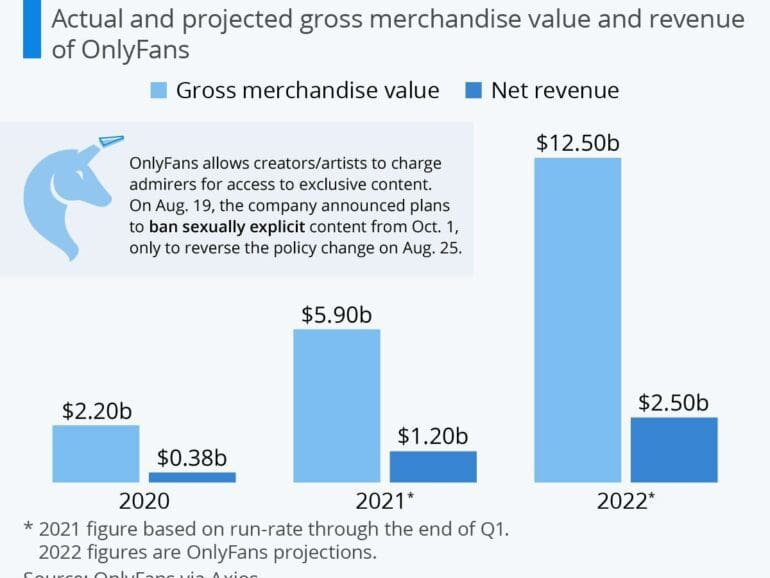

We talk about OnlyFans, and how its bank vendors pressured it to try to ban adult content, and how and why that failed. We also discuss the crypto tax provisions in the Senate version of the $1 trillion infrastructure bill, and their impracticality. These themes are tied together with a metaphysical hypothesis about the role of financial services, anchored in a discussion of the Platonic model of the mind. How are rationality, emotion, and social context involved to define the shape of our industry?

OpenAI, backed with $1B+ by Elon Musk & MSFT, can now program SQL and write Harry Potter fan-fiction

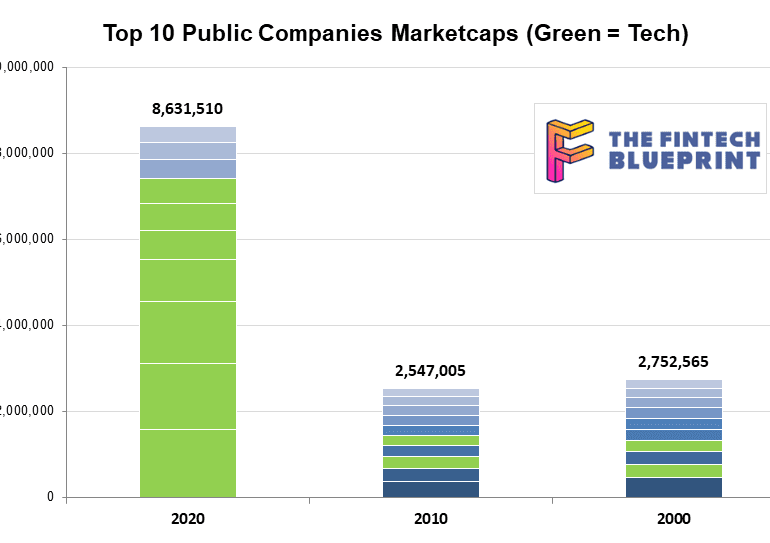

This week, we look at a breakthrough artificial intelligence release from OpenAI, called GPT-3. It is powered by a machine learning algorithm called a Transformer Model, and has been trained on 8 years of web-crawled text data across 175 billion parameters. GPT-3 likes to do arithmetic, solve SAT analogy questions, write Harry Potter fan fiction, and code CSS and SQL queries. We anchor the analysis of these development in the changing $8 trillion landscape of our public companies, and the tech cold war with China.

central bank / CBDCChinacivilization and politicsCryptoDAOsdecentralized financegovernanceIndiamacroeconomicsMetaverse / xRregulation & compliance

