The PayPal earnings call, while upbeat, came with a bombshell. CEO Dan Schulman will be stepping down this year, one year earlier than expected.

“At the end of this year, I felt there were two important considerations in terms of timing,” he said in his prepared remarks. “First, I wanted to be sure that PayPal had positive momentum and was in the position to deliver a solid year of performance, so I can be sure I wasn’t leaving the company in a difficult position…I wanted to be absolutely sure that takeout was on solid footing with a bright future.”

“Second, it was important to me that the board have enough time to conduct a thorough search and have a reasonable transition period.”

His reference to “solid footing” is evident in the tales of growth woven into most of the earnings report.

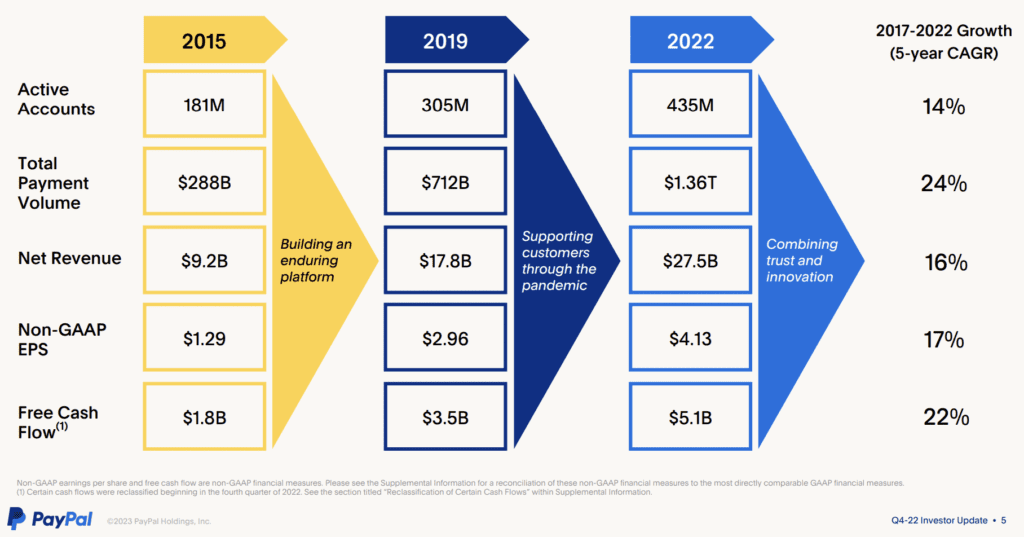

Both numbers of active users and payment volume continued to increase, following a five-year upward trend. In 2022, the total payment volume reached $1.36 trillion.

Schulman highlighted that Q4 2022 alone had come with several milestones.

“In the quarter, we set several new milestones, and we returned to operating margin expansion and positive earnings growth,” he said.

“For the first time in our history, we exceeded $7 billion of revenue in the quarter, meeting our guidance of 9% FX and growth with revenues of $7.4 billion. In addition, we exceeded 6 billion transactions in a quarter for the first time, resulting in 51.4 transactions per active account, growing 13% year over year.”

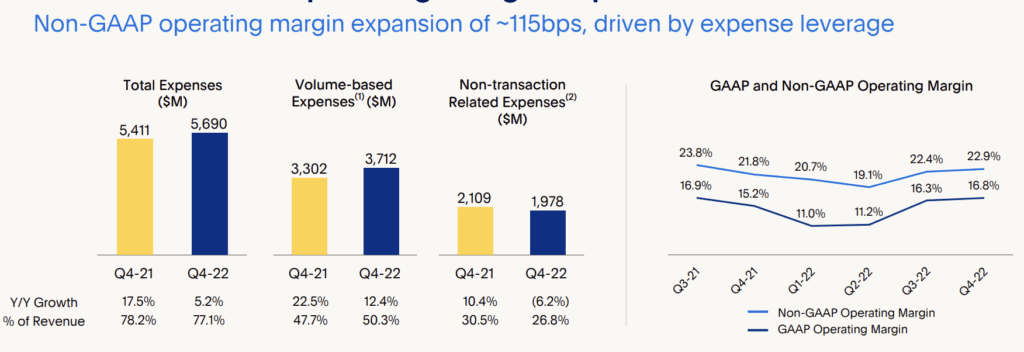

The company also noted the quarter had been an inflection point, and its non-GAAP operating margin expanded for the first time since the first quarter of 2021, marking a return to profitable growth.

Despite this growth, the company announced job cuts to 7% of its workforce just one week prior, casting a hint of foreboding amongst the positive results.

Deceleration in e-commerce sector

As part of the vision forward, Schulman said that the company had identified additional cost savings. This had already translated into reducing the workforce earlier in the month.

“As we look towards 2023, I want to lay out our thinking about the year ahead,” he stated. “First, we have identified an incremental $600 million of cost savings on top of the $1.3 billion of cost savings previously identified.”

As well as the reduction of headcount, he explained that the company would be reducing its external vendor spend and real estate footprint.

He noted that the e-commerce sector had continued growth deceleration.

Gabrielle Rabinovitch, PayPal’s acting CFO, said, “The rate of e-commerce growth in our core markets has decelerated. Inflationary pressures have affected discretionary consumer spending, and post-COVID spending patterns are still evolving.” Creating an air of caution to the future outlook of the industry.

Accordingly, the company said they are opting to keep discretionary spending low. However, they noted that Q1 2023 had started well with high acceleration through January and the beginning of February.

Schulman said that the planned cost structure would allow the company to continue investing in growth initiatives.

“We are putting significant resources behind the modernization of our checkout experience to defend and grow our market share in our branded checkout business,” said Schulman. “This includes the drive towards passwordless, one-click native in-app experiences and deploying the next generation of advanced checkout using our data and AI capabilities.”

He also stated the company would focus on growth for Braintree and on opportunities within the SMB space and consumer-focused digital wallet creation.

Revenue lacking in guidance for full year

Revenue guidance was only given for Q1 2023, with the company declining to provide an estimate for the entire year.

Rabinovitch explained that for this first quarter, they expected the revenue growth to be around 9% and 7.5% on a spot basis, to $6.97 billion. They expect non-GAAP earnings per diluted share expected to grow 23%-25%.

Citing the ongoing macroeconomic uncertainty, the guidance focus for the year remained on earnings, which they expect to grow around 18% (non-GAAP EPS).

“In putting together our financial architecture for the year and guiding 18% non-GAAP EPS growth, we have been prudent about our planning assumptions for our revenue performance and establishing an efficient cost structure that enables us to deliver on this commitment,” said Rabinovitch.

“We believe we can deliver 18% earnings growth even with revenue growth in the mid-single digits… Our objective is to grow revenue ahead of this baseline.”

“Our revenue growth is highly correlated to discretionary e-commerce spending in our core markets. We are optimistic that when e-commerce growth re-accelerates, we will fare better than most.”

RELATED: Fintech Ticker Table