The race is on to reduce carbon emissions.

The target year for a global net zero is silently looming, and many declare we are running out of time. Despite current efforts to reduce emissions, the amount produced worldwide continues to rise. Reports of a slower rise in 2022 than the year before are celebrated but still amount to almost 300 million tonnes.

The reduced rates are attributed to an increased deployment of renewable energy. The COP27 summit has peaked hopes that more development in the sector will soon be underway.

Recent reports from the summit tell of new renewable energy plans and fulfillment of pledges.

Some are skeptical. During the 2022 EthBarcelona conference earlier this year, Jahed Momand, Co-Founder of Cerulean Ventures, stated, “Everyone in charge has failed to act. Last year was COP 26. This year we have COP27. We are currently on target for 3.3-degree warming in this century. That’s a not habitable planet in 150 years.”

Could it be a question of too little too late?

RELATED: DeFi presents new opportunities in scaling voluntary carbon markets

Mobilizing carbon credits to incentivize regenerative farming

While world leaders gather to discuss possible ways forward, private players have jumped into action.

Doing what they can to target the agricultural industry, the European carbon farming scaleup initiative, Agreena, has partnered with ZTLment to connect carbon credits with fiat currency, facilitating easy payments to farmers.

Like Momand, they feel that voluntary carbon markets are a viable way for individuals to make a difference in the climate crisis.

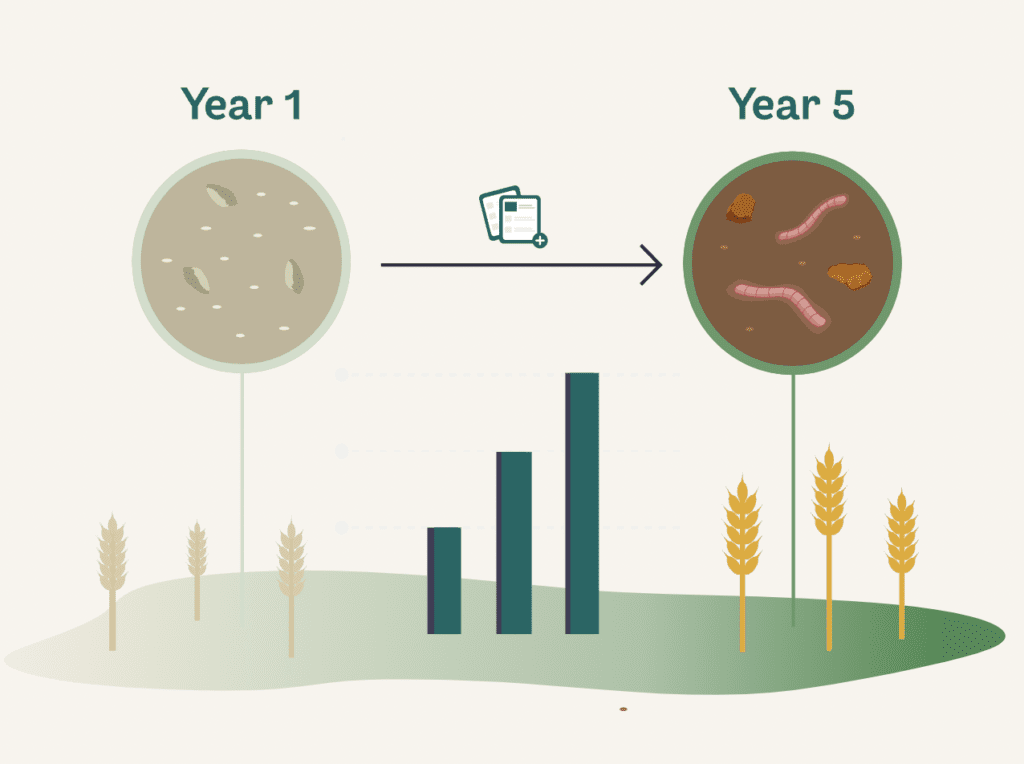

The solution tokenizes soil carbon certificates. Currently, soil carbon accounts for 30% of global greenhouse emissions. Farmers can preserve and increase the amount of carbon stored in the soil by applying regenerative farming practices to conserve soil carbon.

Incentives for regenerative practices are sparse. Although some governments are positioning themselves to support such practices, funding is few and far between, with many government-funded initiatives oversubscribed.

The tokenization of soil carbon certificates could financially incentivize farmers to implement these regenerative practices.

“We see our new ability to use blockchain for issuing payments as a key to unlock the market for farmers to transition from conventional agriculture to carbon farming,” said Simon Haldrup, CEO of Agreena. “With agriculture responsible for approximately one-third of the global carbon footprint, the switch to regenerative farming practices creates one of the greatest opportunities for climate action in the world – we are here to enable that.”

Implementing blockchain technology

Partnering with automated payment solutions provider ZTLment, Agreena has brought blockchain interoperability to monetize carbon certificates. Simplifying the process, tokenized certificates can automatically generate payments to farmers in fiat currency.

“We set out to do away with the complexity of blockchain and open banking regulation,” says Mads Stolberg Larsen, co-founder and CEO of ZTLment. “With Agreena, we have built one of the first examples where real-life assets on a blockchain can be traded for real-life money.”

ZTLment is one of the first regulated European payment providers built on blockchain. Based on open-banking regulations, they use their e-money provider, Monerium, to facilitate on and off-chain ramps.

“Farmers don’t need to know a thing about tokens or on-chain payments to see the reward we are bringing,” says Haldrup, “Nonetheless, this is a hallmark moment, not only for carbon farming but also for the blockchain community and people driving real-world use cases of Web3.”