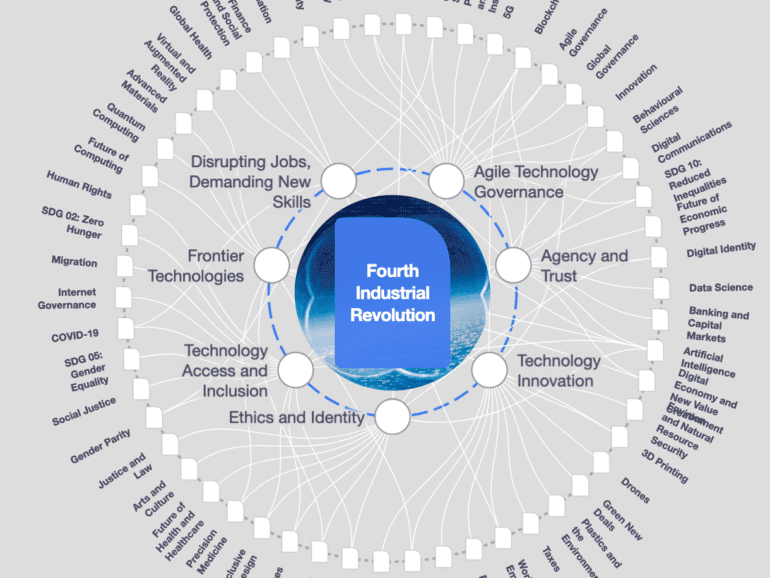

·In this conversation, we are so lucky to tap into the brilliant mind of none other than Sheila Warren who sits on the Executive Committee of the World Economic Forum and is a key member in the executive leadership of the Forum’s Centre for the Fourth Industrial Revolution (C4IR), in which she oversees strategy across the entire C4IR Network, consisting of centers in 13 countries. Sheila also holds board member and advisory positions at multiple institutions and organizations including The MIT Press (Cryptoeconomic Systems), The Organisation for Economic Co-operation and Development (OECD), NGO network TechSoup and she is a Member of The Bretton Woods Committee.

More specifically, we discuss her professional journey from small claims court to NGO Aid to refugees to corporate law to The WEF, touching on rational choice theory, corporate personhood and its correlation to the growth around ESG, new substrates, DAOs and protocols, artificial intelligence, the purpose of The World Economic Forum and its impact on governments and society alike, and just so much more!

This week, we look at:

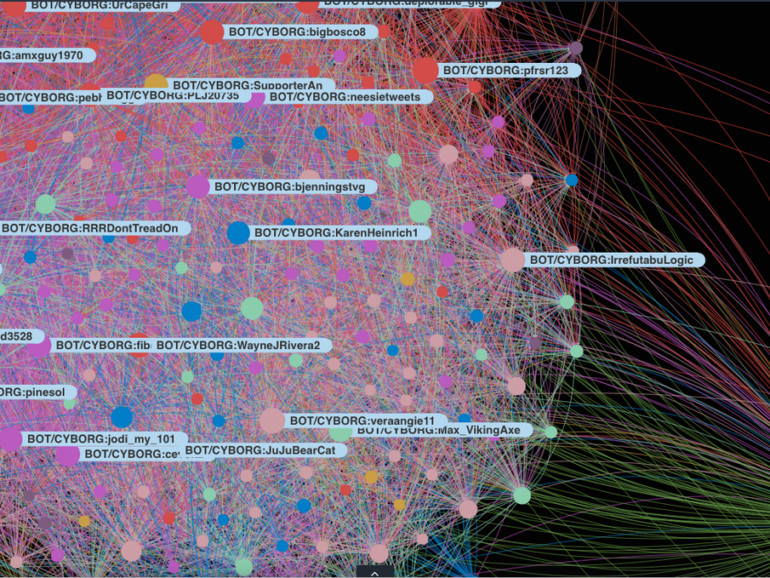

Deep Fakes behind South Park creators' new parody, Sassy Justice

The AI-created author of the fake Hunter Biden intelligence report

GPT-3 winning the love and attention of people on Hacker News

How should we react to these robots and their desire to mess with our minds

Unlike equities, the crypto markets were born from machines, and are constructed from code. Hold dear the tokens in which you believe, and stay away from the stories of easy money. Nothing is easy. To win Russian roulette is not good fortune. It is, instead, a grave mistake to play a lethal game. Have you nothing to lose?

And then Brexit. And then Taiwan and China. And then Covid, again. And then, who knows.

From now on and forever, your counterparty is the data center running an AI cluster on top of the Internet. The data center that has already profiled you and knows everything about you. Bring the tinfoil hat.

This week, we look at:

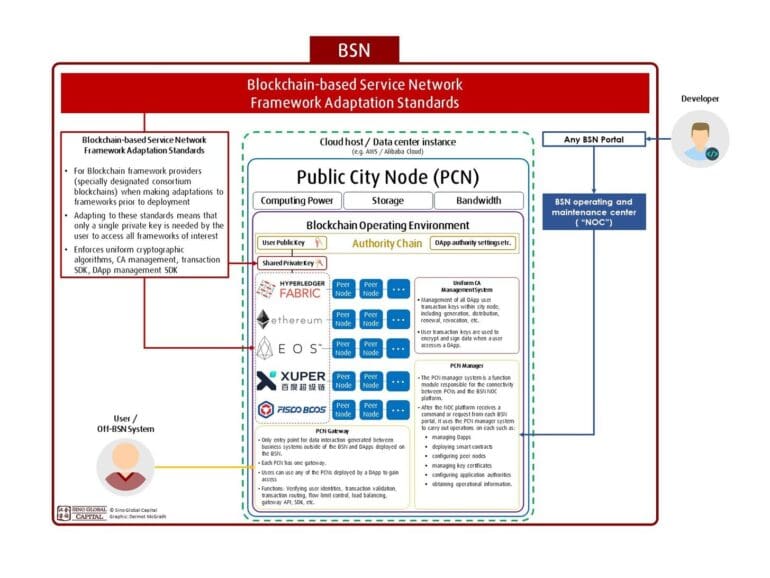

China’s Five Year Plan, the industrial logic of the system, and its ramifications for blockchain and fintech in the country

The regulatory challenges faced by Chinese tech companies, including the resignation of Ant Group’s CEO and the anti-competition fines for Tencent

The growth path of the e-CNY digital currency, as well as Beijing’s enterprise blockchain powering the city infrastructure and governance

Footnote: Stripe worth $95 billion, closing $600 million investment

I look at the boundaries that Telegram and EOS have crashed into in the US with recent SEC actions and lawsuits, and the melting of Facebook Libra. There have been a number of interesting regulatory moves recently, and the positive headlines of 2017 have become the negative headlines of 2019. How does SEC jurisdiction reach foreign institutional investors? We also touch on the $1.5 billion NBA distribution deal now on the fence in China, and how US companies are under the speech jurisdiction of a foreign nation. How does China reach American protected speech? Through pressure, boycott, and economics.

