Citi announced in a release today its partnership with the Swiss firm, METACO, to establish and develop digital asset capabilities.

“We are witnessing the increasing digitization of traditional investment assets along with new native digital assets. We are innovating and developing new capabilities to support digital asset classes that are becoming increasingly relevant to our clients,” said Okan Pekin, Global Head of Securities Services at Citi.

Citi joins a growing list of incumbents that are turning to digital assets solutions, an area which, not so long ago, was the exclusive domain of developers and tech enthusiasts.

Citi follows demand

Customer demand for digital assets has been rising rapidly. Despite the recent (catastrophic) “blip,” news of staggeringly lucrative investment in NFTs and cryptocurrencies has been capturing the hearts and minds of the public. In August 2021, the global market capitalization of cryptocurrencies had more than doubled from the end of 2020, reaching a new high of $2 trillion.

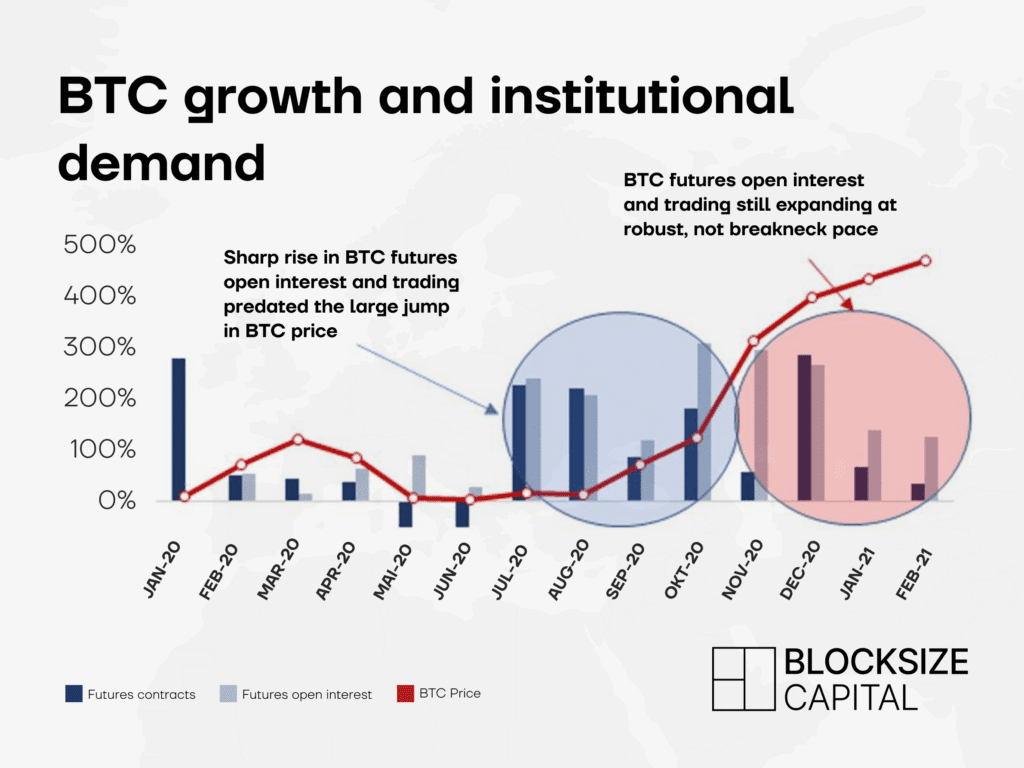

Institutional investment was partially responsible for the early 2021 crypto bull run, signaling a widespread acceptance of the asset class, fueling trust, and continuing growth in demand. As regulated parties, clients were assured of credibility despite the volatile valuation.

As the digital asset market has matured, so has the underlying technology, providing further opportunities for secure investment. Use cases are widely discussed, and more businesses are looking towards stablecoins and CBDCs for future processes such as international settlement.

Their Citi Ventures market trend report stated an interest in Digital Economies, outlining potential opportunities. The report said, “As these fast-evolving economies mature, their stakeholders will need strategic guidance, support in scaling, and help to understand their potentially vast implications.”

“This presents compelling opportunities for financial leaders to engage with the space by exploring “fractional ownership” and the shift from ownership to access models; helping expand the crypto and DeFi ecosystems; banking the Metaverse; empowering digital wealth creation and management; and more.”

Therefore, it is perhaps unsurprising that Citi has moved to digital assets. The collaboration combines METACO’s technology and digital solutions with Citi’s expansive custody network, developing a platform to enable clients to store and settle digital assets seamlessly and securely.

Partnership builds on institutional digital asset strategy

The strategic partnership between Citi and METACO allows Citi to use its existing technological, operating and servicing model while expanding to include digital asset capabilities.

METACO will integrate their Harmonise platform, providing orchestration and custodial capabilities, allowing Citi to issue, store, trade, and manage tokens. They ensure regulatory compliance and, in the past, have supported several key implementations, including FINMA, BaFin, FCA, Banco de España, and MAS-regulated institutions.

The resulting technological development will form a critical part of Citi’s Institutional Client Group digital asset strategy. With a physical presence in 95 countries, local trading desks in 77 markets, and a custody network in 63 markets, the group currently facilitates approximately $4 trillion in financial flows daily.

Citi has over $27 trillion in assets under custody, administration, and trust to date. The inclusion of digital assets is likely to push this significantly higher.

Adrien Treccani, CEO and Founder of METACO, commented, “We are pleased to team up with Citi, one of the largest securities services firms, to support them in their vision to bridge digital and traditional assets. This initiative is a market-defining moment for institutional adoption of digital assets.”