The topic of data collection connects intrinsically to fintech. APIs and solutions we see developed today are based on data analysis, requiring vast amounts of accurate data.

Many within the fintech sector report data access as an issue. In many nations, companies are only required to share as much data as possible, leading to tailored results and, at times, manufactured marketing points.

Initiatives within government entities have been set up to open out access to data but have been met with reluctance. In a report carried out by Frontier Economics for the UK’s Department of Culture, Media and Sports, barriers to sharing of data included:

- A lack of incentives.

- Legal, commercial and ethical risks.

- A lack of knowledge of the types of data that could be shared.

The most common barrier to data sharing, perceived legal risk, accounted for the reasoning behind the refusal to share data of 39% of businesses surveyed.

Accurate climate data drives impactful innovation

A sector where accurate data access and collection is most critical for fintech development is climate change. Numerous funds have been set up to encourage company development to meet climate change objectives and regulatory sandboxes to drive innovation.

“The thing that you see a lot is that there’s a very fine line between image PR driven sustainability initiatives and actual carbon reduction,” said Alex Lempka, CEO and co-founder of Connect Earth, a company focused on improving access to climate data.

“Fintech is a great way to empower companies and consumers because we meet them where they are.”

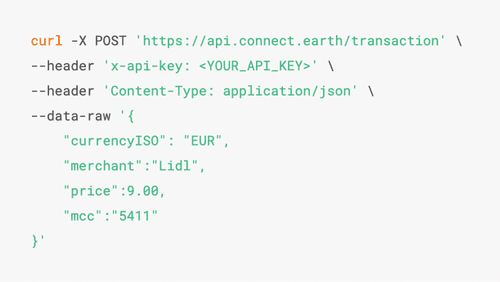

Connect Earth is an environmental data company based in London that creates easily accessed APIs for integration into fintech products.

Founded in September 2021, as part of the Entrepreneur First program, they have recently secured $1.8 million in pre-seed funding to expand their data offering throughout Europe and the United States.

“Our vision is to make it as easy to build a climate change product as it is to use Wix to build a website,” said Lempka.

“What we do is collect this data from sources and standardize it within our database. The aim is to create APIs and toolkits to make it easy for anyone to build a climate change product.”

‘The open banking of climate data’

Lempka believes that data transparency is key to the development of climate solutions. This led to him creating a company that open sources all their data, providing free access for companies and consumers that can be used to inform spending patterns and business decisions to become more carbon efficient.

“We aim to become the open banking of carbon data. We chose to integrate existing B2B and B2C apps and focus on transaction data that is mostly enough for SMEs to give a carbon estimate. While we did that, we saw that just getting the data is a huge undertaking,” he said.

Generally, the larger the data pool, the more accurate the results, allowing for anomalies and outliers to be identified and disregarded.

“It’s really hard to get this data. What we have built internally is a proprietary data and science toolkit where we look at industry averages and proxies as well as company data,” said Lempka.

“The real key is finding a hybrid. The greenhouse gas protocol recommends finding a hybrid between company data and proxy or category data. That’s what we are working with.”

Encouraging climate change consumer action

In a recent survey by Dynata, it was found that 69% of the consumers felt an “urgent” need to take action to combat climate change. However, it is not always clear how to do so.

Connect Earth’s data set includes merchant data, with variances according to the companies consumers and businesses choose to buy from. They hope to increase awareness and enhance decisions based on reducing carbon footprint.

“It’s the way you present data, not just giving data. Saying that your carbon footprint is x amount isn’t enough. You need to provide solutions to incentivize consumers,” said Lempka.

“Linking it to reward-based systems or gamifying it, point-based systems that companies can launch can help.”

This approach references the numerous fitness apps such as Sweatcoin that use point-based systems or passive income generators and cryptocurrencies to incentivize consumers to improve their health and fitness.

Lempka then explained that other incentives such as carbon offsetting through donations face challenges on a consumer level. Connect Earth’s co-founder, Nicolas Carmont, previously founded a carbon footprint app and found only 3% of consumers chose to offset their carbon emissions in this way.

Multi-sector data funding to increase traction

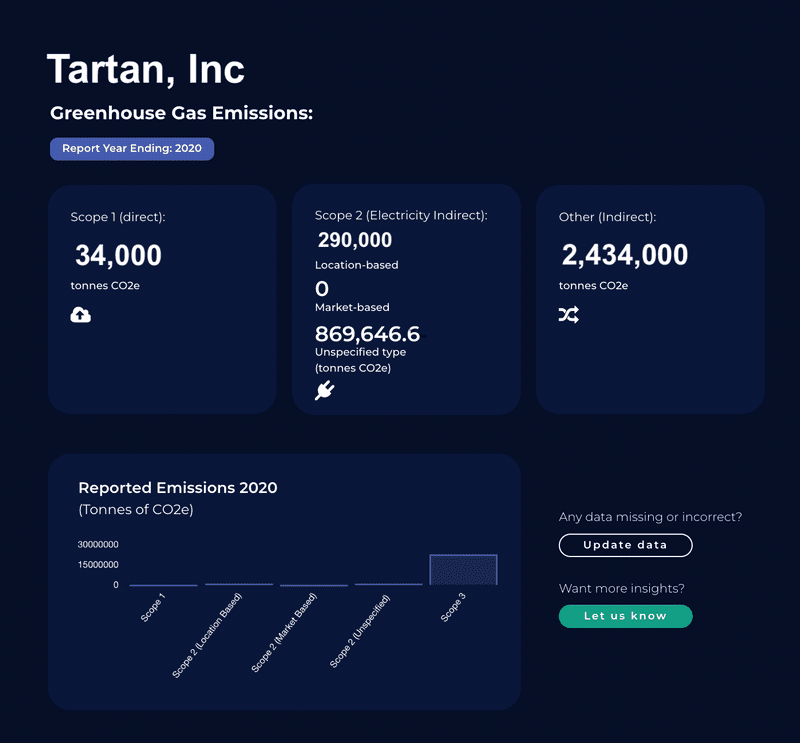

Connect Earth’s first product, an API solution that uses carbon accounting standards to calculate the carbon impact of consumers and companies based on their spending, has met much success. Focused mainly on fintechs and banks, Connect Earth’s traction points include running a PoC with the Elevator Lab Partnership Program powered by Raiffeisen Bank International (RBI) and working with a US-based challenger bank, Cogni, to engage their GenZ audience.

In securing backing from various investors, ranging from impact funds, marketplace-driven investors, offset providers, and climate data investors, they hope to create a company that holistically targets climate change.

“In the short term, our funding round is more of a data funding round. All of our KPIs are data,” Lempka said.

“Fintech is the obvious route to market because we have exposure to millions of users over one integration. Exposure leads to a reduction in carbon emissions and spending habit change,” he continued.

The recent funding comes from various investors, including Market One Capital, D2, Plug and Play, and Entrepreneur First. However, the leading players are Mustard Seed MAZE (MSM). The impact fund has made many investments in environmentally-focused companies in the past and believed Connect Earth to be essential for future growth in creating environmentally conscious fintechs.

Henry Wigan, the Managing Partner at MSM, said, “Connect Earth is critical in ensuring we have the infrastructure to help businesses embed sustainability data into their products. We believe that this infrastructure is the missing piece to allow for better climate decisions. We are excited and thankful to be partnering with Connect Earth on their journey ahead.”

The increase in funding will allow Connect Earth to expand its operations further and build an infrastructure supporting the development of fintech into an environmentally conscious outlook.