Could AI have prevented the Silicon Valley Bank (SVB) crisis? Maybe not completely, but consumer sentiment analysis could have dramatically reduced its impact.

That’s what Constellation learned when it used Aurora, its new AI-powered technology, to analyze public discussions about SVB.

SVB provides two important lessons

Two main lessons emerge. While the run wouldn’t have been altogether avoided, had Silicon Valley Bank been properly assessing consumer sentiment and conversations via social listening technology, much damage would have been avoided.

The second is financial institutions should leverage social monitoring tools to better protect themselves from future peril.

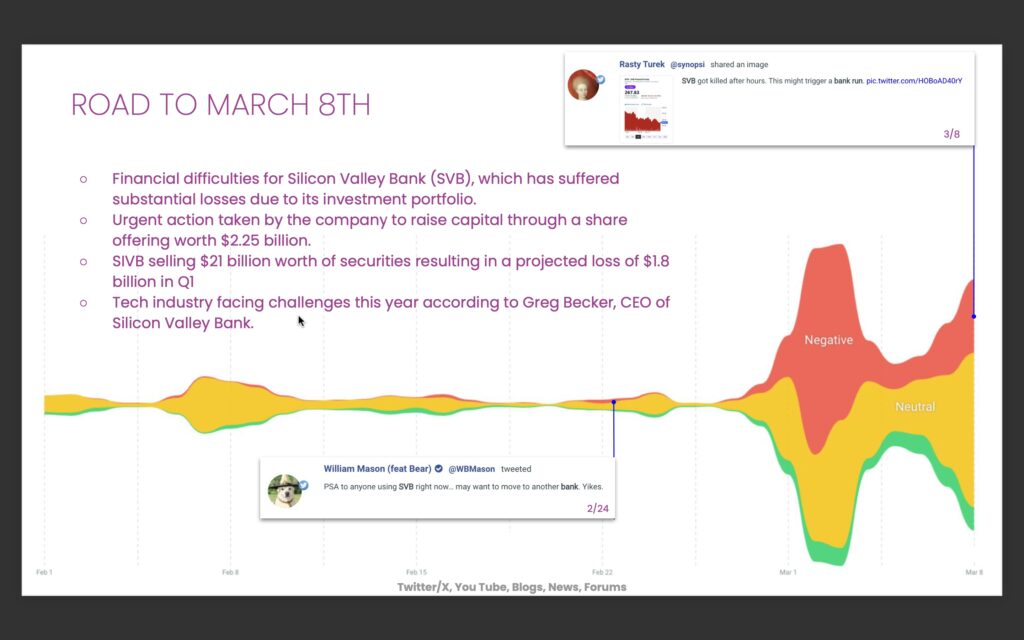

SVB trouble brewed early

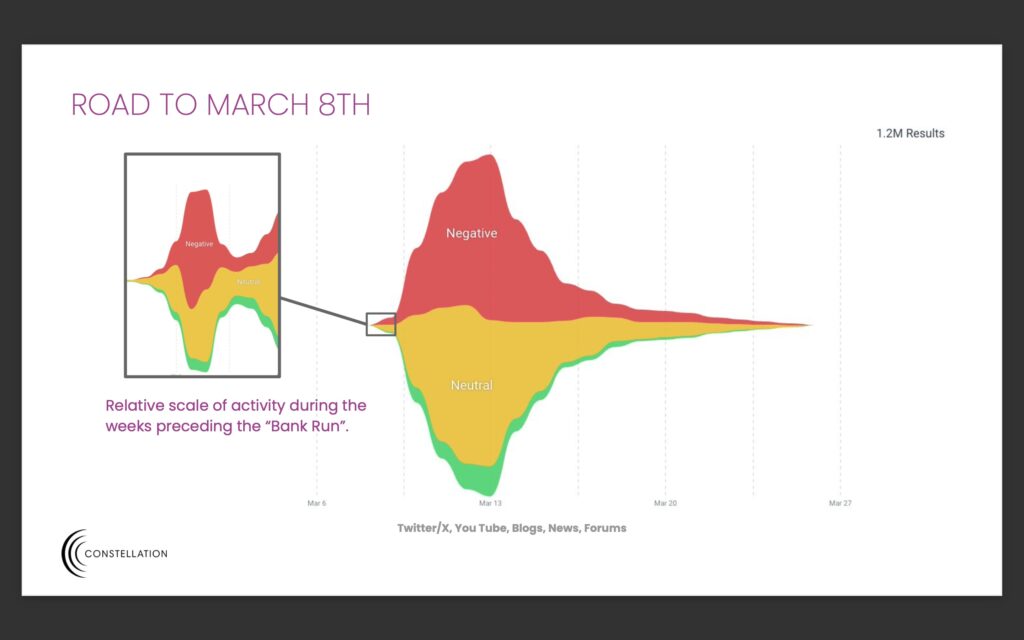

