Clim8‘s logo may be familiar to you if you’ve been in England recently.

After winning both The Times Earth Advertising Fund and being approached by Channel 4 ventures, the climate impact investment fintech is making a lot of noise in mainstream media.

“Everyone talks about being mission-driven as a start-up, but I think we genuinely have a big mission,” said Duncan Grierson. “We are very passionate and very focused on making an impact.”

Investing savings in a greener future

The investment company is the brainchild of Grierson, the founder, and CEO, with 20 years of Venture Capital investment, renewable infrastructure, and cleantech experience under his belt.

Highly passionate about his approach to reducing greenwashing and making a difference in climate change, he has been featured in multiple magazines and newspapers discussing his opinion on ESGs and the global approach to climate change.

He formulated the idea for Clim8 in 2019, looking to empower individuals to make a difference with their savings. In April 2021, the product was released. Since then, the company has gone from strength to strength.

At this relatively early stage in its development, the company has raised £12 million in venture capital and has a team that’s 42 people strong. Six of these employees make up the in-house investment team, explicitly focused on investing in companies that positively impact climate change.

“What we are trying to do with this platform is make it easy for anyone to invest and make an impact,” he said. “We have managed to bring into the team a group of incredible people who want to make a difference when they go to work.”

Clim8 is different from many other firms in its approach to ethical investment. Single-mindedly focused on climate impact, their portfolio consists only of companies that help improve climate change. Many other firms include ESG factors, allowing fossil fuel companies to form a part of their fund, reducing the positive impact of the money invested.

“There are many ways you can make an impact, and what you do with your money can make a big one,” said Grierson. “There are several pieces of research saying that where you invest your savings will make about 20 times more positive impact to the environment than behavioral changes such as eating less meat or cycling.”

“We are looking to attract people who want to make sure their money is invested into the right kinds of companies.”

The climate impact of ethical investment

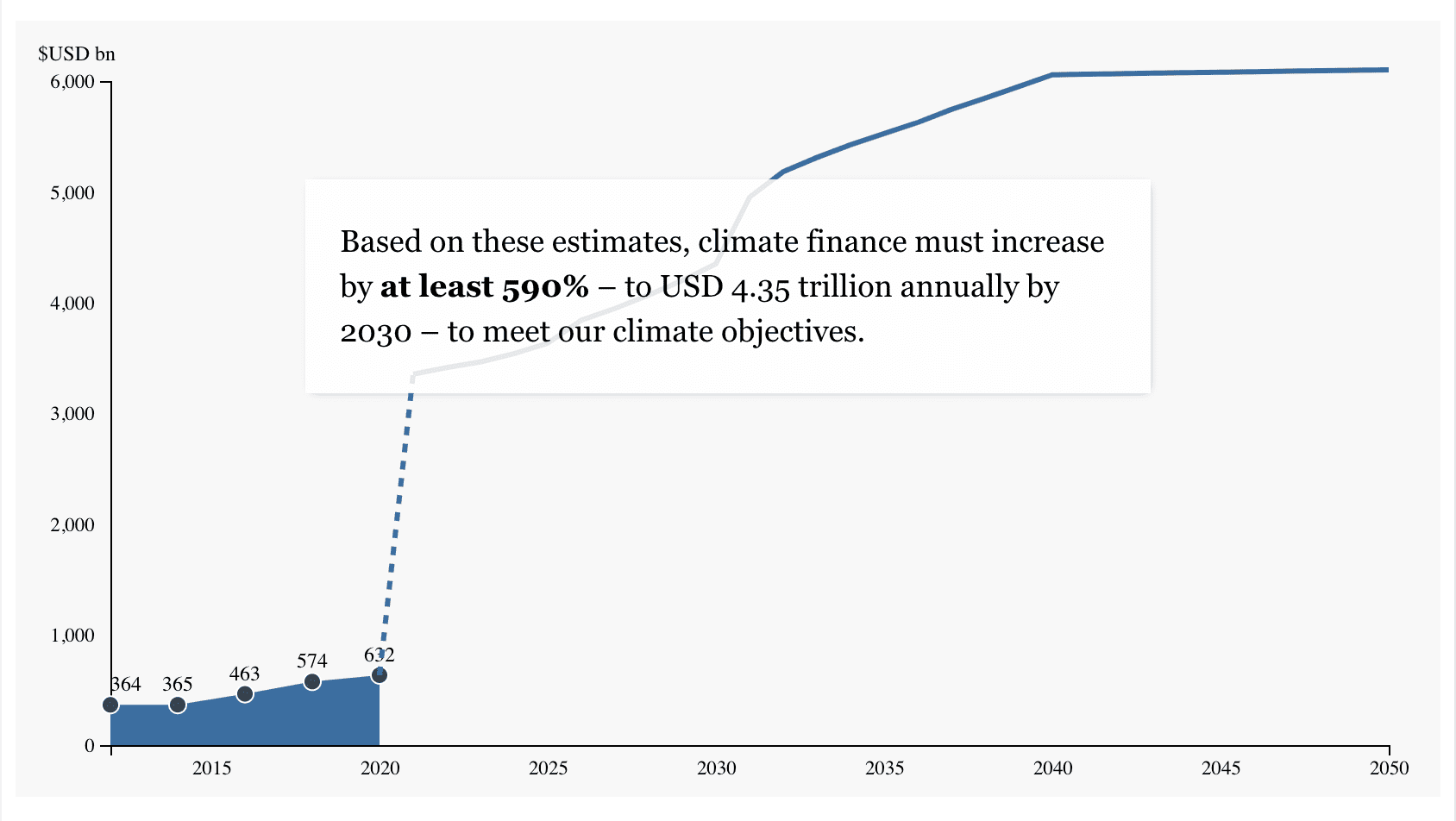

The UN estimates that $5 trillion to $7 trillion per year between 2015 and 2030 is needed to achieve the global Sustainable Development Goals (SDG). Globally, there is a need for $90 trillion by 2030 in infrastructure investments to make a change; two-thirds of this are required in middle and low-income countries.

The International Finance Corporation (IFC) estimates that up to $2 trillion is currently invested with the motivation to achieve a positive impact. Still, there is an appetite for more, perhaps as much as $25 trillion.

In The Promise of Impact Investing report, the IFC stated that if just 10% of the $269 trillion in financial assets held by institutions and households worldwide went towards improving social and environmental outcomes, it would make a big difference to the SDGs, including facilitating the shift to a low carbon global society.

“I think net-zero objectives can be achieved, but I’m an optimist. A lot of things have to happen with momentum,” Grierson said.

“It’s all about impact. Government, large corporates, SMEs, and then individuals, everyone has their part to play in this, and we need all of it,” he explained. “We are a B2C product, we focus on customers, but I think just by existing, we can have some sort of impact all the way up the stack.”

“We are raising awareness. We aren’t expecting the whole market to move our way, but we are looking for a community of people that want to have an impact through investment. If people don’t become customers of ours, they might impact elsewhere.”