On Monday, the Treasury published a long-awaited report on stablecoin cryptocurrencies, and they want the government to have more oversight into crypto.

Still, they do not believe they have the power to do it. The report invited Congress to create stablecoin laws to regulate the coins more like a banking deposit product than a currency.

“If well-designed and appropriately regulated, stablecoins could support faster, more efficient, and more inclusive payments options,” the report read.

“Moreover, the transition to broader use of stablecoins as a means of payment could occur rapidly due to network effects or relationships between stablecoins and existing user bases or platforms. Stablecoins and stablecoin-related activities present a variety of risks.”

The paper, published by the President’s Working Group on Financial Markets, argued that regulation must address defi money laundering and terrorism financing to create broader investor protection. SEC Chair Gary Gensler, Treasury Secretary Janet Yellen, and Fed reserve Chair Jerome Powel are a part of the group. The report is the first step into the inevitable regulation of a $2 trillion industry in a year of massive crypto bull runs.

But creating a new framework entirely for cryptocurrency regulation seems to be on the horizon, starting with stablecoins. The group explicitly outlined vulnerabilities within current regulatory powers that it hopes Congress can put a bandaid over with new laws.

Laws should require stablecoin issuers to be “insured depository institutions,” subject to supervision and regulation to stop price runs. For all the FUD that comes out of regulation woes, FDIC-protected cryptocurrency exchanges would be the definition of mainstream adoption.

Similarly, regulators in the report ask for the power to enforce anti-money laundering and other regulatory checks on stablecoin wallets and issuers. Further guidance calls for stablecoins to be interoperable or work with each other, like Tether working with USDC, for example.

What will happen now?

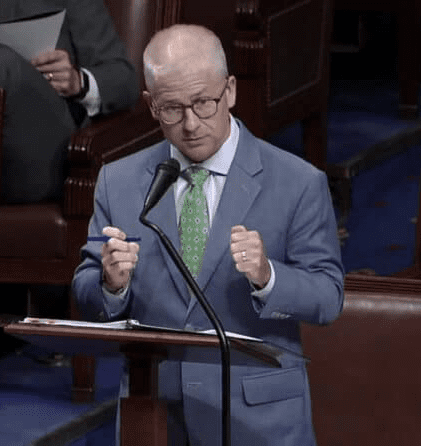

The ball is officially in the lawmakers’ court, and it’s unclear when they begin working on actually writing laws. In a statement, Congressmen Patrick McHenry, the Republican lead on the House Financial Services Committee, said if they were not careful, innovation in the crypto space might stop dead in its tracks.

“This report lays bare the jurisdictional challenges our regulators face when it comes to emerging financial innovations, like stablecoins.”

The President’s Working Group, led by Treasury, has taken the first step by putting the ball in Congress’s court. Unfortunately, Congressional Democrats and the Administration appear committed to blocking technology they don’t understand.”

Without going into specifics, McHenry said it was essential to examine the risks while understanding the potential of crypto.

“I look forward to working with my colleagues to make the most of this opportunity to responsibly advance innovation.”

Congress is not the only branch of the government dealing with cryptocurrency innovation: the Federal Reserve is on track to develop a stablecoin of its own. While regulators fumble to manage the new tech, the Fed is in the early stages of developing a digital currency, or stablecoin, of its own. Working with MIT through the Boston Fed, researchers are building what they hope will be a new public deposit product for all Americans, nicknamed Project Hamilton.

Project Hamilton

“In Boston, what we’re doing is technical experimentation, a project we call Hamilton,” Jim Cunha, SVP of the Boston Federal Reserve, said at a LendIt Webinar in August. “Working at MIT with the Digital Currency Initiative, they’ve been studying this deeply for years and have some of the world’s experts working at the DCI.”

Researchers are trying to build a transaction system for the future that can process tens of thousands of transactions per second. Cunha said they are working with ten central banks that are proposing policy implications to study. The Fed is looking at 40 different platforms, some based on Blockchain, some more traditional.

“We’re going to publish a white paper and then create an open-source license with the code,” he said. “We want others to both learn from what we’ve done with MIT but also to contribute to telling us what they like what they don’t like, actually contribute code.”

Meanwhile, down on earth

There are practical reasons regulators and legislators alike are harping about cryptocurrency laws: the market has been on a tear for nearly a year. Just this past week, Facebook announced it would be called Meta from now on and pledged to build a virtual universe built on digital currencies, likely based around its Novi digital wallet.

In a futuristic alternative reality presentation, Mark Zuckerburg presented his vision for the future: Everyone will live, work, and play in a virtual reality universe, popularly called the metaverse by cryptocurrency nerds and futurists.

Facebook has run into the brunt of financial regulators in the past, blocked from launching a cryptocurrency called Libra last year. So, the firm, along with the International Diem Association that backs the currency project, shifted to a stable coin and launched a mobile wallet in August.

It’s not just Facebook- everyone is going crypto. In recent news, the mayor-elect of New York City, Eric Adams, said Wednesday he supported the idea of an NYC native cryptocurrency and even poked some friendly competition at Mayor Saurez of Miami. Saurez has been pro-crypto for some time, recently proclaiming he wants part of his salary as crypto, and established a Miami coin test pilot. CityCoins, a startup crypto company, already offers mining for Miami coins by donating 30% of freshly minted coins directly toward the city.

Not all fun and games

Despite the rosy glasses of the future technocratic multiverse: there are still scammers out there. Scams in the crypto world are as common as ever. On Monday, the crypto called SQUID modeled after the Netflix hit, Squid Game, shot up 33,000% in five minutes, only to drop to a thousandth of a cent when the developers pulled the rug. The coin offered to let people compete online in Squidgame contests, just like the show, paying in tokens toward the winning jackpot.

The price went from $15 to over $2,000, then to nothing in a day. It turns out the devs wrote the contract to stop virtually any selling of the coin, and everyone lost but those who controlled the scheme from the start.

It seems thousands of investors forgot the whole point of the show is that only the wealthy who control the game win: everyone else dies. Even so, the coin is rising again from its low, up from 300% to $0.015.