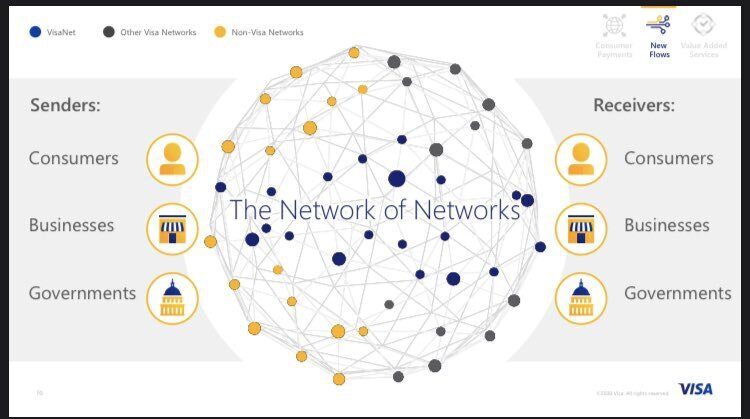

The principle behind Mastercard’s CipherTrace acquisition, L1 growth, and IRS getting your bank data

Paying attention is the path to seeing and doing. Mastercard has bought CipherTrace to see blockchain-based finance, to launch new businesses, and to plug in more networks into its nexus. The crypto networks proliferate at every layer, creating more computation on Ethereum, Polygon, Arbitrum, Optimism, Fantom, and Solana. The US executive seeks to see more too, asking the banks for their records of financial transactions to enforce taxation compliance.

It must have been hard for those early Internet dot com founders to watch their ideas burn up like kindling. What was yesterday a song of genius and risk-taking became a caricature of hubris and bubbles. Pets.com, lol, they said.

Of course all the Internet people were right, just not at the right time. Being in the moment, you really can’t tell when the right time is. You might only be able to tell when it’s over, and the music ain’t playing no more.

It’s the roaring twenties, people say about the start of this decade. Like, that’s a good thing? Of course the 1920s ended with the Great Depression, a restructuring of the social order, and a political path to the worst war in human history. But you know, some people had fun in the stock market! Even Keynes — for all his economist words — lost his shirt. Only political power and the gun mattered in the end. It was Kafka who was right.

This week, we look at:

The relationship between an individual and a system, and how that applies to the power games of politics and economics. Did Trump change the system, or did the system generate Trump?

The difference between fighting and signalling, and what creates fragility and flexibility in governance structures

Why the Communist Party stopped Ant Financial's IPO, and how Jack Ma bears a resemblance to Mikhail Gorbachev

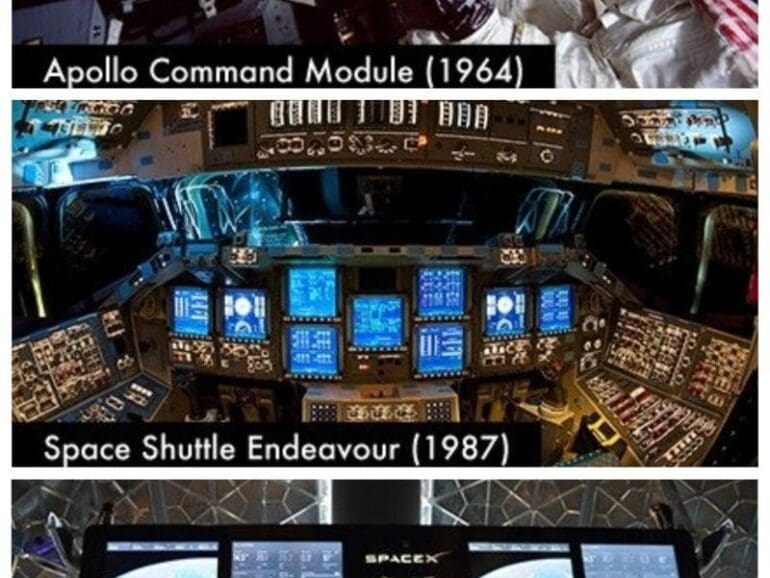

This week I discuss SpaceX, and its Dragon rocket carrying American astronauts to the International Space Station for the first time in 9 years. The 20 year old company is a testament to the incredible iron will and absolute insanity of the most visionary capitalist alive -- Elon Musk. We walk through various attributes of the company and recent launch to derive lessons for the financial industry and the entrepreneurs rebuilding it.