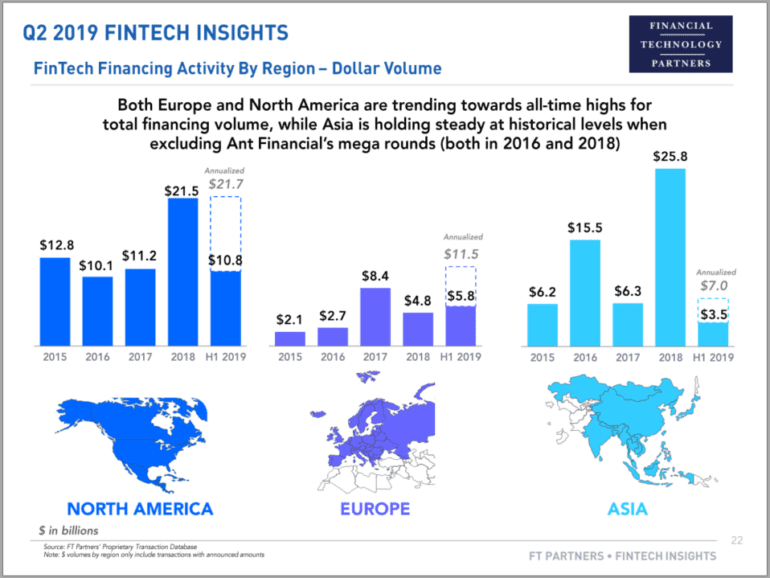

I have been reading Alibaba: The House that Jack Ma Built this week, something everyone interested in understanding the future of Google, Goldman, Uber, or Amazon should do. The narrative starts with China's small business explosion, and Ma's genius is to tap into global demand for the products of those businesses through an online marketplace and associated financial services. But I am getting ahead of myself. Let's pause to acknowledge a massive, systemic transaction that was announced this week: payments processing company Global Payments acquiring TSYS (Total Payments Systems) for $21.5 billion.

Fintech is expensive. Fintech is everywhere. If you are a thinking about starting a financial services company, and it does not have technology at its core -- don't. You will lose to someone similarly positioned building a more augmented business. Fintech is the global competition for regulation, talent, and macroeconomic supremacy. Fintech is the trade war between the US and China. Fintech is Facebook and Amazon. Fintech is the next bubble to burst. Fintech has burst already.

The realist digs deeper to that Constitution and holds it up to a magnifying glass. The Three Fifths Compromise is right there in Article 2, counting "other persons" as 3/5ths of a free person for taxation and representation. The intent of this clause was to balance power between the North and South, preserving Congressional representation of the free States, where slavery was outlawed. Maybe it was better than nothing -- but in all cases it reminds us of the truth of American slavery and the determinations of its power.

It must have been hard for those early Internet dot com founders to watch their ideas burn up like kindling. What was yesterday a song of genius and risk-taking became a caricature of hubris and bubbles. Pets.com, lol, they said.

Of course all the Internet people were right, just not at the right time. Being in the moment, you really can’t tell when the right time is. You might only be able to tell when it’s over, and the music ain’t playing no more.

It’s the roaring twenties, people say about the start of this decade. Like, that’s a good thing? Of course the 1920s ended with the Great Depression, a restructuring of the social order, and a political path to the worst war in human history. But you know, some people had fun in the stock market! Even Keynes — for all his economist words — lost his shirt. Only political power and the gun mattered in the end. It was Kafka who was right.

OpenAI, backed with $1B+ by Elon Musk & MSFT, can now program SQL and write Harry Potter fan-fiction