Constellation founder and CEO Diana Lee and head of data science Yusuf Khan said Aurora caught chatter one year out about concerns. Fast forward to weeks before, where trouble was brewing on X and niche blogs in early February, a full month before the collapse. Most of that (82.8%) was on X, which led to a 101,696% increase in negative sentiment throughout March.

That last week saw a surge in negative sentiment, with 11,000 expressions on Wall Street Bets, 53,000 on CNBC, and 210,000 on X, with 93% negative or neutral. Much of the opinion came from the American coasts.

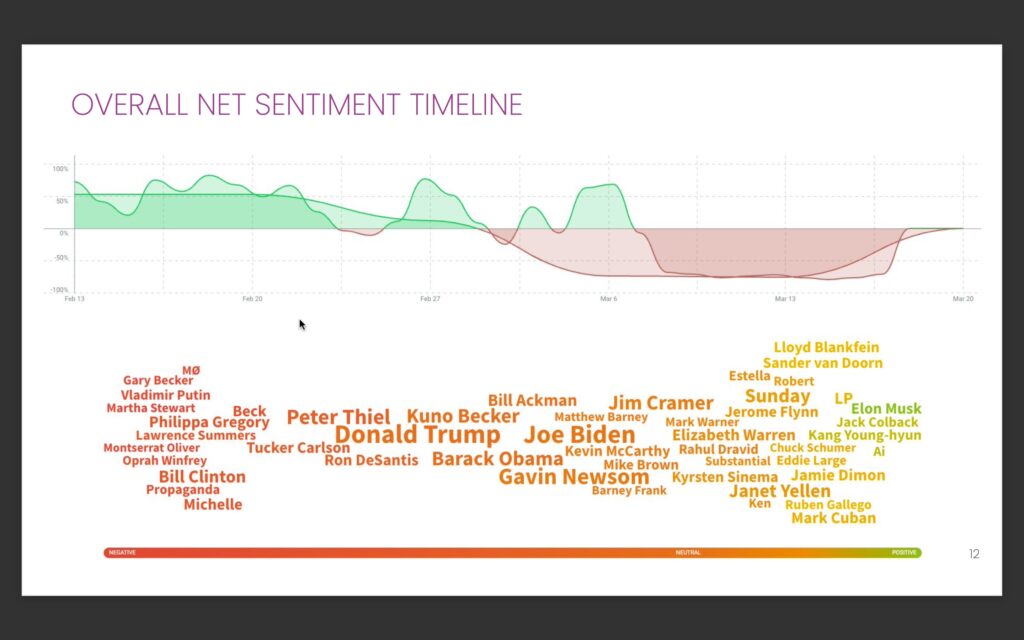

Some surprising voices led the charge

Some leading voices like Joe Biden, Donald Trump, Gavin Newsom, Peter Thiel and Elon Musk were no surprise. Others, like Oprah Winfrey and Tyra Banks, were. Musk remained among the most positive, while Martha Stewart was among the most negative. While Peter Thiel’s comments drew attention, others, like Bill Mason, sounded earlier warnings.

