One of the fastest-growing ecosystems worldwide, the industry’s current state in Brazil now calls for specialization. In that regard, a new fintech niche is emerging.

This month, digital bank Nomad announced it was rolling out a rather innovative product. The fintech, which since 2019 has offered dollar accounts to Brazilians, will now allow its customers to pay in installments for purchases made abroad.

The model, a sort of Buy Now Pay Later for international payments, is the latest illustration of a new segment within the country’s burgeoning sector. Digital banks are geared toward international products, from apps enabling overseas investments to global payments and cross-border transfers.

“The wave of alternative solutions in foreign currencies first brought players such as Nomad, Avenue, and Wise,” said Bruno Diniz, a fintech book author in Brazil. First, they offered a dollar account, an international debit card, and the option to invest overseas. “Now, they are creating new products on top of these, and we will certainly see an expansion of this niche as competition strengthens.”

Since 2020, the Brazilian real has lost 20% of its value against the U.S. dollar. Brazilian equities also have performed poorly in the face of other developed markets. That has led many Brazilians to seek new alternatives.

Before, just a few Brazilians in the affluent sector enjoyed the benefits of international banking. New fintechs now seek to fill the gap with user-friendly products in this segment.

Nomad fintech’s new product

To be sure, Nomad’s alternative is rare in Brazil. As it is now, Brazilians — who, contrary to U.S. citizens, are highly used to paying in installments — have few options to do so abroad.

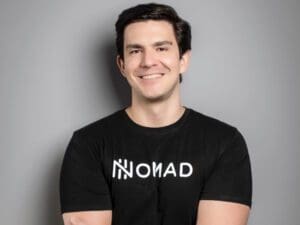

“We were in limbo because we knew that the customer wanted to purchase in installments and Nomad’s value proposition, based on travel savings, was not enough for them,” said Lucas Vargas, CEO of the fintech, in an interview with a Brazilian outlet, Estadao. “That’s why the product of dollar installments was created, which is settled in reais.”

With this new product, Nomad offers its clients the chance to pay in three, six, or nine installments. The interest rate varies on a case-by-case basis.

The Latin American fintech has raised $32 million in Series B financing last year. According to Crunchbase, the company has received $60 million in funding.

Revolut, a new player in town

Neobanks have proliferated in Brazil in the past few years, with many signing up clients by millions. But as most fintechs and digital wallets have gained size, many have pointed out a need for newcomers to differentiate themselves.

This year, the British neobank Revolut, one of the most popular in Europe, finally launched in Brazil. The decision is part of a broader strategy from the European bank to reinforce its global appeal. To compete with solid local players such as Nubank, Revolut has prioritized its global account strategy.

The digital bank opted to bring a global account with a 27-currency remittance option, implemented through partnerships with local businesses.

“Revolut comes at a time when several players have been designing innovative models and becoming stronger in the international remittance service,” Carlos Augusto de Oliveira, executive director at ABFintechs, told FIntech Nexus. He points out Nomad and cases of smaller-sized fintechs such as Remessa online or Bexs.