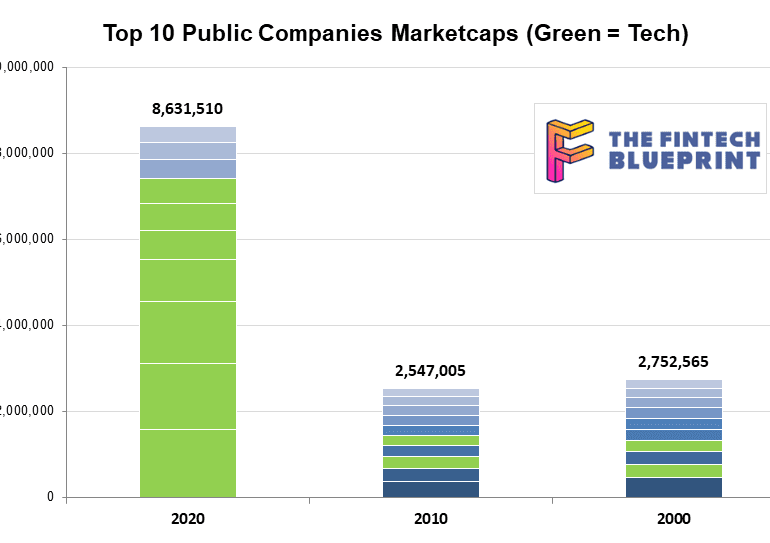

This week, we look at a breakthrough artificial intelligence release from OpenAI, called GPT-3. It is powered by a machine learning algorithm called a Transformer Model, and has been trained on 8 years of web-crawled text data across 175 billion parameters. GPT-3 likes to do arithmetic, solve SAT analogy questions, write Harry Potter fan fiction, and code CSS and SQL queries. We anchor the analysis of these development in the changing $8 trillion landscape of our public companies, and the tech cold war with China.

civilization and politicsgenerational changemacroeconomicsmicroeconomicsnarrative zeitgeistphilosophySocial / Community

·Chlöe Swarbrick, a 25-year old climate MP was presenting her climate change case to the New Zealand parliament, and was heckled by an older audience member. Without missing a beat, she acknowledged and dismissed the challenger with a pithy “Ok, Boomer.”

The recording has since gone viral, inspiring everything from merchandise to Vogue articles. While the incident isn’t the source of the phrase “Ok, Boomer”, today it is the most well known manifestation. So what does the phrase mean? If you are inclined to more colorful language, see Urban Dictionary. But the meaning is obvious on its face — Gen Z is dismissing utterly and without consideration the judgment and protestations of society's elders on multi generational issues like economics, climate change, and social norms.

This week, we look at:

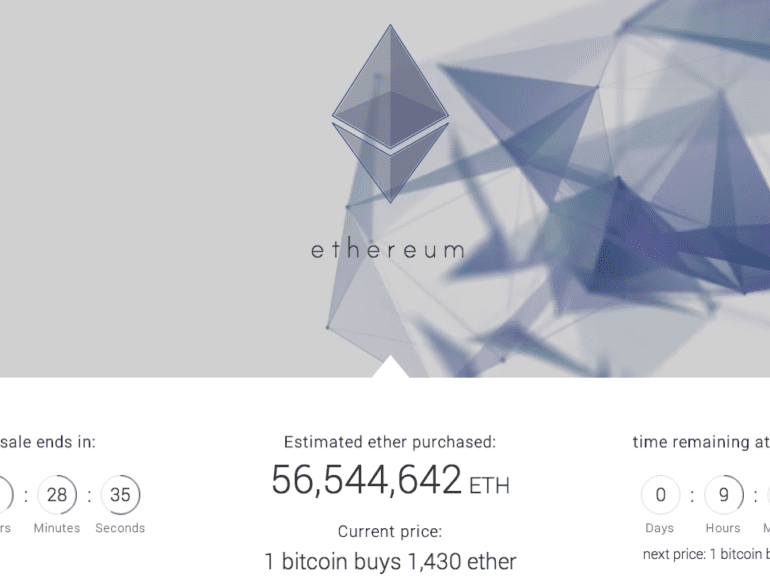

The spectacular price increase in crypto assets, hitting new records for Bitcoin, as well as the comparable statistical situation around Covid cases

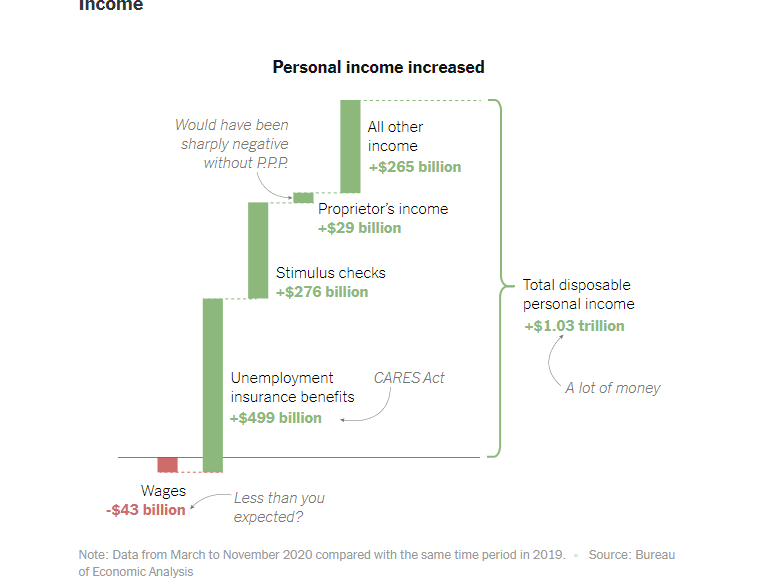

An explanation of the $1.5 trilion income effect in 2020, and how it has led to both capital acumulation and inequity (thanks NY Times!)

