Before the issues with FTX (remember that time?) crypto had another factor to contend with.

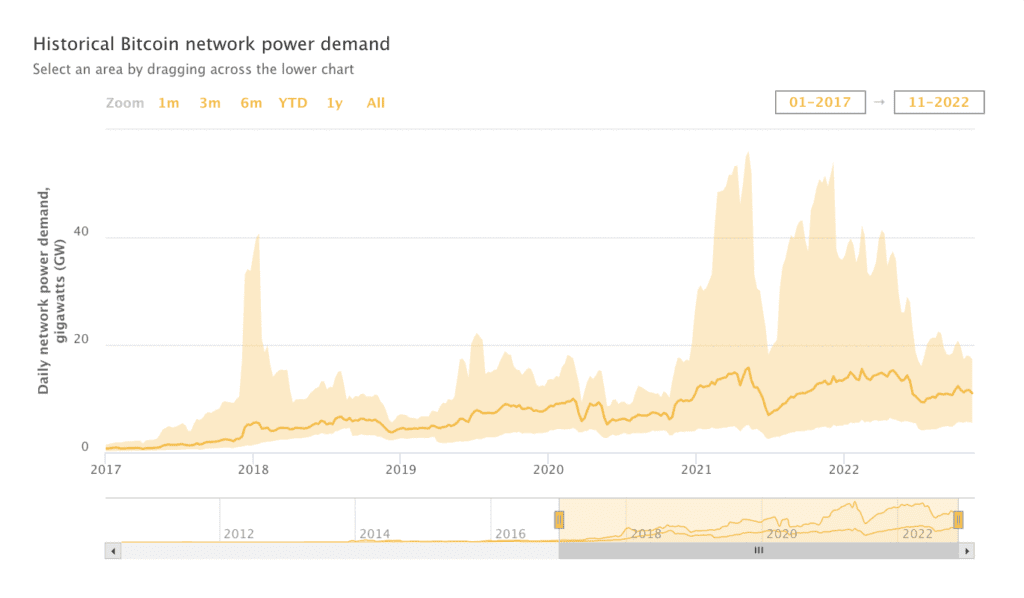

Proof of Work has been making headlines with reports about its staggering energy consumption. Blockchains like Ethereum have made the switch to Proof of Stake and regulatory bodies hinted at a future ban on the consensus system.

While the ability to ban a decentralized system is debatable, the issue has been proven by countless studies.

“Environmentalists, financial institutions, and policymakers are growing increasingly concerned about Bitcoin’s electricity consumption and its associated environmental repercussions,” said Alexander Neumueller, digital assets CBECI project lead at CCAF.

Many in the industry insist the issue is a question of energy sources and already 57% of energy is renewable. However, tools developed by the CCAF have found increasingly that the quantity is much less, hovering around 37%.

In addition, issues with water consumption and e-waste associated with mining are rarely addressed yet cause ever-increasing concerns.

“A significant decrease in mining profitability led to a decline in electricity consumption despite substantial increases in hash rate,” continues Neumueller. “Given the recent sharp decline in mining revenue per unit of computing power, a shift to more efficient hardware occurs, which leads to the, at least temporary, retirement of older, less efficient hardware.”

The awareness is there but some chains still reluctant

With bitcoin unlikely to change any time soon and a compounding issue as its popularity increases, many in the industry have found it necessary to counteract the effects of Proof of Work by forming initiatives to target the issues.

“There’s actually interesting pressure coming on the industry from institutional customers who have a broader ESG program and there’s pressure coming from younger consumers,” said Nick Jones, CEO, and Co-Founder of Zumo Money. “The good thing is it’s being owned and dealt with in a way that it wasn’t. The industry was just kind of pretending and ignoring it until a year and a half ago. There are now 250 signatories of the Crypto Climate Accord so lot of serious change.”

Kirsteen Harrison, Advisor to Zumo Money on Environment and Sustainability, agreed. “I don’t think we’re there yet with what needs to happen. But there is definitely much more of a move towards that happening,” she said.

While the bitcoin community is reluctant to change practices stating the PoW is the “only” decentralized way to operate, industry experts believe there is room in the sector to shape change.

Estevão Bello, CEO, and founder of SeaChain explained that he felt exchanges could make a difference. “We can change them into something that’s doing good for the planet…At the end of the day, we do have a lot of decentralized investment and decentralized exchanges, but when you’re going to cash out money, centralized exchanges are super influential.”

A collaborative movement towards sustainable practices.

Jones and Harrison explained that the opportunity to make change is, in part within blockchain technology. The traceable, transparent nature of most blockchains allows for the ability to verify claims of sustainability. However, in order to make a significant impact on the sustainability of the industry, pressure needs to come from all stakeholders.

“You need that kind of downward pressure from government and from institutional customers who have these broader and very serious ESG commitments within reporting and then you definitely need upward kind of community pressure as well,” said Jones.

“Gen Z users gravitate towards, you know, ETH projects and others other things on other chains, where there’s collaboration and get published research around how they’re not energy intensive…it can be massively important.”

Harrison explained that there can be complications in government involvement, and sanctions banning the use of PoW may not make much impact.

“If you ban it somewhere, it will pop up somewhere else, no miner is going to just say, Okay, I’ll pack up my equipment and you know, put open a shop or something. It’s the jurisdictions that are probably more progressive, that might look to do something like that. And it will have the unintended consequence of shifting miners to places that they know that’s not going to happen.”

A number of initiatives tackling the issue

The Crypto Climate accord was launched in April 2021 by a number of private sector entities. Inspired by the Paris agreement of 2015, it focuses on decarbonizing cryptocurrency and blockchain.

It is one of a number of initiatives Zumo and other crypto and blockchain-focused companies have formed to combat the carbon emissions of the technology.

In addition to the accord, Zumo joined the Crypto Sustainability Coalition in October of this year. Led by the World Economic Forum the coalition is formed of three groups targeting the sustainability issue. The initiative targets three specific areas where the 30 member companies focus their practices; Energy consumption, Web3’s potential for climate action, and carbon credits.

Both initiatives aim to drive research and innovation through collaboration within the private sector.

Many entities have focused on energy consumption, using blockchain to increase transparency in carbon emissions. Zumo has engaged in tracking and verifying carbon emissions through the production of Renewable Energy Certificates. By using the certificates, they ensure energy involved in the transactions of bitcoin is from renewable sources.

However, energy consumption is just one piece of the puzzle.

RELATED: Bitcoin’s toxic e-waste problem

In addition to the high amounts of energy used to mine bitcoin, e-waste production is a growing issue. In many areas where miners conduct activities, there is a lack of formal pathways for e-waste recycling, and few industrial miners incorporate it into their own practices.

While Zumo Money does collaborate with Waste Aid, to target some of the recycling issues, other decentralized entities are starting to actively engage in the problem.

SeaChain has used the benefits of decentralization to form a non-profit aimed at taking waste out of waterways. Using NFT mints and the native SeaChain token, the underlying “hybrid” DAO organizes and funds the building of barriers, which capture rubbish before reaching the sea.

“We need to understand that but there are different types of crypto,” said Bello. “Everything has its own impact. It’s up to the token to mitigate that impact. And also to prove to their own community, how they’re doing that, and what steps they’re taking to go into that direction.”