, many of whom own crypto.

Overwhelming for lenders

Perhaps they want to offer loans against crypto holdings. If they decided to do it in-house, the institution would have first to recruit experienced blockchain technicians. Then comes forging links with maybe one dozen providers, such as custodians, trade execution specialists, liquidity providers, and settlement specialists. And don’t forget about compliance needs.

“It’s very overwhelming for the lender because they now have to manage relationships with all these vendors and then come up with a solution and then put that solution in their existing workflow,” Fulzele said. “I think the entire process takes them two years.

“We have already made connections to a whole bunch of custodians, a whole bunch of liquidity providers, a whole bunch of settlement providers, a whole bunch of compliance providers, and there’s a no-code on top of it. That will, within probably about three to four months, deliver the same capability.

“That’s where we come in. We essentially reduce the cost and the time to market for an established lender, especially non-crypto-savvy lenders.”

There’s plenty of debate about whether cryptocurrency is mainly a store of value or if there is a strong urge to put it to use in the economy. The technology allows you to do both, Fulzele said. Holders can lend to anyone in the world while earning real returns, especially compared to bank interest. Those who know the ecosystem and technology can do this with minimal risk.

But regulation will inevitably come, with the SEC possibly determining how much holders can stake at one time, for example. Savvy entrepreneurs and institutions must factor in this uncertainty.

Fulzele said buy now, pay later, for all its buzz, is essentially an installment loan. This is a dangerous time for the concept to be gaining traction because low default rates can camouflage spotty underwriting models.

Stress-test the model

“Once we get to that part of the credit cycle where things are tight, the economy’s tight,… that’s when you will stress test your underwriting model,” he said. “That’s when you will stress test your risk management appetite, or you know how credibly you’ve done it.

“Many of these binary operator companies, I’ll be surprised if they continue that momentum forever. There will be a time because these are loans. At the end of the day, people will default. And if you’re going into a territory where he’s probably a 500 FICO, and you don’t care, I think he’s going to come and bite you.

“Convenience is the new loyalty. You are making it really, really convenient for end-users to buy, and I think the Gen Z’s and millennials want to pay everything in installments, even if it’s 25 bucks worth of a t-shirt. But it’s a risk management game at the end of the day. So I think a lot of the other BNPL players will get weeded out over time. The ones that will succeed are the ones who have managed to do the risk management job properly.”

Crypto offers an intriguing BNPL possibility, Fulzele said. Merchants can accept crypto as collateral, which can easily be liquidated if the borrower defaults or the LTV falls below a specified point. Risk management is already built into the product, so there are controls even though crypto is volatile.

The ability to securitize portfolios on the blockchain is tantalizing for financial institutions, Fulzele said. They can insert some sort of particular purpose vehicle on the blockchain that can control distributions to investors.

“This sounds amazing (to financial institutions) because it reduces their transaction length from 12 months to, say, nine months,” Fulzele said. “That’s millions of dollars of savings, and that brings more transparency to investors. So those progressive institutions will eventually benefit, but they have to go through the process of this not being the usual stuff. I think we have to really understand this.”