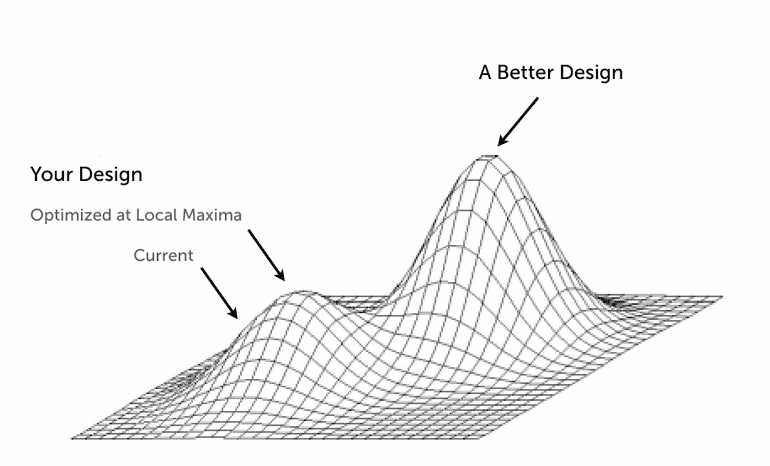

A discussion of all-time-highs and all-time-lows, why we need them, and their connections to the macro-economy, computer code, music, and the universe itself

One wonderful takeaway from Watts, which of course is not his, but beautifully plagiarized into the English language, is the duality of experience. The need for polar opposites, in a clock-like cycle. To have black, you must have white. To have the top of the wave, you need the bottom of the wave. To have a melody, you need equally the presence of the notes, and their absence in silence. To breathe in, you need to breath out. It is meaningless to have a data point without the context in which it exists.

central bank / CBDCcivilization and politicsenterprise blockchainmacroeconomicsnarrative zeitgeistphilosophyregulation & complianceSocial / Communitystablecoinsthings that are not true

·We anchor our writing around the World Economic Forum 223 page report on CBDCs and stablecoins. The analysis highlights the key conclusions across several white papers in the report. We then add a layer of meta analysis around the language in the report, and question what it is trying to accomplish, and whether that will work with the Web3 revolution. This leads us to think about the tension between populism, as represented by crypto, and institutionalism, as represented by banking structures. We discuss theories of cultural and national DNA, and the rise of populism, as difficult problems to solve for any global alignment.

In this exciting conversation, we talk with none other than Joe Lubin of ConsenSys and Ethereum, about his journey from being exposed to advances in artificial intelligence at Princeton to becoming the household name in programmable blockchain. Additionally, we get an insider look into his founding of Ethereum and ConsenSys, and how the technology and individuals behind these two companies are transforming the very fabric of financial institutions that exist today and how new products/services are started for the betterment of humanity.

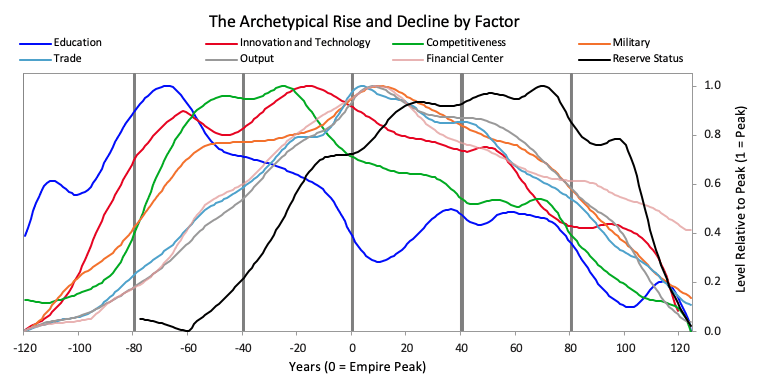

This week, we engage deeply with Ray Dalio's economic research about American Empire, capitalism, and the structure of money and credit. His clear ideas and model of the macro economy help connect the dots between emerging schools of thought, like Modern Monetary Theory and Market Monetarism, and the scarcity-focused philosophies of Gold and Bitcoin. This exploration will give you tools for understanding the $2 trillion printed by the US government, as well as potential associated impacts on finance and society.