How Constellation leverages the power of the crowd

Lee founded Constellation in 2016 to deliver a modular system that produced regulated content like web pages and social media posts for automotive retailers (and later pharmaceuticals). The process included studying Reddit, Twitter, Pinterest and Snapchat consumer reviews.

While reviews influenced buying decisions, people considered them individually and not in aggregate. An early, powerful opinion could lead to an ill-informed decision. That myopia extends to brands, who could not infer overall sentiment.

Extend these concerns to financial institutions. What is the crowd saying, and how important is it?

Those are interesting and sometimes foreign conversations in the C-Suite. Many executives are from older generations and don’t even have their own social media pages. As fintechs show the financial sphere the importance of meeting the customer where they’re at, many established figures badly fail.

“They’re ignoring what the younger generation and millennials are feeling or thinking, but they’re the ones that are driving the customer sentiment out there,” Lee said. “They don’t even go on dates unless they go on social media channels to ensure they’re safe to meet these people.

“But when you look at the regulated industries, there are industries they’re not even factoring in that these are the profiles that are buying their products now.”

The problem of LLMs and false information

Khan said Reddit and X drive general sentiment, which has AI implications. ChatGPT and other large language models refresh their data from almost every publicly available avenue.

“One of the biggest challenges is the false information that can be embedded in,” Khan said. Think about the number of conversations people could have that are farthest away from the truth. But… no human being would be able to fully design a system so scalable that it can classify everything as accurate or false information.

“So they must have all types of information flow into these models.”

That’s a price we pay for speed. It’s easy to see examples where an LLM recommends an inferior product because it has ingested false information.

How Constellation combats false information

Constellation’s solution is contextual social listening. Khan said Constellation ties information to other metrics to identify contextual relationships between certain voices or opinions and actions. Different voice categories get different weights. Peter Thiel will have a more prominent voice in finance than a social media influencer who only leaves a few comments.

“Even though we differentiate that, there is always going to be this challenge of false information flowing,” Khan cautioned. “Broad social listening is dying because a lot of false information is floating around there. And it will continue to get worse with AI-generated content, which (leads to) hallucinations, where an AI system is spitting something out which looks real, but it’s not.”

An obvious counter to that is to check the accuracy of what we’re told. If only everyone would do that.

“Being able to influence the videos, the speech and sound, that level of fake information… If that’s being propagated, imagine the amount of content that’s now coming out, which is not (of) human thought, and which can be a little bit further away from the actual ground truth,” Khan said. “That will make it harder and harder to measure and contextualize some of these things.”

The importance of contextual social listening

If you’re a financial institution executive thinking, “What’s the deal with contextual social listening? Should we invest in it?”, you are already behind the eight ball.

“My worry for the regulated industries is, if you’re so far behind, you’re not even paying attention to these influencers,” Lee said. “Looking at it from a contextual level, or even at a local level, you’re going to be blind to what ends up happening on the AI side because it’s the foundation of all it has been social media, and then they’re building on top of that.

“When (brands) don’t know how to de-risk themselves, social media is going to be a big piece of how do they do risk and looking at things contextually, to see where they rank in terms of the risk, based off of what people are saying should be a big factor on whether people are going to continue to do bank runs in the future.”

Be proactive in getting a strategy in place because if you’re forced to react, you could be dead in the water. Information goes viral in a flash. When it’s noticed, and the CEO is involved, it’s often beyond the company’s control.

How contextual social listening could have helped pre-SVB

And if you think, “We are watching our social media mentions, we’re good”, you’re missing the point. Lee said the value is learning how the overall sector sentiments relate to your firm.

Consider the banks that had to step in after the SVB collapse. Lee said they didn’t realize they would have to stop the spread by buying some banks. Regional banks were under threat.

“At that point, it created a lot of havoc, chaos and fear where people were questioning if their money was safe,” Lee said. “That’s where we would come in and say contextually, if all of these people knew what they were doing and contributing to, it wasn’t just the collapse of SVB. It is how we feel general sentiment about the banking industry is, the banks that we’re doing business with.”